Why Washington can’t outbid Beijing and Moscow in Central Asia

Central Asia is courted by the West but sustained by Beijing and Moscow. The region uses Western attention to lift its value — yet its survival still hinges on China and Russia. How long can this price-raising game last? Academic Hao Nan explains.

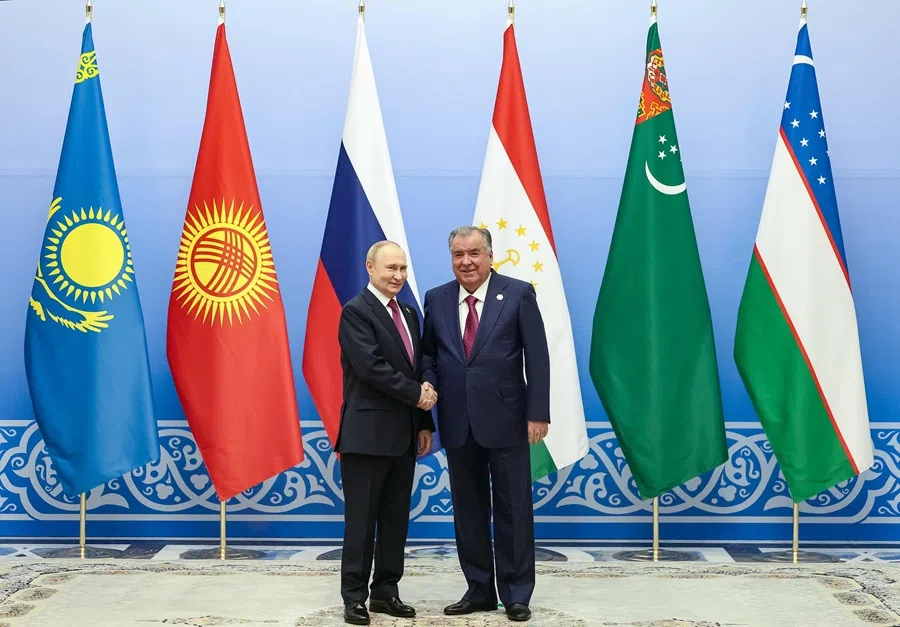

In 2025, Central Asia has quietly moved from the periphery of global geostrategy to the centre of a four-way contest between the US, Russia, EU and China. Within a single year, the region showcased more suitors than ever before, with the first Central Asia-EU Summit held in Samarkand, Uzbekistan, in April; the second Central Asia-China Summit held in Astana, Kazakhstan, in June; the second Central Asia-Russia Summit held in Dushanbe, Tajikistan, in October; and the Central Asia-US Summit held in Washington, US, in November.

Yet despite talk of “multi-vector diplomacy” and diversification, structural realities mean that, for the foreseeable future, Central Asia will still treat the US and EU as an insurance policy — and China and Russia as the main partners.

... China takes the lead on trade, infrastructure and investment; Russia remains the default provider of hard security, labour-market access and much of the media and language space.

Attention shifting east

Behind the summitry, economic gravity is plainly shifting east. China is now Central Asia’s largest single trading partner, with trade reaching US$94.8 billion in 2024 — more than double the region’s trade with Russia, which amounted to US$45 billion in 2024 — and clearly ahead of any Western partner. Belt and Road projects have turned Central Asia from a “starting point” into the key land bridge of the Middle Corridor between China and Europe, reinforced by new pipelines, logistics hubs and the long-planned China-Kyrgyzstan-Uzbekistan railway, now finally moving from paper to construction. The EU remains a major market and a leading source of foreign direct investment — about 40% of FDI stock over the past ten years — but its economic presence is mediated through rules, feasibility studies and climate conditions.

Security architecture, meanwhile, is still fundamentally Russia-centric. The Collective Security Treaty Organization (CSTO), backed by Russian bases in Tajikistan and Kyrgyzstan, remains the only functioning mutual-defence structure in the region. When unrest shook Kazakhstan in January 2022, it was CSTO troops flown in from Russia and allied states — rather than any Western force — that restored order, cementing Moscow’s image as the last-resort security guarantor for nervous elites. Add to that millions of Central Asian labour migrants in the Russian economy, remittances worth up to half of GDP in poorer republics, and Russia’s control over many legacy pipelines and power grids, and the hard dependency picture is clear.

China and Russia: division of labour in Central Asia

This is the Sino-Russian baseline into which Washington and Brussels are trying to insert themselves. Since the invasion of Ukraine, Russia has leaned heavily into its partnership with China, seeking markets, technology and a diplomatic lifeline, while Beijing has used the relationship to lock in discounted energy flows and strategic depth on its northern and western flanks. In Central Asia, that translates into a so-called “division-of-labour partnership”: China takes the lead on trade, infrastructure and investment; Russia remains the default provider of hard security, labour-market access and much of the media and language space.

For Central Asian leaders, China’s offer is straightforward. Through Belt and Road, Beijing has financed highways, railways, power stations and digital infrastructure that help deliver short-term growth and visible projects. The Central Asia-China Summit mechanism — Xi’an in 2023 and Astana in 2025 — wraps those deals in an institutional shell: regular leaders’ meetings, a permanent secretariat, thematic cooperation years and the new treaty of “eternal friendship” that writes China’s preferred narrative of “community of a shared future” directly into legal texts. Money flows faster than EU grants, and Chinese officials stress “non-interference” — precisely the language that appeals to regimes wary of outside scrutiny.

If you are a president in Bishkek or Dushanbe facing unrest or budget shortfalls, it is the Russian state — not the US or the EU — that can send riot police, cheap gas and a job market next month.

The push and pull of need and fear

Russia’s offer is more defensive but no less structural. Moscow uses “security, labour and old networks” to keep Central Asia in its orbit: CSTO and Commonwealth of Independent States (CIS) structures, regular Russia-Central Asia summits, joint military drills and enduring arms supplies. Even under sanctions, Russia-Central Asia trade has grown to over US$45 billion, in part because the region has become a key re-export channel for sanctioned goods. Remittances from migrants working in Russia remain a “lifeline”, especially for countries like Tajikistan and Kyrgyzstan, in some years approaching half of GDP. If you are a president in Bishkek or Dushanbe facing unrest or budget shortfalls, it is the Russian state — not the US or the EU — that can send riot police, cheap gas and a job market next month.

The paradox is that Central Asian elites both “need and fear” this Sino-Russian ecosystem. They depend on Russian troops and markets but view Moscow as their main long-term security risk after Ukraine. They welcome Chinese investment and infrastructure but worry about debt, over-dependence and the political backlash of being seen as sold off to Beijing. However, if you rank partners by “who can give you things quickly and who will stand by you when you are in trouble”, Russia tops security, China dominates infrastructure and trade, while the US and EU are mostly about long-term modernisation and education.

US: too little, too late

Trump’s Washington summit is trying to change that calculus — but on narrowly transactional terms. The November 2025 C5+1 summit in the White House was essentially a “minerals, aircraft and corridors roadshow”, with Kazakhstan announcing a billion-dollar tungsten joint venture with a US firm backed by export-credit commitments, and regional leaders signing up to aviation and digital economy cooperation. The agenda fits neatly into a broader US pivot toward a Critical Minerals Dialogue and efforts to pull Central Asian resources into American-led supply chains. But beyond these deals, US economic engagement remains modest compared to Chinese and European projects.

... Washington offers no security guarantee comparable to NATO or its alliances in East Asia; in Central Asia, it is a distant “offshore balancer” without bases or treaty commitments...

Three structural weaknesses limit the US offer. First, the time horizon is short. Trump’s foreign policy is openly electoral and deal-driven: summits that can be bragged about at rallies, not painstaking institution-building over 10-15 years. Second, Washington offers no security guarantee comparable to NATO or its alliances in East Asia; in Central Asia, it is a distant “offshore balancer” without bases or treaty commitments, and its previous presence was tied to the Afghan war. Third, domestic volatility — from the recent budget standoffs to the rise of Democrats in local elections — makes the Trump administration’s commitments look fragile, especially when flagship programmes such as the Economic Resilience Initiative for Central Asia remain in the tens of millions of dollars and multiple years.

The EU’s offer is deeper but slower. At the Samarkand summit, Brussels framed Central Asia as a “partner of choice”, promising 12 billion euros for cross-Caspian transport, green energy, digital connectivity and critical raw-materials value chains, as part of a much larger Global Gateway vision to re-route Eurasian trade away from Russia and reduce dependence on Chinese processing. It follows years of new strategies, enhanced partnership agreements and a steady drip of education, border management and climate programmes that have made the EU Central Asia’s largest source of FDI and a key channel to global markets.

EU investment: slow disbursement and uncertain

Yet three limits bite hard. EU investment arrives through the European Bank for Reconstruction and Development (EBRD), the European Investment Bank (EIB) and private co-financing in a slow sequence of “pledge, study, tender and disbursement”, often tangled in governance, human rights and environmental conditionality. Brussels also lacks hard security muscle: it will not send troops or underwrite regime survival, leaving that role to Russia and, increasingly, China. As a result, the Samarkand summit package looks less like a new Silk Road and more like a long-dated call option: a real position in Central Asia, but one whose value depends entirely on execution. For now, Central Asian leaders see the EU as an attractive diversifier and reputational partner, not as their primary economic or security pillar.

None of this means Central Asia is a passive object of great-power games. All five states proclaim “multi-vector” foreign policies: they want Russian security and labour markets, Chinese infrastructure and trade, European standards and investment, and American political and technological backing — without becoming anyone’s client. Regional differences are stark, from Kazakhstan’s advanced balancing to Tajikistan’s heavy dependence on Russian bases and Chinese loans. But at an aggregate level, in the short term, Central Asia would likely prioritise China and Russia for investment, pipes and security, while keeping the US and EU in the portfolio as necessary insurance and bargaining chips.

... a crowded marketplace where Central Asian elites act like portfolio managers: they use US and EU engagement to raise the price that Beijing and Moscow must pay, while continuing to anchor their day-to-day survival in the Sino-Russian alignment.

The closer China and Russia grow, the stronger the theoretical incentive for Central Asia to diversify away from them. In practice, Trump’s deal-first America and an internally preoccupied EU offer only partial options, not full-fledged alternatives. That is why the region’s new stage in 2025 is best understood not as a simple shift from “backyard” to “Western frontline”, but as the emergence of a crowded marketplace where Central Asian elites act like portfolio managers: they use US and EU engagement to raise the price that Beijing and Moscow must pay, while continuing to anchor their day-to-day survival in the Sino-Russian alignment.

For Western policymakers, the lesson is uncomfortable. If Washington wants to be more than a distant price raiser, it will need to move beyond one-off mineral deals and build durable institutions, predictable financing and at least some clarity about what it is willing to defend. If Brussels wants to be more than a connectivity fund plus a lecture circuit, it will have to take greater risks on transformative infrastructure and investment.

For Central Asia, the challenge is equally stark: new visibility brings leverage, but also pressure to pick sides. The real contest is not over whether the region turns “East” or “West”, but over whether its leaders can keep treating the West as a hedge, China and Russia as core partners — and still carve out genuine autonomy in between.