[Big read] Singapore’s wealthy elites are transforming the philanthropy landscape

Although Asia is the world’s second-largest source of ultra-high-net-worth individuals (UHNWIs), donations by Asia’s UHNWIs only account for 13% of the global share. This may be about to change, with the rise of family offices being set up in Singapore, and new modes of gifting that make it easier for donations of the wealthy to reach those in need here and in the region.

In February this year, Hong Kong’s H.S. Chau Foundation made its inaugural gift of S$1 million (about US$735,000) to SingHealth, Singapore’s largest public healthcare group.

While this foundation may be unknown to many Singaporeans, its founder Solina Chau and director and board member Debbie Chang, wield significant influence.

According to Forbes, Chau has a net worth of around US$2.3 billion and ranks 35th on Forbes’ 2024 list of Hong Kong’s 50 Richest, while Chang is former Hong Kong Chief Executive Tung Chee-hwa’s cousin.

Chau is often called a “confidante” of Hong Kong tycoon Li Ka-shing; Horizon Ventures, founded by Chau and Chang, is Li’s private investment arm.

Horizon Ventures set up a family office in Singapore in 2022. Since then, the firm has kept a relatively low profile — the foundation’s donation in February was its first media appearance.

Chang, now a Singapore permanent resident, represented the foundation at the signing ceremony, where she revealed that the S$1 million donation was decided within just ten days. The donation will support financially vulnerable women of all ages, who need advanced cancer treatments such as proton therapy and immunotherapy.

... the foundation’s approach to philanthropy is founded on two principles: one, directly benefitting those in need; and two, having a multiplier effect. — Debbie Chang, Director and Board Member, H.S. Chau Foundation

When interviewed, Chang said, “We have done many of such programmes in Hong Kong which have been well received. Since I am now a Singapore permanent resident, I believe I have the responsibility to introduce the Dear Girlfriends programme [a medical subsidy scheme for more precise and high-end cancer treatment for female patients] to Singapore. Our requirements are very simple, it all depends on whether the patient needs it.”

The foundation is mainly funded by venture capital returns from Horizon Ventures. Chang pointed out that the foundation’s approach to philanthropy is founded on two principles: one, directly benefitting those in need; and two, having a multiplier effect.

She said, “Simply put, one’s ability and resources are limited, and maximising resource efficiency is something we consider before embarking on a new project. We have also told SingHealth that this is just the beginning.”

Education and healthcare the top priority

There are quite a few examples of ultra-high-net-worth individuals (UHNWIs) from overseas setting up family offices in Singapore and giving back to Singapore society.

Tan Sri Dr Lim Wee Chai, founder of Top Glove Corporation Bhd, the world’s largest manufacturer of disposable gloves, donated S$1 million each to the National University of Singapore (NUS) and Nanyang Technological University (NTU). This donation will become an endowment fund to set up a visiting professorship at both universities, inviting outstanding overseas experts and academics in medicine and healthcare to both universities for exchanges.

The Singapore Ministry of Education provided 1:1 and 1.5:1 matching grants for the endowment funds of both NUS and NTU.

Established in Malaysia, Top Glove made a secondary listing in Singapore in 2016. During the Covid-19 pandemic, the demand for medical gloves surged. According to Forbes, Lim had a net worth of US$3.5 billion at one point. As of late May 2023, Lim has a net worth of US$1.1 billion, about the same as his net worth pre-pandemic.

Lim, 66, told Lianhe Zaobao, “Health is the greatest wealth. I believe that we should continue to promote excellence in medical education… We must continue to learn and gain knowledge, so that we can improve and prevent mistakes… My personal goal is to live until I am 120 years old. To do so, I must ensure I am healthy.”

... education and healthcare are the social issues that many of the ultra wealthy are most concerned about.

Having built his empire out of nothing, Lim said his goal is to continue giving back to society, such as helping to close the gap between the rich and poor through education. He believes that in order to continue giving back to society, one must be in good health.

Both the H.S. Chau Foundation and Lim’s family office have repeatedly emphasised that education and healthcare are the social issues that many of the ultra wealthy are most concerned about.

Calculated based on publicly-available statistics, Altrata, a London-based research organisation that tracks the ultra wealthy, found in the Ultra High Net Worth Philanthropy 2024 report that education is the most popular philanthropic cause among the ultra wealthy, especially in Asia, which accounts for over 54% of individual donations.

Healthcare and medical research ranked second, accounting for 21% of individual giving by Asian UHNWIs. The report asserted that the damage and impact caused by the pandemic prompted wealthy Asians to be more engaged in healthcare philanthropy.

... donations by Asia’s UHNWIs only accounted for 13% of the global share, and has remained at this level in recent years. — Altrata’s Ultra High Net Worth Philanthropy 2024 report

Giving in Asia lags behind Europe and the US

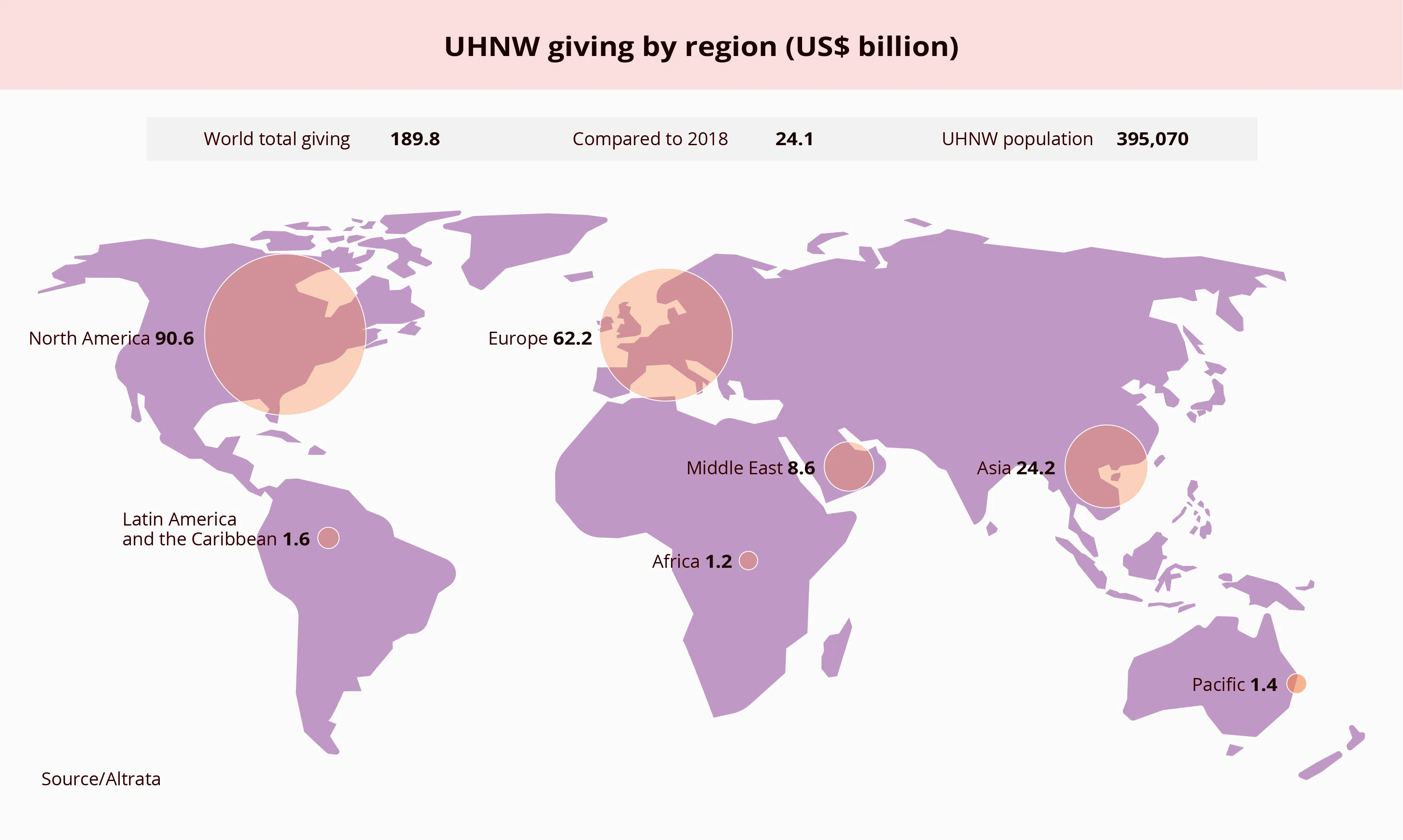

However, based on the overall donations, Asia still lags behind Europe and the US. Based on the Altrata report, the ultra wealthy gave a total of US$190 billion to philanthropic causes in 2022, up nearly 25% from 2018. Asia’s ultra wealthy gave a total of US$24.2 billion, up 28.3% from 2018.

Although Asia is the world’s second-largest source of UHNWIs with such individuals numbering around 108,370, 7% more than Europe, donations by Asia’s UHNWIs only accounted for 13% of the global share, and has remained at this level in recent years. The report analysed that this is because Asia’s non-profit sector is less developed, which can be partly attributed to cultural and regulatory factors.

In an interview, Laurence Lien, CEO and co-founder of the Asia Philanthropy Circle, underscored the complexity of generalising across Asian countries due to their diverse development levels.

He said, from a macro perspective, Asia’s civil society is less developed than in Europe and the US. People generally do not trust non-governmental and non-profit organisations, and most philanthropic activities are still driven by enterprises. The latter’s capacities are often limited to the communities they are familiar with.

Lien added, “In Asia, to a certain extent, philanthropy is more similar to Dana in Buddhism, where we give with no strings attached, and gifts must be pure and authentic… In the West, they are much more receptive to calls for donations and are prepared to give to strangers whom they have never met before, and their philanthropic activities could reach every corner of the globe.”

That said, he observes that these differences are changing. Many of the new generation of philanthropists are global citizens with global awareness and who focus more on giving internationally. Thus, they are also more likely to pay attention to global challenges such as climate change.

‘Mini foundations’ expected to emerge

At the same time, the Singapore government also plays an important role in encouraging philanthropy.

Lien said, “Singapore’s stability and security has attracted an increasing number of wealthy individuals to set up family offices here in recent years, and the government encourages these family offices to give back not just to us but to the wider region. We are hearing from the banks that there’s a demand for philanthropy services from their clients.”

Lianhe Zaobao understands that Temasek Trust, having recognised the demand, has launched a charitable advisory service targeting large charities, family offices, and HNWIs.

The number of family offices in Singapore has risen sharply from around 50 in 2018 to 1,100 family offices by the end of 2022. In July 2023, the Monetary Authority of Singapore (MAS) introduced the Philanthropy Tax Incentive Scheme for family offices, which came into effect in January 2024. This scheme aims to encourage single family offices (SFOs) in Singapore to contribute more to philanthropic causes.

SFOs that apply under the fund tax incentive S130 or S13U schemes can claim 100% tax deduction for their overseas donations, capped at 40% of the donor’s statutory income, when they use Singapore as a base and if they meet the criteria. Terms include appointing and maintaining a philanthropy professional (inhouse or outsourced), and incurring additional local business spending of at least S$200,000, and so on.

Lim Kexin, partner specialising in entrepreneurial and private business and tax at PricewaterhouseCoopers (PwC) Singapore, felt that regardless of whether tax incentive programmes for overseas donations are provided by the MAS, families with the means to establish family offices think globally.

When interviewed, Lim said, “The MAS sends two strong signals by introducing the Philanthropy Tax Incentive Scheme (PTIS). Firstly, it recognises that these families have charitable interests internationally. Secondly, having a family office presence in Singapore can be well leveraged to make a positive societal impact beyond economic investments from our shores.”

In September 2023, Lien linked up with two members of the Asia Philanthropy Circle, Rumah Group’s Stanley Tan and Firetree Philanthropy’s Francesco Caruso, to launch the Asia Community Foundation (ACF).

Statistics show that Singapore’s charitable contributions accounted for 0.6% of its GDP, while for the US it is 2% of its GDP. Lien hopes that through the ACF, the figure for Singapore can be raised to 1%.

The ACF is a Donor-Advised Fund (DAF). Lien describes the mission of the DAF being to assist donors in forming a “mini foundation”, adding that “we have a professional team so donors do not have to hire staff, and we can help in finding charitable organisations, programmes, as well as conduct checks, evaluate results and so on.”

Statistics show that Singapore’s charitable contributions accounted for 0.6% of its GDP, while for the US it is 2% of its GDP. Lien hopes that through the ACF, the figure for Singapore can be raised to 1%.

DAFs breaks new ground for philanthropy

DAFs originated in the 1930s in the US; as of 2022, total charitable assets for DAFs in the US amounted to nearly US$230 billion, the second-highest value on record.

Sheryl Fofaria, head of social impact and philanthropy for UBS Southeast Asia, pointed out when interviewed that DAFs first appeared in the Asia-Pacific region in the mid-1990s in Japan and India. She said, “In Singapore, the first DAF was introduced in 2008 and since then, over 270 DAF accounts have been set up receiving more than S$500 million in donations.”

She anticipated that DAFs would continue to gain traction “especially as the Singapore government expands its focus on encouraging philanthropy and evolves its policies and support for the sector accordingly”.

She noted that donors of UBS’s DAF have contributed greatly to areas from education and health to climate and the environment, adding that “donors today, particularly the rising generation, are eager to learn how to engage in philanthropy more impactfully and efficiently. For instance, in addition to conventional grantmaking, there is more interest to explore innovative methods of driving and financing impact such as social and blended finance.”

Li, a venture capitalist and private equity investor, moved to Singapore from China 12 years ago, and roughly four years ago, he set up his own family office and foundation.

With the integration of UBS and Credit Suisse, their two DAFs in Singapore would be merged into one platform called “UBS SymAsia Donor Advised Fund”.

Li Foundation founder Lionel Li is a “graduate” of SymAsia. Li, a venture capitalist and private equity investor, moved to Singapore from China 12 years ago, and roughly four years ago, he set up his own family office and foundation.

Li’s first charity event held in Singapore was linked to his decision to start running marathons for his health, which led to him participating in nearly 90 marathons all over the world.

Making money is a craft, spending money is an art

Li stated when interviewed that “amateur marathon runners all over the globe have a dream, that is to clinch six medals from the World Marathon Major. I’m among the first 30 Chinese amateur runners to achieve this dream.”

“I discovered that sports can change a person. Not only would you become healthier, even more importantly, it strengthens you. I first worked with SportCares through SymAsia, giving an opportunity to disadvantaged children to learn running, cycling and swimming after they get off from school.”

This two-year project was extended to five years along with the growth of the foundation.

“These foundations also hope to extend its reach to other areas, and Singapore would naturally develop into a charity centre.” — Lionel Li, Founder, Li Foundation

His experiences over the years left Li with a deep understanding of how difficult philanthropy could be. He said, “Setting up a family office, our goal is to use 10% of our profits each year for charity. When you have a goal, and you intend to make serious use of these funds, it is not that simple. I often say that it’s a craft to earn money, and an art to spend it.

“Everyone is going about the traditional methods, including the old families. What new thinking can a young foundation like us have that can help bring along even more people to join in?”

Currently, the foundation is focused on early childhood development for children from birth to three years of age, as well as issues concerning the elderly. When Li, with his parents in mind, was thinking about establishing a retirement plan tailored for the Chinese community, he found that some local foundations were already thinking and acting on similar issues. He said, “If we can establish a successful model in Singapore, perhaps it can be replicated in other Chinese communities.”

Li felt that Singapore already possesses a set of conditions for it to be developed into a regional charity centre. “Singapore is an asset management centre for Asia, as well as a financial centre. With so many UHNWIs and SFOs gathered here, it would naturally attract family foundations. These foundations also hope to extend its reach to other areas, and Singapore would naturally develop into a charity centre.”

This article was first published in Lianhe Zaobao as “富豪云集狮城 掀慈善新格局”.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)