China's semiconductor Great Leap Forward is doomed to fail

Political commentator Jin Jian Guo believes that the semiconductor Great Leap Forward pushed by the Chinese authorities could have the same devastating effects as the Great Leap Forward of the past. In an industry that is globally interconnected, persisting with the impossible endeavour of becoming fully self-reliant would only result in further instances of failing to learn from history.

The German philosopher Georg Hegel famously said, "The only thing that we learn from history is that we learn nothing from history." And so it is with the Great Leap Forward of 1958. Will it be déjà vu for China in its semiconductor Great Leap Forward?

Exponential growth

The Great Leap Forward campaign that began in 1958 ended in tragedy. But some 60 years later, its model is being replicated.

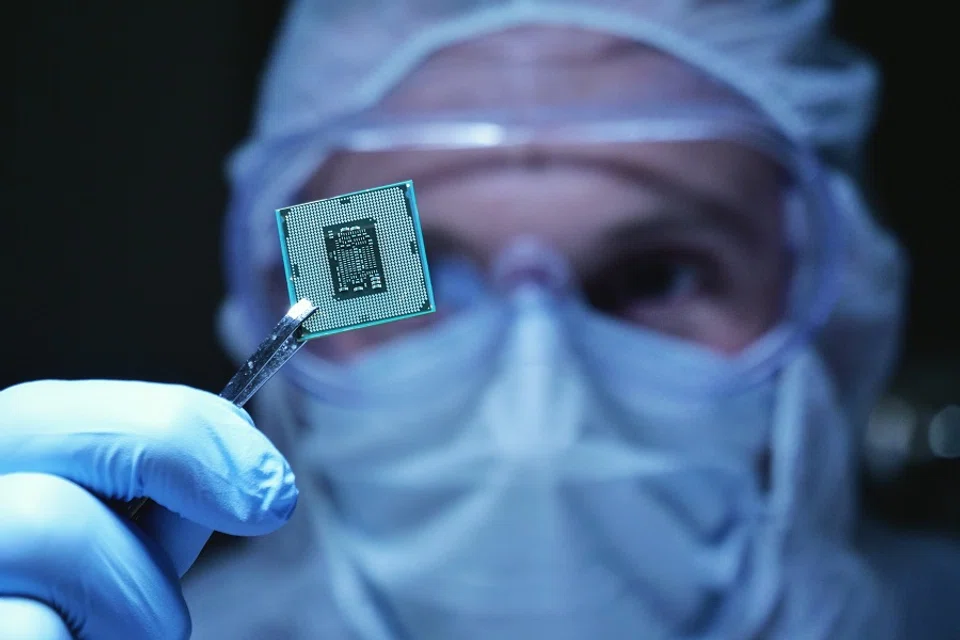

As part of the China-US trade war, the US imposed advanced computer chip bans on China. This led to increasing calls for the country to become self-reliant in advanced technologies. Nimble Chinese businessmen and state-owned enterprises (SOEs) began investing in chipmaking, and the relevant government departments released guidance on increasing investments in emerging industries of strategic value. With the government paving the way, along with the allure of profits and subsidies for businessmen and SOEs, a flourishing chipmaking campaign is underway in China.

According to estimates by 21st Century Business Herald, over ten provinces including Anhui have earmarked 1.42 trillion RMB for chipmaking in 2020.

As of February 2021, there are 66,500 semiconductor-related companies in China, of which 22,800 are newly registered in 2020, marking an increase of 195% year-on-year. In Guangdong alone, there are 22,900 semiconductor companies. The numbers grew even faster in 2021, with 4,350 new semiconductor companies registered in the first two months of the year, an increase of 378% year-on-year.

However, reports of reckless investments gone awry emerged soon after the semiconductor Great Leap Forward began. By September 2020, the Wuhan Hongxin project that was said to be worth hundreds of billions of RMB had stalled. In May 2021, the same happened to Chinese chipmaker Jinan Quanxin, which had received 59.8 billion RMB in investment. In July 2021, the 300 billion RMB Tsinghua Unigroup faced bankruptcy and was only given a new lease of life following a debt restructuring. Up to a trillion RMB has been invested in the semiconductor Great Leap Forward. According to estimates by 21st Century Business Herald, over ten provinces including Anhui have earmarked 1.42 trillion RMB for chipmaking in 2020.

Marred by corruption

Even as the public awaits the outcome of the semiconductor Great Leap Forward, the Chinese government launched an anti-corruption campaign targeting the industry in August this year, implicating a number of industry leaders.

On 9 August, Du Yang and Yang Zhengfan from Sino IC Capital were placed under investigation for alleged serious infractions. Others who landed in hot water with the authorities include Ding Wenwu, general manager of the China Integrated Circuit Industry Investment Fund (or known as the Big Fund) and former director of the digital information department of the Ministry of Industry and Information Technology; Lu Jun the former CEO of Sino IC Capital who managed the Big Fund; and Xiao Yaqing, the former minister of industry and information technology.

Indeed, the chipmaking campaign has not led to any breakthroughs for the industry.

Three more individuals are said to be under investigation and uncontactable - Zhao Weiguo and Diao Shijing, Tsinghua Unigroups's former chair and president respectively; and Wang Wenzhong, a partner at Shenzhen Hongtai Fund Investment Management that is a subsidiary of the Big Fund. All of those implicated are closely linked to the Big Fund.

Indeed, the chipmaking campaign has not led to any breakthroughs for the industry.

China Merchants Securities highlighted that according to IC Insights data, of the US$31.2 billion worth of semiconductors manufactured in mainland China in 2021, mainland China-headquartered companies produced US$12.3 billion, which accounts for only 6.6% of the US$186.5 billion domestic semiconductor market.

Another US$18.9 billion worth of semiconductors or 10.1% of that consumed in mainland China was supplied by companies with semiconductor fabrication plants located in mainland China, such as Taiwan Semiconductor Manufacturing Company (TSMC), SK Hynix, Samsung, Intel and United Microelectronics. The remainder was imported.

In terms of semiconductor sophistication, Chinese companies continued to face difficulties in manufacturing 14-nanometre chips.

Semiconductors are products of a global supply chain, not of an individual company or even a single country.

Product of a global supply chain

The lack of breakthroughs from the chipmaking campaign cannot be explained away by corruption, what is critical is that the campaign itself goes against the principles of the semiconductor development process. Semiconductors are products of a global supply chain, not of an individual company or even a single country. Countries collaborate on research and development (R&D) and the manufacturing process to produce semiconductors.

The chipmaking process includes different phases such as R&D, design, fabrication, and assembly, testing and packaging (ATP). R&D is an independent phase, while the ATP phase is relatively more straightforward.

As of 2019, the top three companies in chip design are US companies Broadcom, Qualcomm and Nvidia. These fabless chip designers outsource the manufacturing of the semiconductors to foundries, of which TSMC is the biggest.

The chip design phase also involves the collaboration of companies from different countries. For instance, when it comes to chip design, China relies heavily on Arm, a British semiconductor company that is also a leading global supplier of semiconductor intellectual property. At the same time, chip designers depend on software companies for specialised chip-designing software.

The semiconductor supply chain also includes equipment manufacturers and raw materials suppliers. US company Applied Materials is the world's biggest supplier of semiconductor manufacturing equipment. While Dutch company ASML is the sole manufacturer of extreme ultraviolet lithography machines that are needed for the production of semiconductors smaller than seven nanometres, it does not build these machines from scratch in-house or solely using resources from the Netherlands. In fact, quite a substantial proportion of the components are sourced from the US.

Indeed, the division of labour and cooperation in chipmaking is an outcome of the market economy instead of government intervention.

Division of labour and cooperation

Chipmaking history is a part of the broader history of the global division of labour and cooperation based on the market economy. Every segment of the semiconductor manufacturing process comprises core technologies and it is impossible for any country alone to possess all the core technologies.

In fact, it is already a remarkable feat for a country or a company to enjoy absolute superiority in a segment of the semiconductor industry. Intel is one of the inventors of semiconductors and is involved in the design, production and ATP. However, the company chose to stay out of the R&D, raw materials and production equipment space. Today, Intel's core product is CPUs and it is moving away from memory chips even though the company got its start there. Unlike Intel, TSMC is not involved in semiconductor design and ATP, and much less so with R&D.

Indeed, the division of labour and cooperation in chipmaking is an outcome of the market economy instead of government intervention. Even if there was government financing along the way, it did not play a deciding role. Simply put, chipmaking requires more than just money and labour.

Mandating companies that have been given huge injections of government funds to complete stipulated tasks and achieve set goals within a number of years will ultimately cause those without the resources to defraud.

While the dicta of "concentrating a superior force to destroy enemy forces one by one" and "pooling resources for major endeavours" were relevant to China in the past, they need to be refreshed in order to keep up with the times.

During Operation Desert Storm, the US military showed that human wave tactics have become outdated. In the ongoing Ukraine war, Russia's superiority in numbers and equipment has not helped its forces avoid the current series of setbacks.

"Pooling resources for major endeavours" without taking into account the market is unsuitable for high-tech industries, let alone chipmaking.

Adopting the planned economy thinking of "pooling resources for major endeavours" in chipmaking would only result in folly and misdeeds. Mandating companies that have been given huge injections of government funds to complete stipulated tasks and achieve set goals within a number of years will ultimately cause those without the resources to defraud. The Shanghai Hanxin chip fraud case that came to light in 2006 is a case in point. Evidently, the authorities failed to learn from the Hanxin chip incident, otherwise the semiconductor Great Leap Forward would not have been launched.

In a globalised world, even the US cannot be self-reliant in all of the core chipmaking technologies.

Failure to take into account the realities of chipmaking coupled with inadequate oversight create opportunities for unscrupulous actors to benefit fraudulently. Any country that seeks to go at it alone in chipmaking is pitting itself against the titans of the field from the rest of the world, and this is undoubtedly the wrong path to take.

In a globalised world, even the US cannot be self-reliant in all of the core chipmaking technologies. In fact, no country in the world is able to do that, and China is no exception. Persisting with this impossible endeavour would only result in further instances of failing to learn from history.

Related: China's chip industry 'Big Fund' crackdown: Corruptions or failed investments? | Five things to know about China's scandal-struck chip industry 'Big Fund' | Why no country can win the chip war | Chinese tech companies in chipmaking race to be self-reliant | China's going full speed ahead on technology innovation. Will it work? | China's whole-of-nation push for technological innovation

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)