'World's factory' status threatened as supply chain shifts away from China

Even as China seeks to maintain its position as the "world's factory", globalisation means that companies are seeking to diversify their operations, and are shifting away from China in favour of alternatives. Commentator Jin Jian Guo delves into this trend.

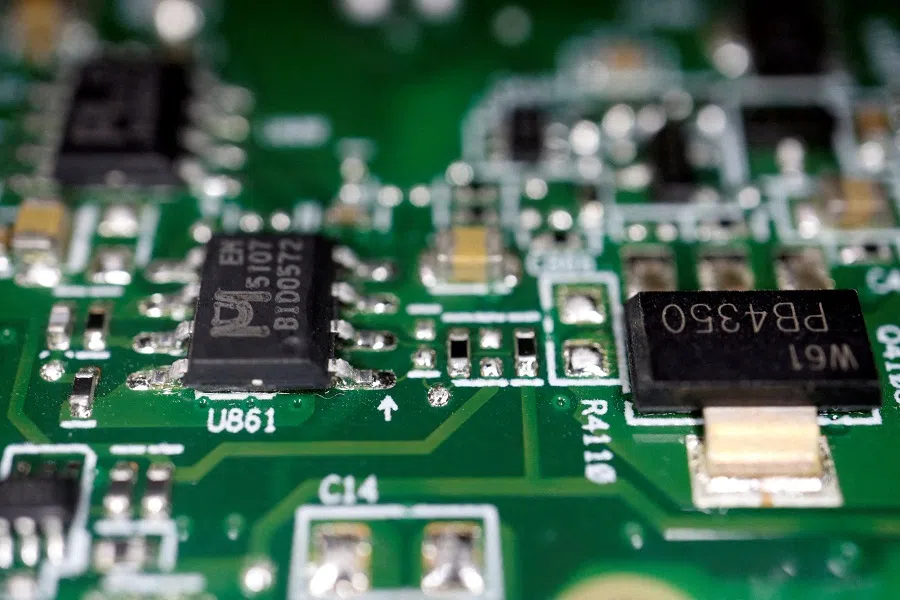

Globalisation has not receded, and the US's implementation of the CHIPS and Science Act is attracting foreign capital to the country. Taiwan Semiconductor Manufacturing Company (TSMC) is building factories in the US, with the first one due to begin operations in 2025 and the second one possibly starting operations in 2027. Operations at TSMC's Japan factory are expected to start this year.

At the same time, South Korea's SK Hynix is planning to invest about US$4 billion to build an advanced packaging plant in the US, while South Korean battery maker Samsung SDI is also set to build a battery plant in the US. These examples are enough to show that globalisation, which was once led by the US, is not going in reverse.

Yet the US has continued to strengthen its chip export controls on China. On 29 March, the US's Joe Biden administration revised rules aimed at preventing China from accessing US artificial intelligence (AI) chips and chipmaking tools. Released in October last year, the rules were meant to halt shipments to China of more advanced AI chips designed by Nvidia and others.

China's response to US measures

Although the US's measures are anti-globalisation, China is also adopting the same measures as the US. Last August, the Chinese Ministry of Commerce announced export controls on gallium and germanium related items. The Financial Times reported on 24 March that the Chinese government has taken steps to reduce the use of US microprocessors from Intel and AMD and to sideline Microsoft's Windows operating system and foreign-made database software.

China-US de-risking would inevitably lead to global supply chain shifts, which will play out mainly in Asia and Latin American countries, and China's role as the "world's factory" will be shared by many countries. The Economist pointed out last year that a crescent of 14 countries and regions including India, referred to as "Altasia" (alternative Asian supply chain), could gradually replace China in the coming years and become the centre of the world's manufacturing activities. While it is unrealistic to expect Altasia to completely replace China, its cake as the "world's factory" is being eaten away, slice by slice.

Changes in Mexico's and China's share in US foreign trade reflect a shift in intermediate goods trade between Mexico and China, which are supply chain shifts.

Where are they going?

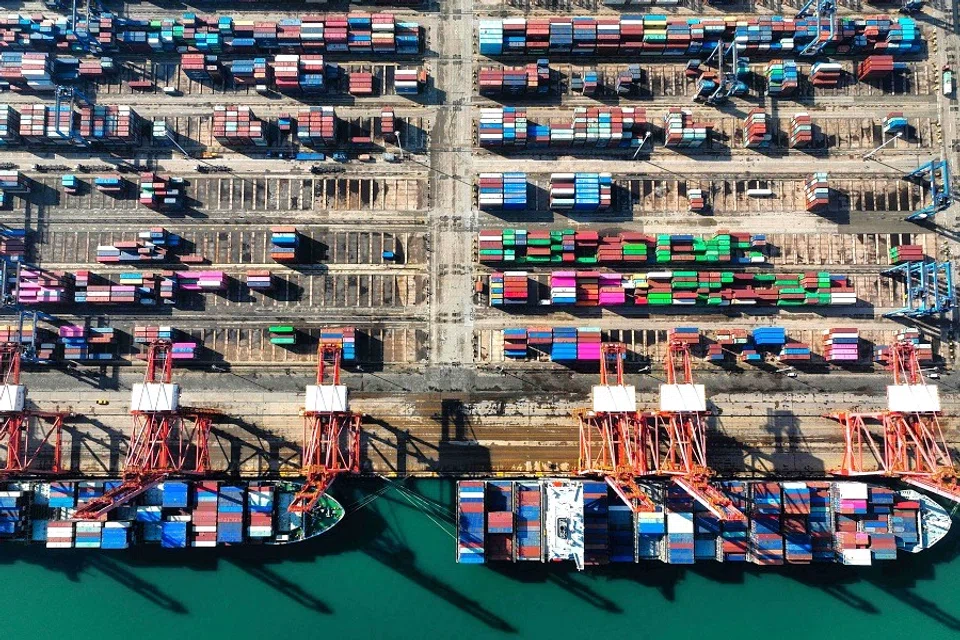

Mexico has replaced China as the top source of goods imported to the US, reflecting the outcome of changes in China-US relations. Figures released on 7 February by the US commerce department showed that the value of goods imported to the US from Mexico rose nearly 5% to more than US$475 billion from 2022 to 2023. At the same time, the value of Chinese imports fell 20% to US$427 billion. A significant portion of these trade volumes lies in intermediate goods.

Intermediate goods are goods used in the eventual production of a final good or finished product, excluding primary fuels and lubricants. The global supply chain represents the division of labour and assembly of intermediate goods across various countries, and China's role as the "world's factory" not only lies in providing the world with finished products but also intermediate goods. Changes in Mexico's and China's share in US foreign trade reflect a shift in intermediate goods trade between Mexico and China, which are supply chain shifts.

Changes in Mexico's foreign trade in China and the US have led to changes in China's trade and investment in Mexico as well. Figures from Container Trades Statistics, analysed by Xeneta, showed the number of 20ft containers shipped from China to Mexico reached 881,000 in the first three quarters of 2023, the most recent period for which data is available, up from 689,000 in the same period of 2022.

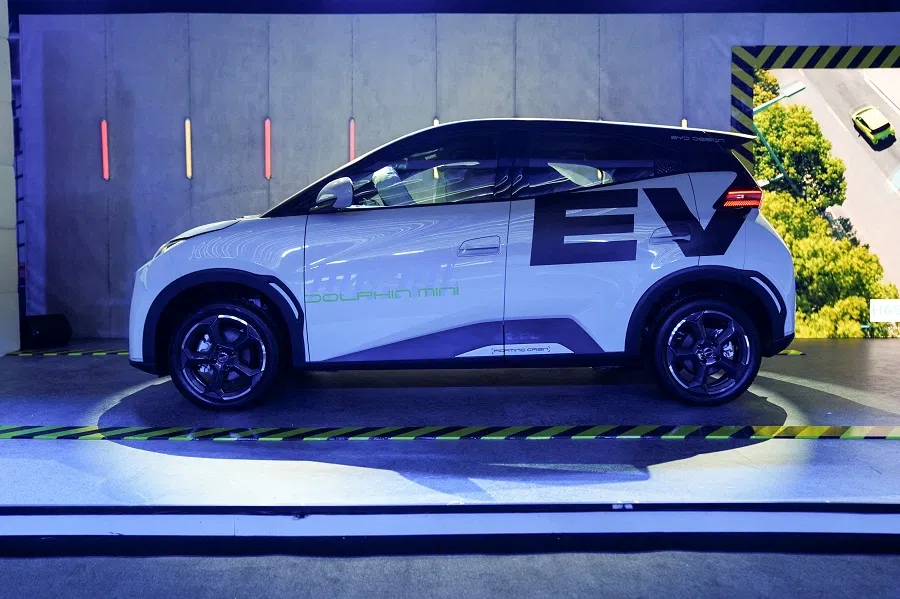

Statistics from Mexico's National Auto Parts Industry (INA) showed that 33 Chinese-owned companies with Mexican operations sent US$1.1 billion worth of parts to the US in 2023, up from US$711 million in 2021, and that Mexico imported almost US$9 billion in auto parts from China last year; one can understand why BYD is looking to set up a new factory in Mexico.

India the focus

India is the focal point of Asia's supply chain shifts. The Indian government is aggressively pushing for its "Make in India" initiative, leveraging the changing China-US relationship and actively seeking foreign investments to develop its own chip manufacturing sector.

Indian Prime Minister Narendra Modi has repeatedly told countries with geopolitical issues with China that India is a reliable partner in building trustworthy supply chains. The Indian government said that the microprocessor chips - that power all things digital - will soon be fully made in India. Last December, a Japan Bank for International Cooperation survey found that Japanese manufacturing companies have ranked India top for the second year in a row in terms of promising countries or regions for business development.

Foxconn's investment in India has also changed the location where Apple's iPhones are assembled. Until 2019, about 99% of iPhones were made in China. But India is now chipping away at China's dominance. Last year, around 13% of the world's iPhones were assembled in India, with about three-quarters of those being made in Tamil Nadu. The volume produced in India is even expected to double by 2025. At the end of last year, Foxconn already announced investments of over US$1.5 billion in India; in March this year, it announced a US$700 million investment for the construction of a new plant in India as part of its efforts to diversify manufacturing away from China.

Although no country in the world including Mexico, India and Vietnam will be able to replace China's position as the "world's factory", the fact that China's status as the "world's factory" is being threatened is affecting the Chinese economy.

In February this year, the Indian government approved US$15.2 billion worth of investments in semiconductor fabrication plants, including a Tata Group proposal to build the country's first major chipmaking facility and a packaging venture between Japan's Renesas Electronics Corp. and the Murugappa Group's CG Power and Industrial Solutions Ltd. Taiwan's Powerchip Semiconductor Manufacturing Corporation has also confirmed that it will assist the Tata conglomerate in building India's first 12-inch wafer fab in Dholera, Gujarat.

Vietnam has also become a centre of Asian supply chains with its rapid economic expansion in recent years. While Apple CEO Tim Cook praised China's openness and prosperity during his trip to China in late March, Apple iPhones have also been affected by worsening geopolitical tensions between China and the US. On 22 March at an Apple retail store in Shanghai's Jing'an district, an elderly woman was seen rebuking those in the queue as "fawning over foreigners". Footage of people angrily smashing iPhones were also seen on Douyin.

Cook must be aware of Apple's situation in China. Thus, Apple is intensifying its search for ways to diversify its supply chain, with Vietnam being one of the destinations to do so. Meanwhile, Foxconn has acquired land-use rights in Vietnam and is considering expanding operations there.

Although no country in the world including Mexico, India and Vietnam will be able to replace China's position as the "world's factory", the fact that China's status as the "world's factory" is being threatened is affecting the Chinese economy. China's reform and opening up that began in the 1980s has undergone a profound shift, which has in turn changed the situation with China's foreign trade and its attraction of foreign investment.