Are Chinese solar giants flying too close to the sun?

With capacity already exceeding demand, analysts and investors are starting to question if the plans of China's solar panel makers to double down on their investment and expand are justified.

(By Caixin journalists Luo Guoping, Zhao Xuan, Fan Ruohong and Denise Jia)

China's solar panel makers, who already account for up to 95% of global manufacturing capacity, are doubling down on their investment in the booming segment, announcing expansion plans up and down the supply chain.

But with capacity already exceeding demand and on track to balloon by 2030 to far in excess of forecast market requirements, analysts and investors alike are beginning to question whether these plans are justified.

Saturated market

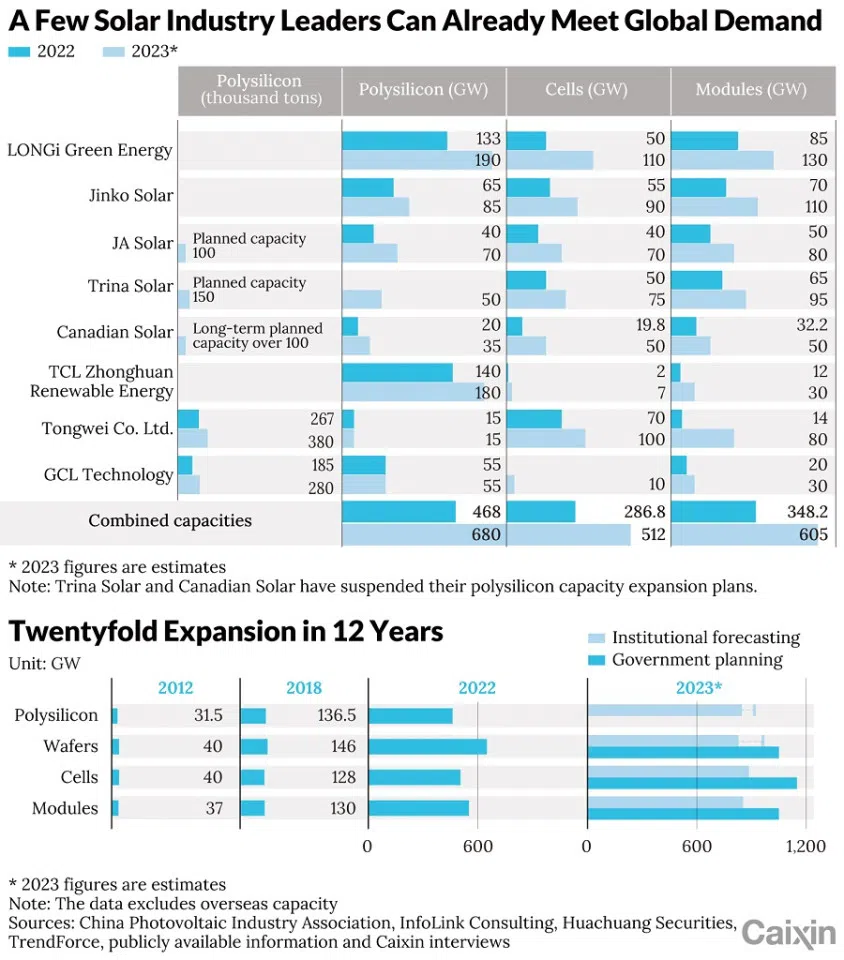

Planned capacity of the top five Chinese manufacturers - Jinko Solar Holding Co. Ltd., LONGi Green Energy Technology Co. Ltd., JA Solar Technology Co., Trina Solar Co. Ltd. and Canadian Solar Inc. - will increase by 54% by the end of this year from 2022 to reach 465 gigawatts, according to Caixin's calculation based on companies' financial reports.

Indeed, their combined shipment target of 310-325 gigawatts this year can already meet most of the world's total demand, according to Caixin's calculation based on the companies' financial reports.

And when including smaller manufacturers and other companies in the upstream and downstream sectors, China's photovoltaic (PV) industry's total capacity will reach nearly 1,000 gigawatts by the end of 2023, more than twice as much as the world can consume, according to estimates by several research institutions and industry experts.

Global demand is forecast to reach as high as 402 gigawatts this year and close to 800 gigawatts in 2027, according to SolarPower Europe, a solar advocacy group representing over 300 organisations across the entire sector.

By comparison, the International Energy Agency (IEA), a Paris-based intergovernmental organisation, estimates solar panel production capacity to be 1,262 gigawatts by 2030.

Therefore, it may come as no surprise that some are beginning to wonder whether their soaring ambitions may be setting them up for a fall.

... investors questioned whether [Jinko's] expansion plan was too aggressive amid a nearly saturated market...

The latest to announce an expansion plan is Jinko, one of the world's largest solar panel makers, who told investors on 15 August that it will invest 56 billion RMB (US$7.7 billion) in the next two years to build the largest integrated solar plant ever seen. The facility will be located in Shanxi province.

The company plans to raise 9.7 billion RMB though a private share offering to fund the first phase of construction.

But even though the plan was announced after a robust first-half report that showed a more than fourfold growth in profits, investors questioned whether its expansion plan was too aggressive amid a nearly saturated market, with its shares tumbling 12% the next day.

Carbon goals

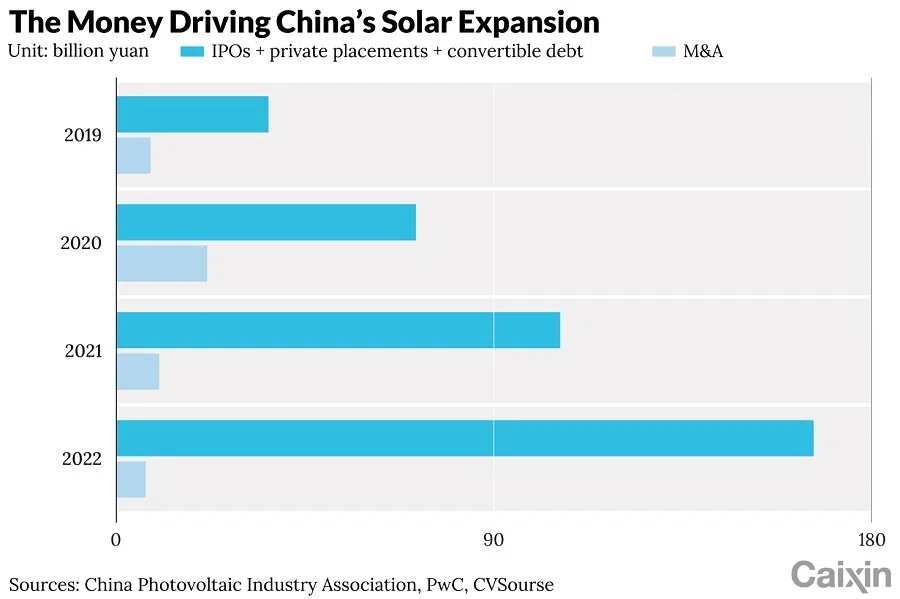

The expansion among China's PV giants has been driven by the government's pledge in 2020 to peak carbon dioxide emissions by 2030 and become carbon neutral by 2060. This made the PV industry the one sector almost assured of growth despite generally slowing economic expansion, and resulted in vast amounts of capital pouring into the sector.

From 2019 to 2022, PV companies raised 380 billion RMB through the capital markets, including IPOs, private placements and convertible bonds, according to statistics from the China Photovoltaic Industry Association.

In addition, this year so far, listed PV companies have raised over 140 billion RMB in the secondary market, according to the association.

From 2020 to July 2023, a total of 164 investment and financing deals were completed in the PV industry in China, attracting prominent investors including IDG Capital, China International Capital Corp.'s investment management arm, Hillhouse Capital, and state-owned National Green Development Fund, according to data compiled by Cailianpress.com's venture capital database. Sixteen of the deals were valued at over 1 billion RMB each, according to the database, although it didn't give a total figure.

... global PV manufacturing capacity has increasingly moved from Europe, Japan and the US to China, which has invested over US$50 billion in new capacity, ten times more than Europe since 2011... - International Energy Agency report

LONGi Green Energy became the first solar company with a market value of more than 100 billion RMB in August 2019. Within two years, its market value skyrocketed to 500 billion RMB, with its net profit rising 62.7% in 2022.

In the rapid growth stage of an emerging industry fuelled by a large influx of funds, companies without scale can't survive, therefore the best option is to expand to become leaders and squeeze out competitors, said an investor at a state-owned new energy investment firm.

But even prior to 2020, over the last decade, global PV manufacturing capacity has increasingly moved from Europe, Japan and the US to China, which has invested over US$50 billion in new capacity, ten times more than Europe since 2011 and taken 80-95% of the solar panel market, according to a 2022 report by the IEA.

China is likely to maintain that share for the next five years, despite efforts to geographically diversify the supply chain, said the IEA.

The PV industry has a long manufacturing chain. The upstream sector purifies polysilicon from industrial silicon smelted from silicon ore. Polysilicon is the primary raw material used to make solar cells. The midstream turns polysilicon rods and ingots into wafers, which are then fabricated into PV cells. In the end-stage, cells are assembled into modules, also known as solar panels.

Seeking integration

Most of the industry leaders aim to expand via a so-called integrated approach, meaning they try to make everything in the industry chain, from raw materials to final products or at least the mid- and downstream wafer, cell and module manufacturing segments. Some companies have expanded their operations to include upstream, making polysilicon.

Several industry leaders said their integrated expansion was a necessary strategy to improve their own supply security, lower overall costs and better cope with market fluctuations.

"When the industry leaders are getting bigger and bigger, and more and more new players coming in, if you don't have integration, you will be slaughtered by rivals," an executive at a solar module manufacturer told Caixin.

As the construction cycle and development speed of each link of the PV industry chain are out of sync, it results in one segment being able to milk robust profits, while the others can only share in small margins or are even unprofitable, said Song Hao, assistant vice-president of GCL Technology Holdings Ltd., the largest supplier of polysilicon in China.

Currently polysilicon manufacturing is the most profitable segment, driven by high polysilicon prices. For example, GCL Technology's gross margins reached nearly 50% in 2022 and Xinte Energy Co. Ltd., another major polysilicon supplier, reported a 70% gross margin the same year.

Therefore integration can better balance the interests of both upstream and downstream industries, said Song.

However, not all agree.

"Integration is just clutching at straws," said Zhang Sen, secretary-general of the PV arm of the China Chamber of Commerce for Import and Export of Mechanical and Electrical Products. PV companies have no other option but integration, as downstream companies can't get the materials if they don't produce themselves, he said.

This was reflected in the prices. Since 2020, prices of polysilicon, ethylene vinyl acetate (EVA), a thermoplastic polymer used in the manufacture of PV modules, and tempered glass used in solar panels, had skyrocketed.

"If you invest 100 million RMB in a PV project, local governments can return at least 30% of the investment to you through land, tax rebates and subsidies." - Person close to Jinko

Polysilicon spot market prices rose from less than US$7 per kilogram in July 2020 to nearly US$40 in July 2022, the highest level since 2011, according to BloombergNEF.

Downstream companies found they couldn't get the materials, Zhang said, and "they have been pushed to expand upstream to secure supply".

Local governments have also played a big role in driving this wave of capacity expansion. A person close to Jinko told Caixin that the company's Shanxi mega plant project has received strong support from the local government, which offered what they described as "the best investment terms in the province's history".

About 20-30 billion RMB of the Shanxi's project's budget of 56 billion RMB comes mainly from local government financing vehicles (LGFVs), state-owned companies set up to finance local government investment, the person said.

Other PV projects across the country are also run on a similar model.

"If you invest 100 million RMB in a PV project, local governments can return at least 30% of the investment to you through land, tax rebates and subsidies," the person said.

PV enterprises' pursuit of integration shows that companies still focus on short-term gains in the industry chain that are not mature, said Teng Yong, partner at Chicago-based consulting firm Kearney.

Although integration offers convenience and overall cost reduction, each link requires huge investment and has been done in order to achieve the advantages of integration, Teng said.

Headwinds

But this rapid expansion has resulted in headwinds. The upward trajectory of polysilicon prices stalled and since January they've fallen off a cliff, with the global average tumbling through the threshold of US$10/kg to US$9.46/kg on 14 June and down from US$38.3 in August 2022, according to Bernreuter Research.

China's share of all manufacturing stages of solar panels globally exceeds 80%, which is more than double its share of global PV demand, according to the IEA's Solar PV Global Supply Chains report published in August 2022.

Domestic silicon wafer production capacity is expected to reach 800 gigawatts in 2023, while Chinese demand for PVs will only be about 340 gigawatts, according to SMM analysts.

With the price drop, some Chinese producers such as Trina Solar and Canadian Solar have suspended their polysilicon capacity expansion plans.

Consequently, many PV manufacturers are now expecting tough days ahead.

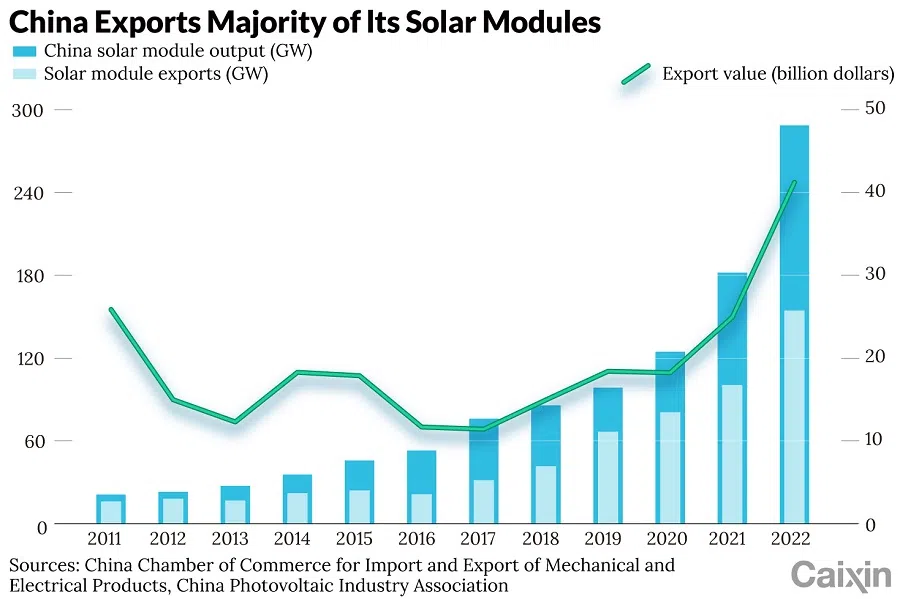

Eight out of every ten PV modules in the world are made in China, while more than half of China's PV modules are exported, according to China Photovoltaic Industry Association.

In fact, more than half of China's solar manufacturers could be forced out in the next two to three years because of excess capacity, Li Zhenguo, president of LONGi Green Energy, told Bloomberg in an interview in May.

The scale of China's industry can't be overstated.

Eight out of every ten PV modules in the world are made in China, while more than half of China's PV modules are exported, according to China Photovoltaic Industry Association.

And this is despite the move offshore, with US tariffs on Chinese-made modules driving module production to Southeast Asia, where many manufacturing facilities import cells from China, according to energy consultancy Wood Mackenzie. China's PV exports also are rapidly increasing to the Middle East, Brazil, Chile and Peru, and South Africa, according to China Photovoltaic Industry Association.

But now these markets are saturated.

"Even Africa told us 'don't ship anymore'," an executive at a solar module manufacturer told Caixin. "Competition in the PV module market is intense. All Chinese companies are trying to grab market share with low prices."

The sector suffered a similar price war about 11 years ago, during which Chinese PV companies were able to expand their capacity thanks to generous government subsidies, but later ran into trade barriers that shrank the market.

One of the world's largest solar-panel makers at that time, Suntech Power Holdings Co. Ltd., ended up in bankruptcy restructuring due to its billions in debt.

The operating rate of module manufacturers currently sits at about 60% of their capacity, Caixin has learned from industry insiders. Now second to third-tier module manufacturers basically can't survive, the executive at a solar module manufacturer told Caixin.

"Those without their own cell manufacturing capacity can't compete with integrated industry leaders and have to cease production," the executive said.

The oversupply will squeeze profit margins in the industry and move more money downstream, broaden downstream application scenarios, and help stimulate the industry, GCL Technology's Song said.

Go west

Chinese PV manufacturers are also stepping up capacity expansions in Europe and the US, where they are taking advantage last year's Inflation Reduction Act that includes US$374 billion incentives for American-made cleantech.

Jinko has invested US$52 million to build a factory in Jacksonville, Florida, where their government in April approved ten-year funding of US$2.3 million for an expansion project to increase its capacity by 1 gigawatt of modules.

JA Solar announced in January a plan to build a US$60 million panel plant in Phoenix, while LONGi Green Energy will partner with US solar developer Invenergy to build a US$600 million, 5-gigawatt solar panel assembly factory in Ohio, the local government announced in March.

In Europe, LONGi Green Energy plans to establish its first factory in Germany, its president Li revealed in June.

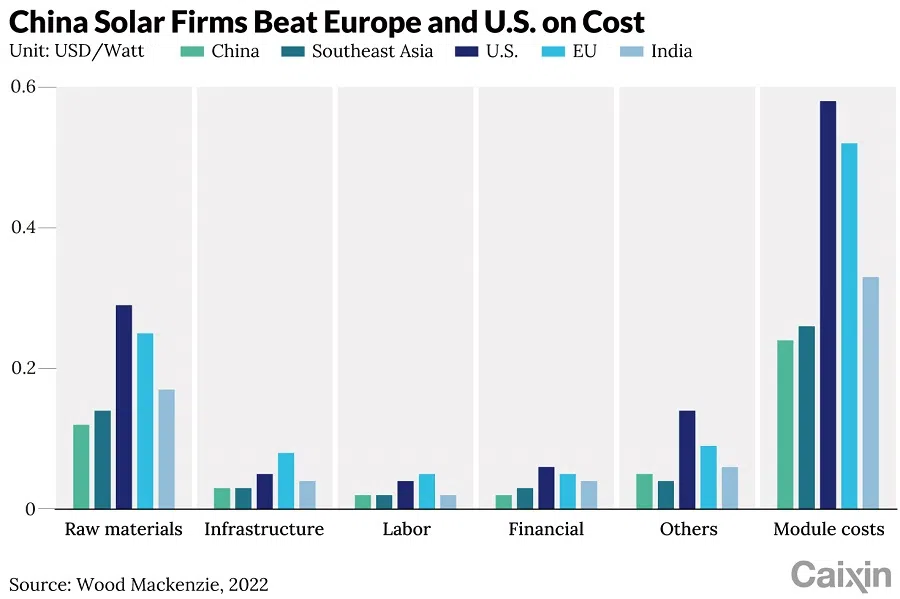

"Why do we need to go to Europe and US? Because they are profitable markets," said Zhang, secretary general of the PV arm of the China Chamber of Commerce for Import and Export of Mechanical and Electrical Products.

PV modules in China were sold at 1.21-1.25 RMB per watt in the last week of August, compared with 1.18-1.3 RMB in Europe and 2.18-3.27 RMB in the US, data from InfoLink showed.

But the costs of construction, labour and equipment are much more expensive in the US. For a 1-gigawatt module plant, it costs less than 100 million RMB to build in China. But the cost for JA Solar's US plant was 570 million RMB, and over 800 million RMB for LONGi's facility.

Despite the higher costs, Chinese companies still think the risks are low. An executive from one Chinese company believes that it can recover the costs in the second year with the Inflation Reduction Act subsidies. But even without the subsidies, a US plant can still break even in three to four years, the company executive said.

Yuan Xiaoshan and Qiu Yi contributed to this report.

This article was first published by Caixin Global as "Cover Story: Are Chinese Solar Giants Flying Too Close to the Sun?". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)