China's plan to break foreign iron ore dependence - mine more at home

China's "Foundation Plan" for iron ore has gained much official support, and is aimed at reducing reliance on foreign sources of iron, including Africa and Australia. The only way to do this effectively is for China to ramp up mining of its own iron resources. However, these resources are scattered and difficult to access, and of lower grade. This means China has its work cut out if it is to succeed.

(By Caixin journalists Flynn Murphy and Luo Guoping)

The creation of China's new state-owned iron ore giant - built to consolidate the nation's mining investments and coordinate purchases of the key steelmaking input - is being felt everywhere from Simandou to Sydney.

The idea is that China Mineral Resources Group, founded on 19 July with registered capital of 20 billion RMB (US$3 billion), will centralise purchasing for state-owned steelmakers and traders to create a unified front in negotiations with foreign suppliers. It will also house overseas mining assets.

The move is underpinned by China's Iron Ore "Foundation Plan," which will unfurl over the next decade. The plan was ostensibly developed by the China Iron and Steel Association, the industry body representing the iron and steel giants that have been paying foreign firms eye-watering prices for the raw material.

However, the plan has been advanced at China's highest levels, with strong support from the chief state planner at the National Development and Reform Commission, as well as the local governments of key steelmaking provinces. Leaked details have been published in dribs and drabs, mostly by the mining industry press. But no official text has been released.

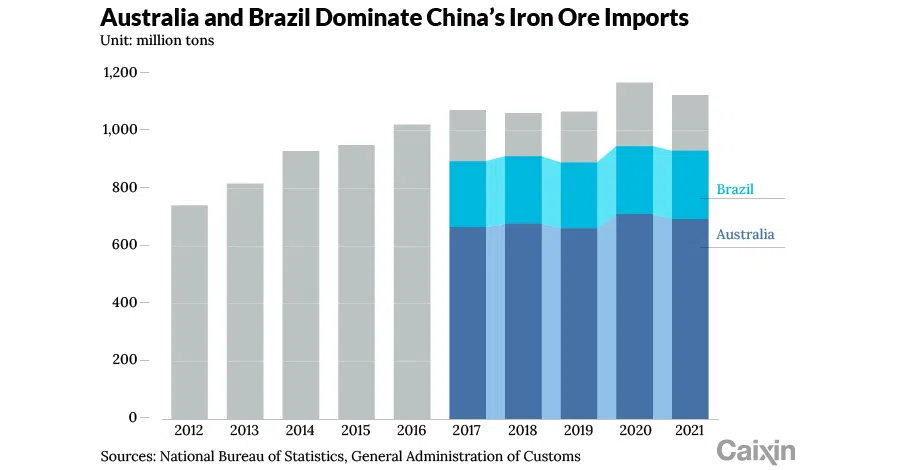

China produces half of the world's steel but is heavily reliant on imported ore, shipping in more than 80% between 2015 and 2020, and 76.2% last year.

Securing access to iron ore

For the world's largest steel producing nation, the goal is uncomplicated: secure access to iron ore. That means asserting market power commensurate with the industry's size to put downward pressure on the price of the commodity, which is mostly purchased from firms like Australia's BHP and Fortescue Metals Group, Anglo-Australian Rio Tinto, and Brazil's Vale.

China produces half of the world's steel but is heavily reliant on imported ore, shipping in more than 80% between 2015 and 2020, and 76.2% last year. In 2021, China spent about US$180 billion on iron ore imports. Its purchasing power is hobbled by the fact its steel industry is scattered among some 500 mills.

Its sources are also concentrated, with Australia accounting for around three-fifths and Brazil about one-fifth. Years of effort investing in mining abroad had only yielded equity of about 8% in overseas iron-ore mines as of 2020.

The foundation plan aims to change the calculus in two ways: by changing the structure of China's iron and steel industry, and by changing its sources of iron ore.

The top five members of China Mineral Resources' management team are former senior executives of four central government-backed mining giants - Aluminum Corp. of China (Chinalco), China Baowu Steel Group Corp. Ltd., Anshan Iron and Steel Group Corp. and China Minmetals Corp. Most have already agreed to acquire minerals through the new platform.

But while the overseas drive and impact on purchasing have made headlines, its domestic mining push and associated costs and impacts have not been well scrutinised.

Growing domestic sources

Possibly the most ambitious part of the plan involves ramping up China's domestic sources of iron ore. The CISA's deputy secretary general, Lu Zhaoming, told Caixin previously that the goals are to increase the annual output of domestic mines to 370 million tonnes, and source 220 million tonnes per year from scrap recycling. Both represent an increase of 100 million tonnes over 2020 levels.

In 2030 and 2035, the scrap steel targets will increase to 350 million tonnes, and then 400 million tonnes, respectively.

The overall cost of getting iron concentrates out of the ground in China runs from US$60 a tonne to more than US$100, depending on the mine. That compares with around US$30 a tonne in Australia and Brazil.

Based on an estimated peak steel production of 1.065 billion tonnes in 2025, industry insiders said hitting those targets could offset 47% of China's annual iron ore needs.

But the devil is in the details.

In the past decade, hardly any domestic iron ore mines have received fresh exploration and development investment, one industry insider pointed out.

It's not like China has no iron ore. Its known reserves - those still in the ground - are thought to be the world's fourth largest at 10.8 billion tonnes. They're mostly in Sichuan, Liaoning, Shanxi, Anhui, Shandong, and Hebei provinces, as well as the Inner Mongolia autonomous region. But these reserves are scattered and hard to access, so they will take more effort and money to dig up.

They're also mostly lower-grade magnetite which takes more work to refine than higher-grade hematite deposits in Australia and Brazil. The overall cost of getting iron concentrates out of the ground in China runs from US$60 a tonne to more than US$100, depending on the mine. That compares with around US$30 a tonne in Australia and Brazil.

So it's no surprise Chinese firms have focused on investing overseas, even though they have found that political and environmental constraints, as well as a lack of knowledge and experience, have limited their access to markets.

Data from China's National Bureau of Statistics show investment in domestic iron ore mining dropped from 169 billion RMB in 2013 to below 100 billion in 2019 and has plunged to around 80 billion RMB since.

Even in 2021, with iron ore prices hitting record highs, domestic iron ore concentrate production only rose 5.2% to 285 million tonnes. That's 85 million tonnes away from the 2025 target - in other words, annual growth in output needs to double each year until then.

... developing mines involves a complex series of approval processes, environmental impact assessments, protection measures, and taxes and fees.

'Market oriented'

In hopes of expanding local mining, the CISA and the China Metallurgical and Mining Enterprises Association have produced a list of more than 50 domestic projects that are worth more investment and development.

The CISA's Lu Zhaoming insists the foundation plan is "market oriented" and that the state-owned firms involved will make independent judgements and decisions about which projects they invest in.

That could prove a barrier to hitting the plan's targets, given the costs and risks of domestic iron ore investment.

And like anywhere else, developing mines involves a complex series of approval processes, environmental impact assessments, protection measures, and taxes and fees. Still, national coordination could get some of those barriers removed.

But high costs may not matter if current geopolitical trends continue.

Greater calculus

Domestic iron ore mining interests may not actually need to be cost-competitive with foreign mines in order for a project to make investment sense to regulators and major iron and steel companies, one analyst told Caixin.

The thinking goes like this: When large iron and steel producers invest directly in iron ore mining capacity, they don't need to turn a profit on the ore. The mining business can supply the ore at or near cost to the steel mill, facilitating a more profitable steel business.

Steelmakers that have greater self-sufficiency are also left in a better bargaining position with foreign miners, offering the prospect of negotiating a discount on imported ore as well.

But high costs may not matter if current geopolitical trends continue. The senior analyst pointed out that boosting production capacity in China may be necessary to strategically buffer the country from supply shortages.

If China can increase its own supply of iron ore, its investments in domestic mines will reduce the risk of Chinese steel companies getting cut off from raw materials in the event of major geopolitical strife with its suppliers.

(Han Wei contributed to this story.)

This article was first published by Caixin Global as "In Depth: China's Plan to Break Foreign Iron Ore Dependence - Mine More at Home". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.