China’s travellers return, but their spending stays home

Industry insiders say travellers are now increasingly value-driven, prioritising value for money and meaningful experiences over lavish spending.

(By Caixin journalists Bao Yunhong, Zou Xiaotong and Wang Xintong)

A record number of travellers swarmed China’s train stations and airports over the summer, yet this surge in traffic concealed a now-familiar post-pandemic paradox: while the crowds returned, their spending did not.

In July and August, a record 943 million passenger trips were taken on China’s railways, up 4.7% year-on-year, according to China State Railway Group Co. Ltd. The civil aviation authority reported a total of 147 million trips, setting an all-time daily record of nearly 2.6 million on 15 August.

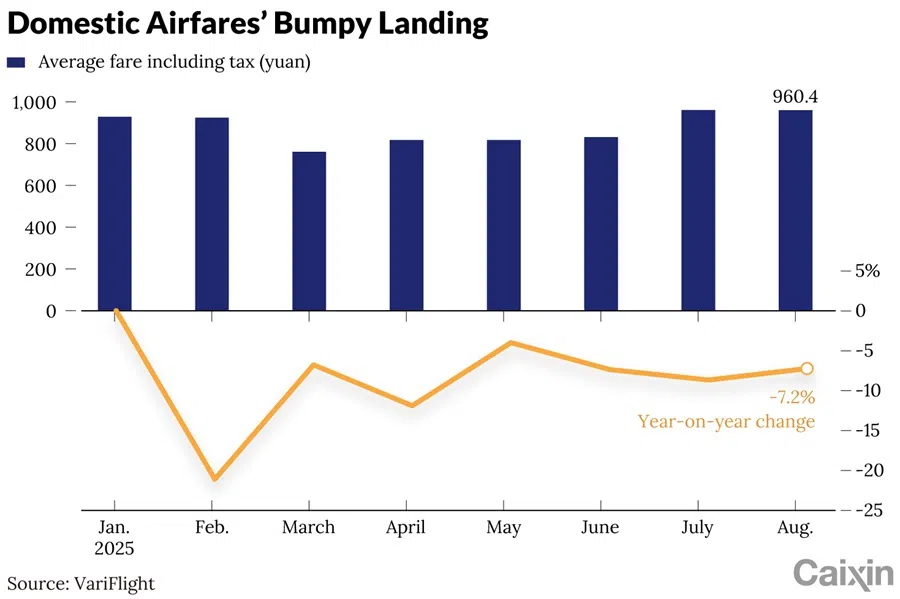

Meanwhile, domestic airfares and hotel rates continued to slide.

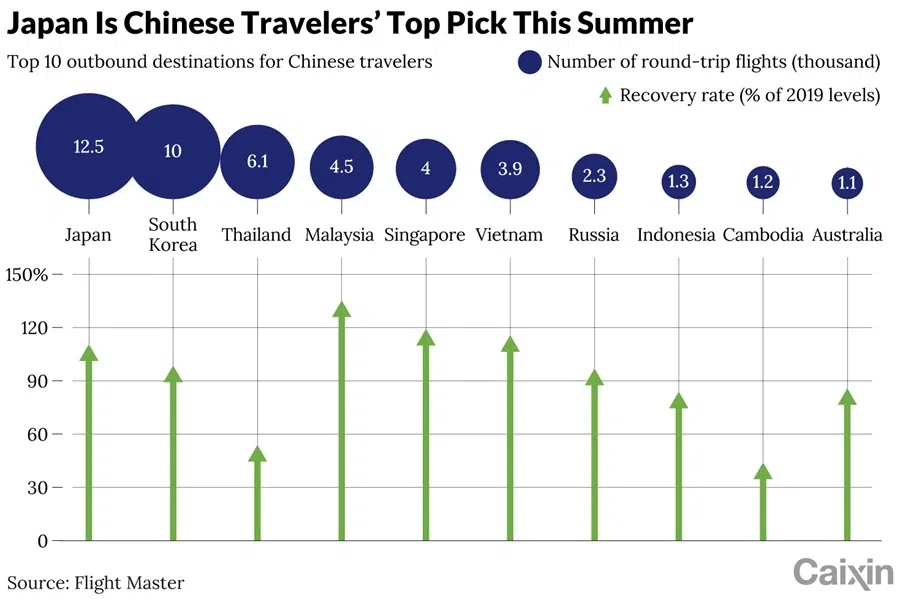

The picture was mixed for international travel. While Chinese tourists continued to favour shorter, economical trips to nearby destinations like Japan and Southeast Asia, long-haul travel to Europe also saw a rebound.

This divergence highlights the challenge Beijing faces in its push to stimulate domestic spending and spur an economic recovery. Industry insiders say travellers are now increasingly value-driven, prioritising value for money and meaningful experiences over lavish spending — a shift clearly reflected in the recent craze for concerts.

A busy season, not a rich one

The disconnect between passenger numbers and spending was particularly stark in the air.

During the summer, the average one-way domestic flight ticket, including tax, was around 900 RMB (US$126), down 5% from 2024, according to aviation data platform VariFlight. International fares fell even more sharply, down 15% to about 1,500 RMB.

“Airfares for the 2025 summer travel season fell more than in 2024,” an employee at an aviation data platform told Caixin. He noted the average domestic fare was 8.6% lower than in the same period in 2019, compared to just a 1% drop in 2024.

The price pressure stems primarily from oversupply, after airlines built up capacity for a post-pandemic travel boom that never came. This, coupled with competition from high-speed rail, is forcing airlines to slash fares to fill seats.

The hotel industry is facing similar headwinds. In July and August, only one week in mid-August saw a year-on-year increase in revenue per room for hotels on the Chinese mainland, according to hotel market data provider STR.

... a two-fold problem: aggressive expansion by chain hotels and “rational”, price-sensitive consumers.

In July, hotel prices in major cities like Beijing, Shenzhen and Guangzhou all fell year-on-year, while prices for mid-to-high-end hotels in Shanghai remained stable, according to STR data.

Zhou Tao, head of property management firm JLL’s Greater China hotel business, pointed to a two-fold problem: aggressive expansion by chain hotels and “rational”, price-sensitive consumers. He argued that going forward, tough price competition will be the norm and operators must differentiate through unique experiences and products targeting specific niches.

“Consumers are no longer willing to pay high premiums for the peak season,” said Zhou Haitao, CEO of tourism industry information and news provider Wenlv. He observed that if a branded hotel’s price jumps from its usual 400 to 500 RMB to over 1,000 or 2,000 RMB, consumers will avoid it.

Since the beginning of the year, international hotel chains including InterContinental Hotels Group PLC, Hyatt Hotels Corp. and Marriott International Inc. have cut ties with several upscale hotels in China, which no longer operate under their brands.

These foreign brands are feeling intense pressure from domestic rivals. On one hand, the supply of mid-to-high-end hotels in China is expanding rapidly, with 5,200 new openings on the mainland in the first half of 2025 alone, according to data form hospitality consulting firm Horwath HTL.

On the other hand, budget hotels are competing for market share by offering services that mimic upscale experiences at much lower prices, Zhou said, concluding that “after repeated rounds of cut-throat competition, no one can command high prices.”

The power of this experience-driven demand is also visible in the “concert economy”.

New playbook for travel

University students were the bright spot for the travel industry.

Data from online travel agency Qunar.com Inc. showed that bookings for domestic and international flights by students aged 18 to 22 both grew by over 10%. This group was the fastest-growing segment for international travel, with bookings up 42%.

While they were quick to snap up the cheapest flights and hostel beds, they were willing to spend on experiences. Qunar data showed for university students this summer, villas and camping accommodation provided by hostels saw the highest growth in bookings. Bookings also doubled year-on-year for pricey guesthouses near famous scenic areas, including those near Yunnan province’s Meili Snow Mountains and Shangri-La city.

The power of this experience-driven demand is also visible in the “concert economy”.

When Chinese boy band Teens in Times held concerts in Dalian, Liaoning province, on 25 and 26 July, hotel bookings by university students near the venue surged 11-fold from the previous year, Qunar data showed. A 9 August concert by singer Wang Yuan in Taiyuan, Shanxi province, drove a sevenfold year-on-year increase in hotel bookings by university students around the venue.

“Post-pandemic, concerts have emerged as a powerful driver of tourism spending,” said an employee at an online travel agency, explaining that concerts also boost spending on dining and accommodation.

Meituan data showed in August, four concerts by Teens in Times in Shanghai drew over 200,000 attendees, pushing the city’s overall cultural and tourism consumption up 31% and hotel orders up 45% year-on-year.

Local governments are now competing fiercely for a piece of the “concert economy”. Nanchang, for example, rolled out a suite of measures in early 2024 to stimulate its performance market, including streamlining the approval process for large-scale events. These efforts paid off. The capital of Jiangxi province hosted 27 concerts last year, attracting 800,000 concertgoers from other cities and generating over 1.6 billion RMB in direct consumer spending.

“The current main consumers are young people, who pay more attention to experiences and emotional value,” Zhou said. He added that scenic spots are adapting by adding interactive experiences, such as employing costumed staff to engage with visitors.

Shifts in overseas travel

For outbound travellers, short-haul Asian destinations remained popular during the July-August period, with Japan, Thailand, South Korea, Hong Kong and Malaysia being the most visited, according to Trip.com Group Ltd.

Travel to Japan was particularly robust. According to data platform Cirium, there were about 12,000 round-trip flights between China and Japan in August, with capacity up 25.1% year-on-year. Flight Master data showed the number of flights between China and Japan had recovered to 106% of the 2019 level.

The number of Chinese visitors to Japan surged 25.5% year-on-year to 974,500 in July, making China the top source of foreign tourists for the month, according to the Japan National Tourism Organization.

A series of events dented Chinese tourists’ confidence in Thailand. The disappearance of Chinese actor Wang Xing in the country earlier this year sparked concerns over personal safety.

Southeast Asia presented a mixed picture. Malaysia saw a surge in Chinese visitors this summer, benefitting from the formal implementation of its mutual visa-exemption policy with China in mid-July, Wang He, general manager of travel service provider Thailand Flying Elephant Travel, told Caixin.

In contrast, bookings for Thailand have fallen far short of 2019 levels, Wang said. A series of events dented Chinese tourists’ confidence in Thailand. The disappearance of Chinese actor Wang Xing in the country earlier this year sparked concerns over personal safety. Other events, including earthquakes, have added to travel anxiety.

Cirium data showed China-Thailand round-trip flights in August were down nearly 30% year-on-year.

Wang said travellers also have safety concerns about other Southeast Asian destinations such as Vietnam and Laos, citing a higher risk of encountering telecom scams in addition to inadequate tourism services.

One merchant specialising in budget travel to Southeast Asia told Caixin their orders across the entire region were declining, with revenue from their overseas holiday business falling from over 30 million RMB last summer to just over 10 million RMB this year.

The merchant acknowledged that Malaysia’s decline has been less severe, citing the fact that the country has more Chinese speakers, political stability, lower travel costs and the recent visa-waiver. However, the merchant cautioned that the market is not yet comparable to Thailand’s, noting that its tourist volume is much smaller and it offers fewer tourism products.

The recovery in long-haul outbound travel also gained significant momentum, particularly to Europe. Visa applications for Italy, Norway and Germany surged over 80% year-on-year this summer, Trip.com data showed.

The recovery in long-haul outbound travel also gained significant momentum, particularly to Europe. Visa applications for Italy, Norway and Germany surged over 80% year-on-year this summer, Trip.com data showed. And bookings for Iceland, Austria, Switzerland and Greece all grew by more than half, according to travel platform Fliggy.

The employee at an aviation data platform said in Europe, the UK and Italy are leading the international flight recovery, with flight capacity reaching 128% and 144% of 2019 levels, respectively. However, the employee said, recovery to North America has been sluggish due to government restrictions, with direct flights to the US only at 26.2% of their pre-pandemic capacity.

Meanwhile, aided by visa-free policies and an increase in international flights, China’s railways handled a 23.9% year-on-year rise in trips by foreign passengers between 1 July and 31 August, according to China State Railway. South Korea, the US, Japan, Thailand and Russia were the top sources of inbound tourists to China during the period, according to Trip.com data.

Foreign tourists are also venturing further afield. Qunar data showed foreign tourists flew to 144 Chinese cities this summer, 16 more than last year. Smaller cities like Tongren in Guizhou province and Longyan in Fujian province saw guesthouse bookings by foreign tourists surge 63% and 50%, respectively, during the summer, according to accommodation platform Tujia.

This trend toward diversified destinations was driven by repeat visitors and ethnic Chinese tourists seeking more novel experiences, Zhou said.

This article was first published by Caixin Global as “In Depth: China’s Travelers Return, but Their Spending Stays Home”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.