Digitalisation: How China's smaller investment banks could compete with big foreign players

The recent accelerated opening up of China's capital market has presented a challenge to investment banks in China, which may have seen their role marginalised or bypassed by major foreign players who have international experience and are highly capitalised and better managed. Academics Pei Sai Fan and Peng Chang suggest how investment banks in China can compete and stay relevant.

With the accelerated opening up of China's capital market, foreign investment banks such as UBS, Nomura Orient, JPMorgan Chase, BlackRock, Goldman Sachs and DBS Securities have recently set up majority controlled or wholly owned companies to enter and operate in the market or expand their operations in China.

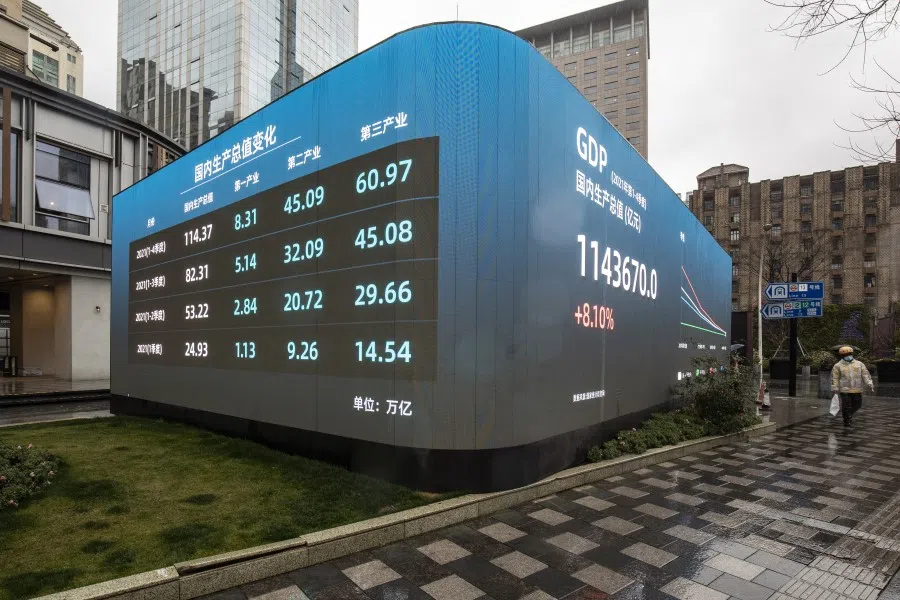

This development endorses the great potential of China's capital market and reaffirms the initial positive outcome of its financial reform.

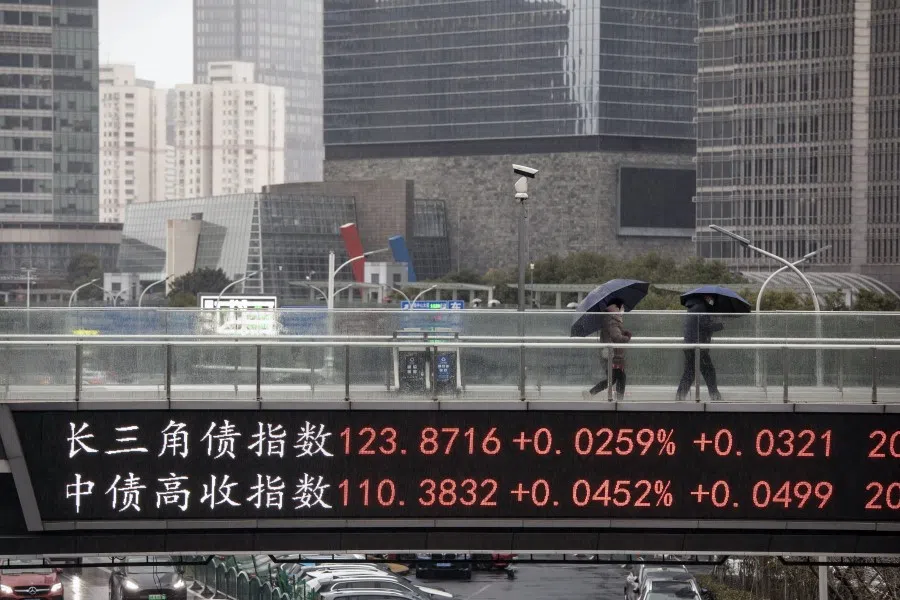

The entry of foreign financial institutions would lead to and facilitate more international investors to take up investment opportunities in China. It would also improve China's financing and investment environment and deepen the connection between China's capital market and the international financial market.

Furthermore, foreign financial institutions also bring valuable international experience into China's capital market in terms of market development and regulation, corporate governance, as well as best practices in corporate risk management and internal control.

However, as China's investment banks have been around for a shorter time, there are issues such as lowly capitalised banks, homogenous business models, and weak risk management capability.

The entry of foreign financial institutions induces greater market competition, which would have some negative impact on incumbent Chinese players - especially small- and medium-sized investment banks and stockbrokers.

Following the 2008 global financial crisis, international financial regulation was tightened. And, with the advent of digital technologies such as blockchain, big data, artificial intelligence (AI) and cloud computing, the traditional financial markets are seeing a profound digital revolution.

Ongoing major changes are seen in the investment banking and securities trading space, including higher expectations from clients, financial inclusion, financial democratisation and stricter regulatory requirements.

... investment banks should actively build their digital business model...

Opportunities for Chinese investment banks

In recent years, ramping up digitalisation and building a "Digital China" has become one of China's key national policies, which is written into its 14th Five-Year Plan for economic and social development, and its 2035 vision. China's digital economy contributed to 38.6% of its GDP in 2020, far ahead of most countries.

In the context of opening up the capital market, China's investment banks should seize the opportunity unleashed by the digital revolution by leveraging China's advantage in massive data generation and rich data application use cases in order to stand out amid the intense market competition.

First, investment banks should actively build their digital business model and grab the first-mover advantage in their business development.

Due to better information flow obtained by market participants from the digitalisation and democratisation of finance, the traditional financial returns that investment banks gain from information asymmetry is being challenged.

For example, in 2016, Comcast Corporation acquired DreamWorks Animation for about US$3.8 billion, and it handled all discussions on the transaction without involving the services of investment banks. In 2018, music streaming platform and unicorn Spotify bypassed investment banks and directly entered the capital market through a public listing, with the opening price determined by the share order volume.

The rise of crowdfunding and peer-to-peer lending has also impacted the demand for funding services by investment banks.

Facing formidable challenges, investment banks should leverage digital technology to build digital platforms and reduce human intervention in business operations. They should try to standardise their online operations as much as possible and build multi-dimensional digital models to serve the different sectors and companies, to satisfy the need for customised and differentiated products by clients while increasing operational efficiency and reducing agency costs.

... investment banks with strong digitalisation capabilities will have a competitive advantage in identifying and sourcing business deals.

Second, investment banks should harness the strengths of digitalisation and build them into their business models to empower their mid- to long-term growth strategies. The financial innovation and improved risk management enabled and driven by digital technology will provide investment banks with a competitive edge.

Digital technology facilitates information flow, which makes it easier for investment banks to identify and act on opportunities for corporate funding, mergers and acquisitions, consultancy services and asset management.

Driven by the aggregation of data flow and powerful deduction algorithms of the underlying data in various business activities, investment banks with strong digitalisation capabilities will have a competitive advantage in identifying and sourcing business deals.

At the same time, digital technology such as blockchain, smart contracts, machine learning and big data analysis are empowering investment banks to better manage and develop financial data. This will lessen their business needs for services in traditional audit, compliance, consultancy and IT, and push investment banks to become more self-sufficient and all-rounder businesses.

Chinese investment banks have the obvious geographical network advantage in serving China's domestic "long-tail" customers.

Third, investment banks should explore the business opportunities that "long-tail" customers, such as small- and medium-sized enterprises (SMEs), may bring and seize the benefits of inclusive finance to gain incremental market share.

Investment banks traditionally focus on business opportunities from high-net-worth clients such as medium- and large-sized enterprises or industry leaders. Following the integration of digital technology and financial markets, the advantages of digital finance in expanding to distant and remote regions at minimal incremental transaction cost became prominent.

Through digital technology, financial services can now be provided to "long-tail" customers, who were neglected in the past, thereby promoting financial inclusion while controlling financial risks scientifically.

SMEs have become the driving force of China's market economy. Compared with foreign investment banks, Chinese investment banks have the obvious geographical network advantage in serving China's domestic "long-tail" customers.

... personalised and differentiated high-end online services would become the direction of future development.

Fourth, investment banks should focus on customer experience and enhance the speciality and usability of their digital securities trading platforms. Digital finance has overcome geographical and spatial limitations and has mitigated the problem of information asymmetry.

The emergence of digital technology enterprises such as Tiger Brokers in the international securities broking market is one good example. These companies are adept at using technology to aggregate financial information and transaction data, successfully gaining a significant share of retail stock trades, and reducing the return of investment banks' securities business.

Investment banks therefore need to optimise customer experience by improving online services, and strengthening the speciality and usability of their smart investment platforms and digital trading platforms.

For example, Goldman Sachs' digital storefront Marquee provides services that include market price information, investment research and transaction monitoring, aiming to enhance operational efficiency and customer experience.

As the physical outlets decrease or even disappear, personalised and differentiated high-end online services would become the direction of future development.

... the current offshore wealth management hubs with the traditional advantages based on regulation and taxation have gradually shifted to hubs with digital capabilities.

Fifth, quantitative investing systems will provide more investment opportunities for clients in the wealth management business.

As investment banks undergo digital transformation, the capital market is gradually replacing manual labour with quantitative investing systems to automatically gather information and optimise market forecasts via continuous data collection, observation and analysis.

At the same time, investment decisions can also be made logically without the interference of irrational behaviour such as those caused by emotion.

In the digital era, investment strategies are increasingly focused on collecting and analysing new information such as "alternative data" to gain better investment insights and enhance alpha - the active return of an investment.

Alternative data refer to various non-standard and non-structured data outside of the financial market, such as satellite images (which provide business intelligence in the flow of humans, goods and vehicles, as well as lighting), social media posts, geolocation tracking, website traffic statistics, retail statistics, freight volume, Internet of Things data, and other industrial and commercial indicators.

At the same time, the current offshore wealth management hubs with the traditional advantages based on regulation and taxation have gradually shifted to hubs with digital capabilities.

Through traditional financial transactions and other data of massive volume, the risk control model can be improved...

Sixth, the digital risk management framework will strike a good balance between effective decision-making and risk management.

The general trend in investment banking now is to harness the strengths of digitalisation to improve the risk control model to achieve the dual goals of effective decision-making and risk control.

Through traditional financial transactions and other data of massive volume, the risk control model can be improved by gaining quick access to the customer's credit history and other information provided by third parties.

Along with the use of advanced algorithms for accurate customer risk assessment, the default rate will be reduced, thereby promoting growth in credit-related transactions.

Investment banks are an important pillar of the capital market. The opening up of China's capital market will have a profound impact on the development of Chinese investment banks, while the rise of digital finance provides new opportunities for Chinese investment banks to catch up with or even overtake foreign players.

If the investment banks in China can seize the opportunities early and strengthen their operations quickly to establish a competitive advantage in digitalisation, it might create for themselves a "win-win" future with foreign financial institutions amid intense market competition, and together they can better serve China's real economy.

Related: China needs timely and professional financial supervision and Singapore's experience may help | China's central bank digital currency has huge potential, but be careful of overregulation | Building an integrated digital economy: How Asia can continue to thrive in the post-pandemic era | China's central bank digital currency (CBDC) innovations

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)