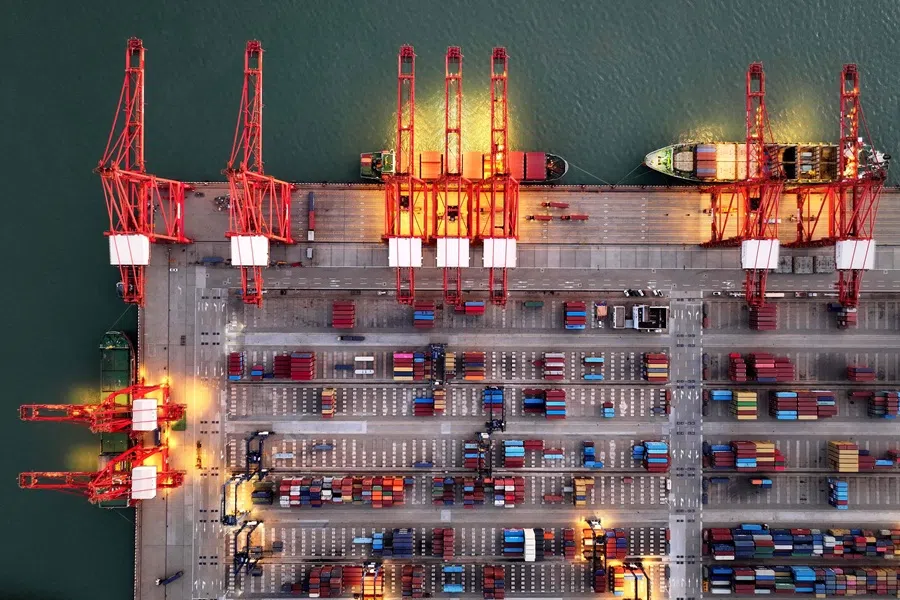

Engineered growth: Can China hold its economy together?

To offset tariffs and slowing growth, Beijing is relying on stimulus, trade diversification and domestic consumption — but shrinking revenues and weak confidence point to deeper cracks. Indian researcher Manoj Kewalramani gives his reading of the Chinese economy.

Amid ongoing US-China trade negotiations, the Chinese economy appears to have withstood the tariff assault from US President Donald Trump. Data released recently showed that while China’s trade with the US has tumbled 12% in the first seven months of the year, overall foreign trade expanded by 2.4%. Exports grew 6.1%, while imports were down 2.7%.

Meanwhile, in its latest World Economic Outlook report, the International Monetary Fund has significantly revised its growth forecast for China for 2025 to 4.8%. This is pretty much in line with the official target of achieving “around 5%” growth expansion for the year. All of this is likely to strengthen Beijing’s hand in dealing with further volatility in economic ties with the US.

China stands well prepared?

In the days and weeks following Trump’s electoral victory, it was evident that the Chinese leadership was prepared for what was to follow. Beijing had spent the past few years piecing together a toolkit of coercive actions. This included export controls, raw materials restrictions, targeted action against American companies and tariffs.

Meanwhile, at home, the leadership was also quick to signal increased policy and financial support. In particular, December’s Politburo meeting signalled a shift from a more conservative position to call for a “more proactive fiscal policy” and, more importantly, a “moderately loose monetary policy”. In other words, Beijing signalled a willingness to jettison fiscal prudence and expand debt if needed.

The steps that have been taken since then to support the economy amid external challenges can be classified under five categories: increased financing, diversification of export markets, strengthening export insurance and facilitation measures, domestic consumption boosting policies, and expansion of employment-related subsidies for firms.

Entities engaged in high-end manufacturing, such as those working on integrated circuits, 3D printing, and industrial robots, and those in the auto sector, are likely to be among the biggest beneficiaries.

Increased financing

First, the signal on policy easing was acted on during the Two Sessions in March 2025. The Government Work Report announced an increase in the annual fiscal deficit target to 4% — a full percentage point higher than in 2024. However, in practical terms, the increase was less substantial when viewed in context. The issuance of 1 trillion RMB in treasury bonds in October 2024 had already pushed the effective fiscal deficit for that year to 3.8% of GDP.

Premier Li Qiang also expanded the target for local government special-purpose bonds to 4.4 trillion RMB, up 500 billion RMB from 2024. The target for ultra-long special treasury bonds was also increased from the previous 1 trillion RMB to 1.3 trillion RMB. Out of this, 500 billion RMB was set aside for large-scale equipment upgrading and the continuing consumer goods trade-in programme.

So far, in the first half of 2025, the central government has issued a total of 7.88 trillion RMB worth of bonds. This is up 35.28% year-on-year, indicating tremendous front-loading amid increased pressure. Meanwhile local government bond issuance is estimated at 5.49 trillion RMB. These include debt refinancing bonds worth 2.16 trillion RMB.

In addition, in early May, the People’s Bank of China (PBOC) announced ten measures aimed at unlocking greater liquidity. For the first time since September 2024, the Reserve Requirement Ratio (RRR) was slashed by 0.5 percentage points.

This, the bank expected, would infuse approximately 1 trillion RMB of long-term liquidity. Additionally, RRR for auto finance companies and financial leasing companies was cut to 0%, and policy interest rates and rates related to housing loans, and lending for small businesses and agriculture were lowered.

The re-lending quotas for technological innovation and technical transformation, and for supporting agriculture and small businesses, were also expanded by 300 billion RMB each, and a new re-lending quota of 500 billion RMB for boosting service consumption and elderly care was established.

The impact of these steps will be evident in the months that follow. However, it appears that lending will continue to remain strong, despite what seems to be a seasonal weakening in July. Firms are likely to continue to invest in equipment upgrading. Entities engaged in high-end manufacturing, such as those working on integrated circuits, 3D printing, and industrial robots, and those in the auto sector, are likely to be among the biggest beneficiaries.

Greater financing is also expected for rural businesses and agricultural production. In particular, support can be expected for farm equipment procurement and upgrades. This could exacerbate non-financial corporate debt, which is already estimated at around 141% of GDP.

In the first half of 2025, China’s trade with Belt and Road countries accounted for 51.8% of total trade. In contrast, China’s exports to the US had already fallen from 17.4% of its total exports in 2020 to 14.7% in 2024.

Diversifying export markets and supporting exporters

Second, for several years, the Chinese government has been working to diversify the country’s export markets. This effort appears to be bearing fruit. From January to July, China’s trade with ASEAN countries expanded by 8.5%, with exports surging 13.5%. Exports to Latin America, Africa and India grew by 7.3%, 24.5%, and 13.4% respectively.

In the first half of 2025, China’s trade with Belt and Road countries accounted for 51.8% of total trade. In contrast, China’s exports to the US had already fallen from 17.4% of its total exports in 2020 to 14.7% in 2024. Underscoring the shift that is taking place, China’s Minister of Commerce Wang Wentao was emphatic during the mid-year briefing in July, stating that China’s trade had achieved diversification.

Third, this expansion of trade with emerging economies has been facilitated through targeted policy measures, including the expansion of export credit insurance. The Export-Import Bank of China has, over the years, expanded credit lines for exporters to emerging markets. Meanwhile, the National Financial Regulatory Administration is increasingly developing insurance products to help exporters mitigate risks.

In May, National Financial Regulatory Administration (NFRA) chief Li Yunze informed that the agency was prioritising export credit insurance, protecting exporters against non-payment by foreign buyers, and domestic trade credit insurance. Li reportedly said that the agency will optimise export credit insurance regulatory policies, improve the underwriting capacity of insurance companies, provide preferential rates, and implement swift claims processing and compensation.

Boosting domestic consumption

Fourth, one element of the NFRA’s support measures focuses on helping foreign trade enterprises pivot toward the domestic market — an initiative aligned with China’s broader dual circulation strategy. Expanding domestic consumption will be crucial to mitigating the impact of tariffs. It is also essential for maintaining employment levels and ensuring social stability.

... the export hub of Yiwu has facilitated enterprises in holding exhibitions in cities and towns in Yunnan, Jiangxi, Fujian and Hebei to expand their domestic market presence.

Thus far, some steps have been taken to ease regulatory hurdles for cross-provincial consumption and the diversion of goods meant for foreign markets to the domestic market. For instance, in June this year, Guangdong province announced 17 measures to boost the domestic market expansion for foreign trade enterprises. It also established the Guangdong Integrated Service Alliance for Domestic and Foreign Trade Testing and Certification, with eight certification bodies building a “green channel” for mandatory product certifications when goods transition from export to domestic sales.

Meanwhile, the export hub of Yiwu has facilitated enterprises in holding exhibitions in cities and towns in Yunnan, Jiangxi, Fujian and Hebei to expand their domestic market presence. Another key initiative to expand domestic consumption is the goods trade-in programme. Data as of May 2025 show that the programme has 1.1 trillion RMB in retail sales.

Thus far, these measures have had an impact, with retail sales reaching 24.55 trillion RMB in the first half of the year, expanding by 5% year-on-year. This represents an uptick from the 4.6% year-on-year growth in the first quarter, which had been aided by the Chinese New Year holiday.

The final tranche of bonds for the trade-in programme will be issued in October. It is evident that this support has boosted the home appliance, passenger cars and digital products categories. As of June 2025, combined sales of automobiles, home appliances, smartphones, home renovation products and electric bicycles had surpassed 1.6 trillion RMB.

The challenge for Chinese policymakers, however, is that this demand is engineered rather than organic. This is evident in the fact that both the Consumer Confidence Index and Consumer Expectation Index continue to remain rather weak.

However, it is important to highlight that while spending is expanding, revenue is shrinking.

Keeping people on payrolls

Finally, the Chinese government has sought to tailor policies to ensure that foreign trade enterprises continue to keep people on the payrolls. In late April, National Development and Reform Commission (NDRC) deputy chief Zhao Chenxin, the deputy chief, said that the government would encourage businesses to maintain stable staffing levels, intensify vocational skills training, expand work-relief programmes and strengthen public employment services. The Ministry of Human Resources and Social Security has extended its job retention and skill development subsidy programmes till the end of the year.

In addition, it is offering a one-off employment subsidy for companies and organisations that hire unemployed people aged between 16 and 24. Another component of the employment support policies is the extension of entrepreneurial loans at the central and local levels. In short, the Chinese leadership is continuing to ease the purse strings to ensure stability.

For the moment, this is keeping people on payrolls, with broad unemployment being stable at 5%. But this masks deeper challenges. Although the factories are humming and exports are expanding, industrial profits are declining, which is indicative of intense price competition. The impact of this is reportedly being felt in reduced wages and underemployment, which in turn are bound to have a ripple effect on consumption.

A difficult balance

However, it is important to highlight that while spending is expanding, revenue is shrinking. China’s fiscal expenditure was 14.13 trillion RMB in the first half of the year, up 3.4% year-on-year. Meanwhile, revenue fell 0.3% to 11.56 trillion RMB.

Out of this, tax revenue was 9.29 trillion RMB, falling 1.2%, and non-tax revenue was 2.27 trillion RMB, a 3.7% increase. The latter comprises items such as land use rights, sales revenue, administrative fees, fines and confiscations, among other things. The expansion of the punitive components of non-tax revenue can imply an adverse effect on business sentiment.

Therefore, Beijing must continue to strike a difficult balance. And while it appears that for the moment, the Chinese leadership has some room for manoeuvre amid external pressures, it is going to be difficult to keep sustaining deeper deficits over a longer term.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)