[Big read] Overcapacity: Surplus of Chinese goods an issue to some, welcomed by others

From steel and batteries to electric vehicles, the surplus Chinese products that cannot be absorbed by its domestic market are being boycotted by many countries, especially Europe and the US. Is China guilty of dumping? Who has the final say on what qualifies as “overcapacity”? Can China’s trade-in of consumer goods action plan help deal with its overcapacity?

Since April, “overcapacity” has become the new bone of contention between China, Europe and the US.

During their respective visits to China in April, both US Treasury Secretary Janet Yellen and German Chancellor Olaf Scholz expressed concerns over China’s overcapacity. At the same time, the European Union (EU) is carrying out anti-subsidy investigations into various Chinese new energy companies, while the US began Section 301 investigations into the acts, policies and practices of China targeting the maritime, logistics and shipbuilding industries for dominance.

In just a month, the overcapacity controversy spread from new energy products like electric vehicles (EVs), solar panels and lithium batteries to traditional materials like steel and aluminium.

Even though all parties stand by their definition and scope of overcapacity, the general opinion is that this situation is a result of the Chinese property sector crisis which has worsened in the last two years.

China accounts for around half of global steel production. Even if it only exports 5% of what it manufactures, this is enough to impact the global market.

China’s overwhelming size and capacity

To mitigate the drag of the property market downturn on the economy, the Chinese government channelled investments into its advanced manufacturing sector to boost the production and export of new energy products. At the same time, the property market downturn exacerbated the fall in demand for steel and building materials, and more Chinese steel makers are looking to export their goods.

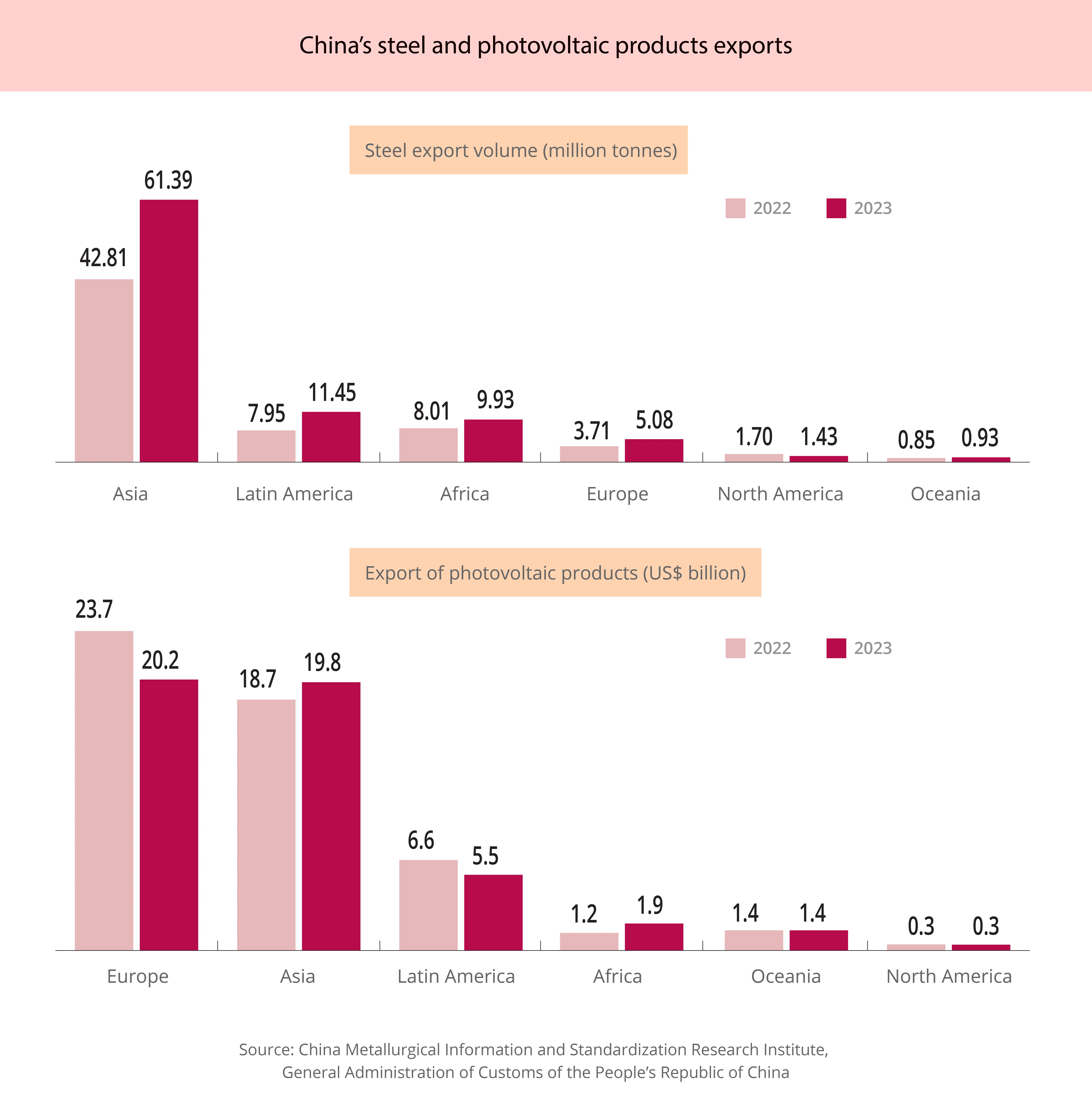

Last year, Chinese steel exports exceeded 90 million tonnes, the highest since 2017, while the average export price fell by 32.7% to US$936.8 per tonne. The trend continued into the first quarter of 2024 as China’s steel export volume grew by 30.7% year-on-year, while the average export price fell another 33.4% to reach US$788.5 per tonne.

In an interview with Lianhe Zaobao, Ma Tao, deputy director of International Political Economy at the Institute of World Economics and Politics of the Chinese Academy of Social Sciences, pointed out that steel manufacturing in China primarily satisfies domestic economic development needs. In fact, China only exports about 5% of its overall steel output, which is far lower than the export ratios of Japan or Korea, so Ma feels that the allegations against Chinese overcapacity are unfair.

However, it should be highlighted that Japan produced 86.83 million tonnes of crude steel in 2023, while Korea produced less than 70 million tonnes, both lower than the amount that China exported.

China accounts for around half of global steel production. Even if it only exports 5% of what it manufactures, this is enough to impact the global market.

According to the China Metallurgical Information and Standardisation Institute, there were 112 anti-dumping or anti-subsidy government circulars issued in various countries around the world against Chinese steel products in 2023, 20 more than in 2022. Other than the developed economies in Europe and the US, developing countries like Brazil, Mexico, Chile, and others have also started pushing back against Chinese goods.

CAP, one of the biggest Chilean steel makers, announced the shuttering of a local steel plant in March as it was unable to compete with Chinese steel that is 40% cheaper.

CAP, one of the biggest Chilean steel makers, announced the shuttering of a local steel plant in March as it was unable to compete with Chinese steel that is 40% cheaper. More than 20,000 workers lost their jobs as a result and they organised a protest in Santiago subsequently to demand that the authorities deal with the unfair competition from Chinese steel.

At the beginning of April, the World Bank cautioned that the Chinese government’s diversion of investment into its advanced manufacturing sector amid the weakness in its domestic property sector and lacklustre domestic consumption may upset the balance of domestic production and external demand.

Overcapacity in new energy sector

World Bank chief economist for East Asia and the Pacific region, Aaditya Mattoo, said that like solar panels, the price of EVs might decline. He added, “Certainly these subsidised exports are going to face resistance. The world’s ability to absorb a China shock is less than in the past.”

As compared to steel, the overcapacity controversy over the Chinese new energy sector is even greater. In the face of accusations made by Europe and the US, Chinese officials initially emphasised that the sector developed rapidly through its advantages like technological innovation, a comprehensive supply chain, and effective market competition, instead of government subsidies. On 25 April, a Chinese Ministry of Commerce spokesperson went on to say that from a global perspective, the new energy sector is facing a capacity shortage rather than overcapacity.

During a Lianhe Zaobao interview, Jayant Menon, a visiting senior fellow at the ISEAS-Yusof Ishak Institute in Singapore, opined that China is trying to offset its low levels of domestic consumption by exporting more, but it is only doing so in specific industries instead of across all sectors.

Menon pointed out that there would be a painful period of structural adjustment for the country’s oversupply of construction materials like steel and cement, which resulted from the slum in its property market. On the other hand, China’s export of products like EVs, solar panels, and electrical appliances is much less affected by the health of its economy.

Chinese new energy products stand out because of the industrial knowledge that China has accumulated over the years instead of their low prices. — Kelvin Pooh, CEO, EagleRE

Chinese new energy products’ winning strategy

Eagle Renewable Energy (EagleRE) is in the business of renewable energy power station development and management. More than 90% of its operations is in China, while it also exports semi-finished goods like solar energy batteries that are made in China to Europe and Central Asia.

In a Lianhe Zaobao interview, EagleRE CEO, Kelvin Pooh, was candid in saying that Chinese new energy products stand out because of the industrial knowledge that China has accumulated over the years instead of their low prices. From photovoltaic technologies, to wind power, and EVs, no other country is able to replicate China’s control over entire supply chains. He added, “While a country can avoid importing finished goods from China, there is no way to not use semi-finished goods manufactured in China at all, so the cost of decoupling completely is very high.”

However, as Europe and the US continue to put pressure on China’s new energy exports, Pooh is concerned about the business challenges arising from this. He said that while many Chinese companies are building factories overseas to circumvent tariffs, the number of export restrictions has continued to rise over the last two years.

For instance, the US has the most stringent restrictions that require disclosure of not only the place of origin of goods, but also where their raw materials are produced. It also requires that the ultimate beneficial owner(s) of the factories cannot be Chinese nationals.

Pooh commented, “Putting up industry barriers to support local emerging industries is common in developing countries. But the US is already a mature developed economy, and it is hard to say whether this is acceptable to the market, because taxpayers are ultimately the ones footing the bill.”

Worries of trade wars

After years of berating Chinese companies for benefiting from government subsidies, the US and Europe have started emulating Beijing in rolling out pro-business policies. In 2022, the US passed two bills to enhance governmental support for its semiconductor and renewable energy industries. Last year, the EU also launched its US$270 billion Green Deal Industrial Plan to enhance the green technology competitiveness of its member states.

Market watchers are worried that the trade barriers arising from the debate over overcapacity might escalate into a fresh round of trade war.

At the same time, China has taken countermeasures after facing a number of export restrictions. On 19 April, its Ministry of Commerce determined that the US is dumping propionic acid products into the country, and announced its decision to impose an increase of 43.5% in deposit requirements for such imports. Market watchers are worried that the trade barriers arising from the debate over overcapacity might escalate into a fresh round of trade war.

Jens Eskelund, president of the EU Chamber of Commerce in China, warned that as the wave of protectionism surges, China and the EU are facing a “slow-motion train accident”, and trade friction between both sides might escalate into a full-blown trade war.

During a meeting held by the south China chapter of his chamber in mid-April, Eskelund said that while it is reasonable for China and the EU to have some trade concerns about each other, if leaders from both sides do not engage each other more closely, the outcome might be a decoupling that benefits neither party. He emphasised, “I think we have reached a critical juncture in this.”

China’s new trade-in scheme to reduce surplus

Even though Chinese officials have repeatedly emphasised that overcapacity is a market economy trait, and a mismatch between supply and demand the norm, they still regard it as the main challenge for China’s economy at the moment.

At the central economic work conference held at the end of 2023, the issue of “overcapacity in certain industries” was mooted for the first time in five years, and it was labelled one of the challenges that China needs to overcome for its economy to recover. The Chinese State Council Government Work Report released in March reiterated this view, urging more precise oversight to foster coordinated development and investment in the country’s key industries to prevent overcapacity and low-quality duplications.

Putting aside trade risks, overcapacity would also cause the prices of goods in China to decline and local companies to face higher debt risks, potentially impacting jobs and incomes. This year, the Chinese government rolled out a trade-in scheme to encourage the upgrading of industrial equipment and renewal of household electrical appliances. In doing so, it hopes to boost consumption and reduce its surplus of steel and EVs.

This March, the Chinese State Council announced an action plan to promote large-scale equipment renewals and trade-ins of consumer goods. The following month, 14 government departments including the Ministry of Commerce jointly provided more details for the nationwide trade-in of consumer goods including automobiles, household electrical appliances, and kitchen or bathroom fixtures.

... other than regions like Beijing, Shanghai, and Shenzhen that are better-off financially, the rest of the country may not have the financial means to support a large-scale trade-in programme.” — Christine Peng, Head, Greater China Consumer Sector, UBS

Funding support required for the new measures

China’s National Development and Reform Commission (NDRC) estimates that the new trade-in scheme could generate at least 5 trillion RMB (S$958.8 billion) in market value annually. But a lack of implementation details makes it difficult for market watchers to forecast the policy’s effects.

Lang Xuehong, deputy secretary general of the China Automobile Dealers Association, said frankly in a media interview, “After the government circular was published, everyone was most interested in fiscal spending. However, no specifics on the funds that the central and regional governments would provide were given, especially on the central government’s part.”

At a policy briefing held a few weeks ago, NDRC vice-chairman Zhao Chenxin pledged that the central government would provide substantial funding support for the renewal of equipment and trade-in of consumer goods. He added that the local governments would also allocate funds after considering their respective financial positions. But Zhao did not go into the details of the sums involved.

In an interview with Lianhe Zaobao, Christine Peng, who heads the Greater China Consumer Sector at UBS, pointed out that after the conclusion of China’s Two Sessions in 2024, its central government did not announce any large-scale fiscal policy to target consumption, so expectations of this are no longer high. She continued, “If local governments are expected to foot the bill, other than regions like Beijing, Shanghai, and Shenzhen that are better-off financially, the rest of the country may not have the financial means to support a large-scale trade-in programme.”

Industry insider: Industry titans should lead in curbing production pace

Commodity research organisation, CRU Group, estimates that China’s trade-in scheme would raise its annual demand for steel by eight to nine million tonnes over the next four years. However, the China Metallurgical Industry Planning and Research Institute expects the demand for steel from the country’s construction sector to decrease by 20 million tonnes this year. Even after accounting for the growth in its machinery and automobile sectors, China’s appetite for steel will still shrink by 16.1 million tonnes this year.

At an industry forum in April, Luo Tiejun, who is the vice president of the China Iron and Steel Association, underlined his industry’s “prisoner’s dilemma” due to the conflict between a strong supply and a weak demand. Luo said that the key to resolving this is for industry titans to take the lead in practising self-discipline and managing the pace of production according to demand.

Differing attitude of ASEAN countries towards Chinese exports

Unlike the vigorous responses from Europe and the US, China’s main export market of Southeast Asia has not had any major trade conflicts with it.

Many Chinese companies are setting up factories in Vietnam so that they can avoid high customs duties on the products they export to Europe and the US, while still importing most of their raw materials from China. — Lim Tai Wei, Adjunct Senior Research Fellow, EAI, NUS

While the Biden administration is pushing to triple the import duty on Chinese steel to 25%, the reality is that China only exported 845,000 tonnes of steel to the US in 2023, less than 1% of its total steel exports. In comparison, nearly 30% of Chinese steel went to Southeast Asia, with five ASEAN countries among its top ten steel export destinations, and Vietnam replacing South Korea as the largest export market for Chinese steel.

On the same note, Thailand and the Philippines are among the top ten export countries for Chinese new energy vehicles, while Vietnam is China’s fifth largest export market for lithium batteries.

Lim Tai Wei, an adjunct senior research fellow at the National University of Singapore (NUS) East Asian Institute (EAI), pointed out in a Lianhe Zaobao interview that the economic structures and development priorities of ASEAN member states vary, so their attitudes towards Chinese exports also differ.

Lim’s analysis is that both Indonesia and Thailand are trying to attract Chinese companies to invest and set up factories, while Cambodia and Laos are hoping to utilise cheap and good Chinese products and technologies to accelerate their green transformation. At the same time, countries in the region which are on friendlier terms with the US boycott Chinese goods out of geopolitical considerations.

Then, there is Vietnam which enjoys close trade links with both China and the US, and is enjoying the best of both worlds. Many Chinese companies are setting up factories in Vietnam so that they can avoid high customs duties on the products they export to Europe and the US, while still importing most of their raw materials from China. The “Vietnamese Tesla”, VinFast, which sells its new energy vehicles to the US relies on Chinese suppliers, such as the battery titan, Gotion High Tech, for its car batteries.

ASEAN supply chains still likely to revolve around China

Menon from the ISEAS-Yusof Ishak Institute feels that an important characteristic of China-ASEAN trade is that the majority is closely related to global supply chains, similar to that between the US and the EU.

He pointed out that ASEAN is not China’s end market, and its trade with China is an integral component of aggregate regional production and exports. He added, “ASEAN supply chains will continue to revolve around China, and major changes to this status quo is unlikely in the foreseeable future.”

However, both the Vietnamese and Thai governments acceded to the requests of local businesses and commenced anti-dumping and anti-circumvention investigations against Chinese steel products last year. Lim from NUS predicts that as countries in the region adjust their industrial policies, Chinese companies may need to adopt mutually-beneficial business practices and move their production lines there in exchange for policy incentives and government support.

In the case of Thailand which is actively promoting new energy vehicles, only EVs manufactured in Thailand would enjoy tax incentives and consumption subsidies from the beginning of this year. At the moment, Chinese automakers like SAIC Motor, Great Wall Motor, and BYD have factories in Thailand.

This article was first published in Lianhe Zaobao as “掀产能过剩之争 中国制造如潮涌 溢向欧美遭围堵”.