How Chinese companies are tapping ASEAN’s growing market through Singapore

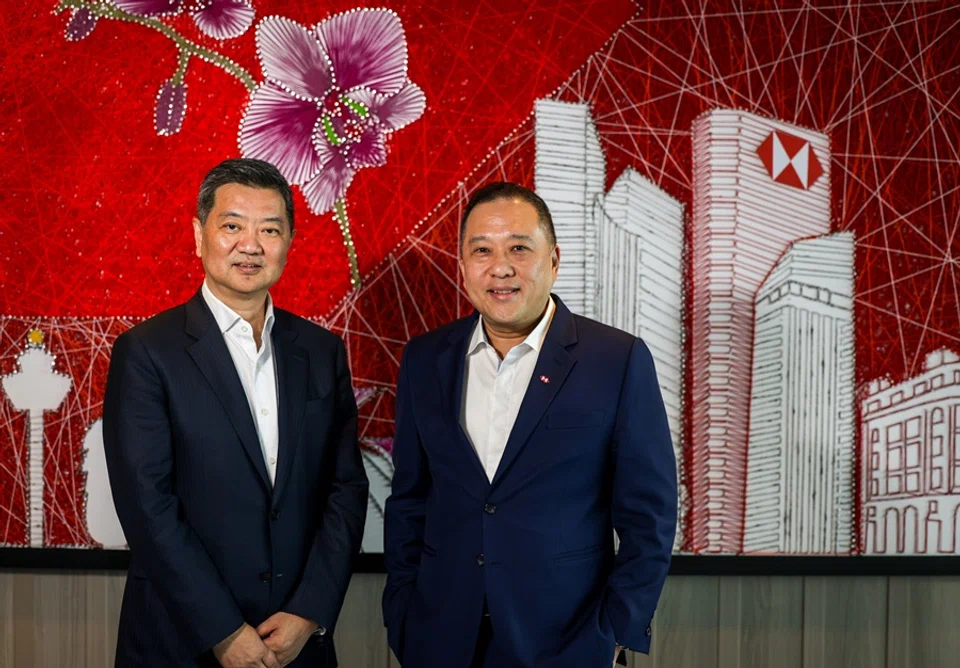

Given its growing middle class with increasing purchasing power, ASEAN is becoming a highly sought-after market for Chinese companies. Lianhe Zaobao associate business editor Hu Yuanwen speaks with Mark Wang, president and CEO of HSBC Bank China Co Ltd, and Wong Kee Joo, CEO of HSBC Singapore, to find out how Chinese enterprises are expanding into the region, especially through Singapore.

Despite the US tariffs imposed on China and ASEAN, Chinese companies continue to invest in the region. In fact, ASEAN is steadily transforming from a manufacturing base for Chinese firms into a significant consumer market.

Mark Wang, president and CEO of HSBC Bank China Co Ltd, and Wong Kee Joo, CEO of HSBC Singapore, shared with Lianhe Zaobao the latest trends of Chinese enterprises expanding into ASEAN, as well as Singapore’s vital role as a regional gateway and wealth management hub.

Wong Kee Joo said that during the first Donald Trump administration, Chinese companies began diversifying their supply chains into ASEAN, using the region as a production base to supply other markets. This trend not only continues, but has become increasingly strategic. Now, ASEAN is seen more as a market for consumer growth.

... when companies set up factories, it leads to job creation, which then creates wealth. This in turn fuels the growth of the middle class, who gain higher purchasing power and are able to consume more high-quality products from China. — Wong Kee Joo, CEO, HSBC Singapore

Growing middle class with increasing purchasing power

He noted that ASEAN has a population of almost 700 million, with a youthful and dynamic demographic — 35% are under the age of 25, and an estimated 65% are expected to enter the middle class within the next five years.

Thus, ASEAN is not only a favourable destination for supply chain diversification, but also a market with strong consumer potential.

Wong thinks that for Chinese enterprises, setting up manufacturing operations in ASEAN is closely tied to expanding local consumer markets.

He explained that this actually forms a virtuous cycle because when companies set up factories, it leads to job creation, which then creates wealth. This in turn fuels the growth of the middle class, who gain higher purchasing power and are able to consume more high-quality products from China.

Mark Wang added that some ASEAN countries are relatively resource-rich, making it easier for Chinese companies to build complete supply chain systems locally — something especially crucial for manufacturing industries focused on cost control.

Also, more Chinese service companies are entering the ASEAN market, including e-commerce platforms, logistics providers and various consumer brands.

Wang said that Chinese companies not only bring products, but also management expertise and automation technologies. In China, most manufacturing plants are already highly automated and intelligent. These experiences and technologies are gradually making their way into ASEAN, helping to raise local management standards and manufacturing capabilities.

This not only helps reduce production costs, but also allows consumers to access higher-quality products at more affordable prices, further driving regional consumption growth.

Since the implementation of the ASEAN-China Free Trade Area in 2010, trade between China and ASEAN has grown significantly; from US$235.5 billion in 2010 to US$696.7 billion in 2023.

70% of FDI flows into Singapore

China and ASEAN are set to sign version 3.0 of the free trade agreement this October, which is widely expected to spur greater two-way investment.

Wong Kee Joo said, “Previous agreements have really driven a rise in Chinese investment into ASEAN, and in 2023, ASEAN attracted US$230 billion in foreign direct investment, of which about 70% came into Singapore. We expect the enhancement of the free trade agreement to bring even more opportunities.”

... for many Chinese companies, Singapore is not only a springboard for regional growth, but also a “multi-corridor connector” for launching global operations. — Wong

Both Wong Kee Joo and Mark Wang stressed Singapore’s key role in supporting Chinese companies expanding into ASEAN.

Wong Kee Joo noted that for many Chinese companies, Singapore is not only a springboard for regional growth, but also a “multi-corridor connector” for launching global operations.

He pointed out that the Johor-Singapore Special Economic Zone has provided a new platform for development. “Singapore could be where Chinese companies have the capital and do their research and development, while Johor could be their manufacturing base, thereby creating a complementary ecosystem,” he said.

... as of May this year, HSBC China’s corporate and institutional banking business focused on ASEAN had achieved double-digit revenue growth. Singapore is now HSBC China’s second largest overseas corporate banking market — second only to Hong Kong. — Mark Wang, President and CEO, HSBC Bank China Co Ltd

Mark Wang added that ASEAN is the top choice for Chinese companies going global, while Singapore is the preferred location for regional headquarters and treasury centres. “The Singapore-China corridor is the strongest in the region,” he said.

He shared that as of May this year, HSBC China’s corporate and institutional banking business focused on ASEAN had achieved double-digit revenue growth. Singapore is now HSBC China’s second largest overseas corporate banking market — second only to Hong Kong.

China is not ‘dumping’

Addressing concerns that the US’s reciprocal tariffs might trigger a flood of Chinese goods overseas, Wang argued that China is not “dumping”, but rather offering high-quality products to overseas markets.

He noted that competition in China’s domestic market is extremely fierce, with only the strongest companies able to survive. This is the essence of the “involution” phenomenon, which the Chinese government has stepped in to regulate due to the deflationary pressure it creates. Also, China’s economic transition, slower growth, and rising unemployment have further squeezed corporate profits.

“Internationally, they make higher margins. Companies selling electric vehicles, solar panels and consumer goods can often fetch better prices overseas. So China is definitely not dumping.” — Wang

To deal with these challenges, a recent Politburo meeting outlined a series of supply-side reform measures, with one key focus being the containment of involution to prevent destructive price wars among Chinese firms.

Wang said, “Internationally, they make higher margins. Companies selling electric vehicles, solar panels and consumer goods can often fetch better prices overseas. So China is definitely not dumping.”

He added that Chinese products are also globally competitive in terms of quality. “If you don’t have high-quality products, you really can’t sell. Doesn’t matter how aggressive you are in terms of marketing,” he said.

“Made in China” is no longer just shirts, shoes or toys. It now includes high value-added products such as ships, chips, computers, cars and even innovative pharmaceuticals, signalling a move up the value chain.

Arrival of Chinese enterprises boosts competitiveness and innovation

The recent entry of Chinese companies into Singapore — particularly in the food and service sectors — has sparked concerns among local businesses about intensifying competition.

Wong Kee Joo stressed that the arrival of Chinese firms will enhance regional competitiveness and drive innovation. For example, the widespread adoption of QR code payments in the region was inspired by practices in China.

Mark Wang believes that Chinese companies are coming to Singapore to make the pie bigger, not to cut the pie.

Wong Kee Joo said that the arrival of more Chinese companies in Singapore brings fresh ideas, helping to foster a stronger sense of competition and encouraging the adoption of new technologies and mindsets, making local businesses stronger as a whole.

The real danger, he warned, is falling into complacency. “We should view them as collaborators, not just competitors,” Wong said.

“China is actually also facing high costs, but how do they then bring costs down? It is really through digitalisation and productivity efficiency that they’ve managed to bring their costs down to be more competitive.” — Wong

Singapore as a testing ground

He pointed out that many Chinese food and beverage companies see Singapore as a testing ground to gauge market acceptance of their products and services before expanding into larger markets such as Malaysia. He noted that Singapore is a safe testing ground — culturally inclusive, quick to respond, and ideal for refining a brand.

Wong, a council member of the Singapore Business Federation, observed that Singapore businesses often report relatively high operating costs.

He shared, “China is actually also facing high costs, but how do they then bring costs down? It is really through digitalisation and productivity efficiency that they’ve managed to bring their costs down to be more competitive.”

To support Chinese enterprises going abroad, HSBC has established China Desks across 26 major markets.

Mark Wang revealed that HSBC China has a larger global business footprint than most domestic Chinese banks and is the largest international bank in China, serving as a key bridge in supporting Chinese enterprises to go global. He hopes that more Mandarin-speaking talent can be deployed in Singapore in the future.

Wong Kee Joo added that HSBC sends staff from Singapore to China for training, “because understanding a Chinese client is not just about speaking the language, it’s also about grasping the culture and business logic.”

Currently, HSBC has deployed around 150 Singaporean employees globally, including to mainland China, to gain experience in various markets.

This article was first published in Lianhe Zaobao as “汇丰:中企在亚细安开启“制造和消费”双引擎推动增长”.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)