Precious metal volatility puts the ‘safe haven’ trade on trial

As gold and silver swung from record highs to sharp sell-offs in a matter of weeks, investors were forced to confront an uncomfortable truth — can precious metals still be relied upon as a safe haven in turbulent times?

(By Caixin journalists Xia Yining, Fan Qianchan, Lu Yutong, Luo Guoping and Han Wei)

“First, they killed the shorts, then they killed the longs and then they killed the shorts again.”

That is how one Chinese mutual fund manager described the recent roller coaster ride in precious metals — a period of violent swings that has left speculators bruised and industries rattled, forcing a reassessment of gold’s place in the global financial system.

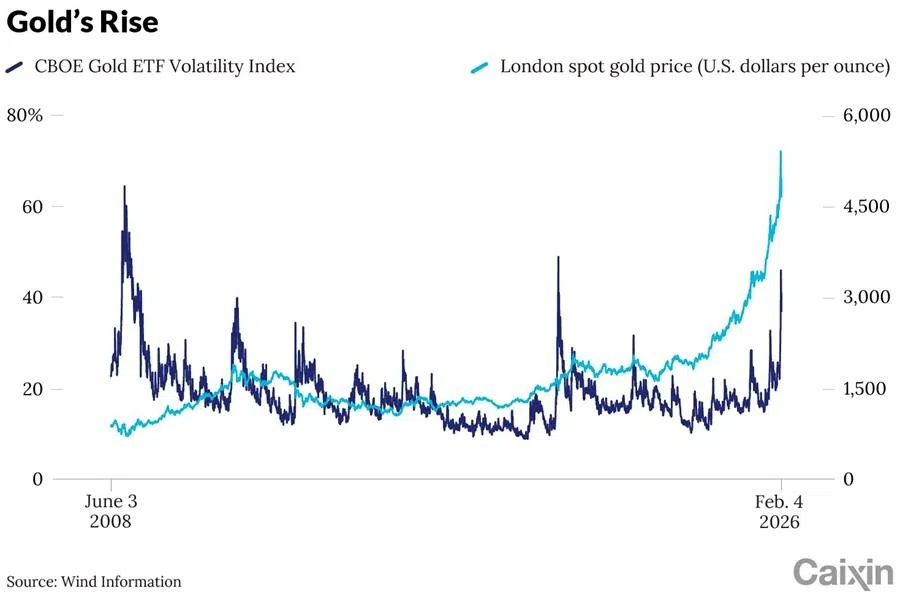

The year 2026 began with a spectacular rally. In January, spot gold and silver prices surged for eight consecutive trading days, climbing to highs of about US$5,600 and US$120 an ounce, respectively — gains of 30% and 67% from the start of the month. But then the rally unravelled just as quickly. On 30 January, prices suffered their worst one-day drop in four decades. Volatility spilled into February, with gold trading at around US$4,867 and silver at US$73 by 6 February.

This frenetic trading pushed the Chicago Board Options Exchange Gold ETF Volatility Index — which reflects expected 30-day swings priced into near-term options — above 44%, a level unseen since the 2008 financial crisis and rivalling the panic of the early Covid outbreak in March 2020.

The turbulence triggered a cross-asset cascade, shaking everything from industrial commodities to regional stock markets and cryptocurrencies, prompting a fundamental question: is gold a speculative token or a true safe haven asset?

For now, many investors believe the long-term logic for holding gold remains intact, driven by a powerful de-dollarisation narrative and persistent geopolitical uncertainty. But the recent chaos stands as a stark warning about the dangers of leveraged speculation in a market increasingly detached from fundamentals.

One macro analyst at a private fund likened Trump’s presidency to the market buying a call option on gold.

An ‘everything boom and bust’

“It was like a tidal wave — boom and bust,” a private equity manager said, calling the tremor in precious metal markets a “once in 30 year” event.

Speculative fervour in January was palpable. “Overextended and accelerating, rising on any news — you could feel the euphoric rhythm in the trading,” recalled a derivatives trader.

Lu Ting, chief China economist at Nomura, said the January rally could no longer be explained by fundamentals and instead reflected speculative sentiment and competing narratives.

A series of moves by US President Donald Trump acted as the catalyst. From a surprise military raid in Venezuela to a criminal investigation into Federal Reserve chairman Jerome Powell and threats of tariffs on European allies, his actions fuelled market uncertainty. One macro analyst at a private fund likened Trump’s presidency to the market buying a call option on gold.

The mania spilled into other commodities. In January, London copper and aluminium futures, along with NYMEX platinum futures, posted peak monthly gains of 15.7%, 12% and 34.7%, respectively.

In response, exchanges in China and the US tried to rein in speculation. The Shanghai Futures Exchange issued 18 market-cooling notices covering dozens of contracts — particularly gold, silver, copper, nickel and alumina — while the Chicago Mercantile Exchange raised margin requirements for gold and silver futures three times.

The bubble burst on 31 January. Gold and silver lost nearly half a month’s gains in a single session. The trigger appeared to be Trump’s nomination of former Fed governor Kevin Warsh, known for his hawkish views, as the next Fed chair.

However, Cheng Tan, founder and research director at GMF Research, argued it was less a Warsh trade than a leverage-normalisation trade. Assets that had risen the most, such as silver, fell the hardest, suggesting a broad profit-taking cascade as long positions were unwound.

A Goldman Sachs report on 3 February noted that much of the volatility occurred while the Shanghai exchange was closed, pointing to Western capital flows as the main driver. A surge of buying in call options on the SPDR Gold Shares ETF — the world’s largest gold ETF — created a precarious setup. As prices approached key strike levels, dealers who had sold the options were forced to buy physical gold to hedge, amplifying the rally.

... three rules of thumb: take a long-term view on gold rather than chasing short-term trades; avoid leverage given extreme volatility; and allocate a disciplined share of one’s portfolio to gold as a baseline hedge against shocks. — Lu Ting, Chief China Economist, Nomura

After the ‘epic squeeze’

The violent swings produced what many investors described as an epic squeeze, wiping out profits and, in extreme cases, entire accounts. Unlike the broadly bullish sentiment during the gold rally of October 2025, investors are now sharply divided.

At the Caishikou department store in downtown Beijing, known as the “No 1 Gold Shop in China”, long lines formed at both the investment gold-bar counter and the buyback desk. Some investors rushed to lock in gains, while others saw an opportunity to buy the dip.

Experts urged caution for retail investors. Lu of Nomura offered three rules of thumb: take a long-term view on gold rather than chasing short-term trades; avoid leverage given extreme volatility; and allocate a disciplined share of one’s portfolio to gold as a baseline hedge against shocks.

The pain was especially acute for holders of Chinese silver-backed funds. UBS SDIC Silver Futures Fund, the only listed fund in China tracking silver futures, made a one-day valuation adjustment of -31.5% on 2 February. The fund, which had been flooded with demand during the rally, aligned its net asset value with the collapse in overseas silver prices, which far exceeded daily trading limits on Chinese exchanges. The move, while compliant with regulations, sparked investor outrage as savings evaporated overnight.

For the first time since the 1980s, the total value of all existing gold, at about US$38.2 trillion, is nearly on par with the stock of US Treasury debt...

Long-term logic holds firm

Despite the brutal deleveraging, many analysts argue that the fundamental case for gold remains strong. The global economy is entering what analysts at Changjiang Securities describe as a period of restructured order, marked by low growth and high debt. When the US dollar and Treasuries are no longer seen as risk-free, gold stands out as a hedge against uncertainty.

A report from China International Capital Corporation said the rally — with gold briefly topping US$5,500 an ounce — marked a watershed. For the first time since the 1980s, the total value of all existing gold, at about US$38.2 trillion, is nearly on par with the stock of US Treasury debt, roughly US$38.5 trillion. The milestone suggests that the post-Bretton Woods system, anchored by the dollar and underpinned by US debt, is beginning to loosen.

That view is echoed by central banks, which have been net buyers of gold since 2008. Their purchases doubled to around 1,000 tons a year starting in 2022, making them a major price driver. The trend signals that central banks view gold as a currency rather than a commodity, trusting it more than fiat money issued by any single authority, said Erik Norland, managing director and chief economist at CME Group.

New buyers have also emerged from the cryptocurrency world. Tether, issuer of the largest stablecoin, USDT, has been accumulating gold aggressively. The company said its holdings have reached nearly 140 tons, far above the roughly 16 tons needed to back its gold-pegged token, Tether Gold. Just before the late-January surge, chief executive Paolo Ardoino told Reuters that Tether was buying about two tons of gold a week without a specific target.

Shi Lei, a partner at Hangzhou Suijiu Private Equity Fund Management, described gold as a “spare tire” for currencies — essential when the rules of the sovereign money system are in flux. That does not signal a return to the gold standard, he said, but underscores gold’s role as a hedge. How central banks respond to the latest pullback will be a key signal for markets.

Silver’s surge is a headwind for producers of solar panels and electric vehicle batteries, where it is a critical input...

Ripples through the real economy

Sustained high prices for precious metals are sending shockwaves through downstream industries. Silver’s surge is a headwind for producers of solar panels and electric vehicle batteries, where it is a critical input. Shi Heqing, deputy secretary-general of the gold and silver branch of the China Nonferrous Metals Industry Association, said industrial use accounts for nearly 90% of China’s silver demand.

Rising costs are accelerating a push toward desilvering. An InfoLink Consulting report found that the cost of silver paste in TOPCon solar modules jumped 77% from November 2025 to January 2026, forcing many manufacturers to halt purchases and consider substitutes such as copper.

That disruption could eventually trigger a price correction. “About 30% of silver demand comes from photovoltaic companies. At the equivalent of US$30,000 a kilogram, the economics don’t work,” said a futures trader at a foreign oil company. “The price has to come down.”

The pressure is leading to substitution. Some photovoltaic cell makers are replacing traditional silver paste with silver-coated copper paste, copper paste or copper electroplating, while accelerating work on next-generation technologies such as perovskite tandem cells to reduce silver use, Shi said.

Substitution is complicated by the fact that copper prices have also climbed on the same macro forces. Some sectors have turned to aluminum-for-copper swaps, but the move is expected to be slow. For many industrial firms, the volatility has heightened the need for sophisticated hedging strategies.

Ultimately, rising precious metals costs could feed into China’s broader inflation picture. After 39 months of falling factory gate prices, China hopes for a rebound in 2026. Higher commodity costs could lift producer prices — a technical positive in the fight against deflation.

Even so, economists say transmission to consumer inflation remains weak because of sluggish domestic demand. For now, higher input costs are more likely to squeeze corporate margins than be passed on to consumers, risking a cycle of constrained wage growth and subdued spending.

Zhang Yuzhe and Quan Yue contributed to the story.

This article was first published by Caixin Global as “Cover Story: Precious Metal Volatility Puts the ‘Safe Haven’ Trade on Trial”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.