US market, China money: Cambodia navigates the trade war

While the US is Cambodia’s largest market for garment and textile products, China is Cambodia’s main source of investment in those areas. Cambodia needs to walk the tightrope between the two countries, as both are crucial for its economic growth, says Cambodian researcher Sokvy Rim.

Cambodia-US relations have seen significant improvement since Cambodian Prime Minister Hun Manet took office. A month after Hun Manet was elected, the US unfroze its aid to Cambodia — the US$18 million was held back due to alleged election irregularities.

Thereafter, exchanges between Cambodia and the US increased. In June 2024, then US Defence Secretary Lloyd Austin met with Hun Manet in Cambodia. They discussed restoring relations between the two countries, including the resumption of joint military exercises and Cambodian students’ access to US military programmes.

Hun Manet strengthening leadership position with economic growth

A few months later, in December 2024, a US military ship was allowed to dock in Cambodia’s deep seaport of Sihanoukville Autonomous Port for the first time in eight years. The presence of the US military ship showed a significant improvement in Cambodia-US relations, with Cambodia’s defence ministry remarking that the visit aimed to “promote bilateral cooperation”.

In February 2025, commander-in-chief of the Royal Cambodian Armed Forces, General Vong Pisen, met with commanding general of the US Army Pacific, General Ronald P. Clark, whereby Cambodia requested the US to resume the Angkor Sentinel joint military exercise, which the Cambodian government had cancelled in 2017. This is seen as the Hun Manet government’s attempt to strengthen mutual trust with the US, especially after Washington accused Cambodia of signing a secret military deal with China over the Ream Naval Base.

In 2024, Cambodia exported around US$9.92 billion to the US, its largest market. Meanwhile, China is Cambodia’s largest source of foreign direct investment.

Nevertheless, Cambodia does not aim to shift attention away from China to the US, but rather to walk the tightrope between the two superpowers as both Washington and Beijing are crucial trading partners. In 2024, Cambodia exported around US$9.92 billion to the US, its largest market. Meanwhile, China is Cambodia’s largest source of foreign direct investment. According to the Council for the Development of Cambodia, foreign direct investment from China amounted to US$34.25 billion, contributing 49.82% of total investment capital in 2024.

Economic growth is significant for Hun Manet administration as it could help strengthen the legitimacy of his leadership. His administration has strongly emphasised on achieving the goal of graduating from Least Developed Country status by 2029 and upper middle-income status by 2030.

China rallying the region against US

Cambodia’s close relations with the US is beneficial to China as it allows Chinese companies to export to the US with lower tariffs via Cambodia. However, China’s influence in Cambodia could be reduced if the US and Cambodia get too close.

As Cambodia-US relations had somewhat recovered from its previous wounds, Cambodia-China relations are facing challenges. China reportedly did not provide any loan to Cambodia in 2024, despite being Cambodia’s largest donor and top creditor. Furthermore, developments of the Funan Techo Canal, which was lauded as Hun Manet’s achievement, remains at a standstill since its groundbreaking ceremony in August 2024 as China’s funding for the project was uncertain. China only openly supported the project during Chinese President Xi Jinping’s visit to Cambodia in April this year.

As Cambodia tries to maintain its relations with the US and China, the changing dynamic of global politics appears to be unfavorable for Cambodia.

An important factor that cannot be ignored is the intensifying trade war between the US and China. Recently, the US imposed 145% tariffs on Chinese products, which is the highest so far, and could potentially reach as high as 245%.

While Xi’s charm offensive might be hard to resist, if Cambodia is inclined to show strong support for China against the US, Cambodia could get caught in the middle of the trade war.

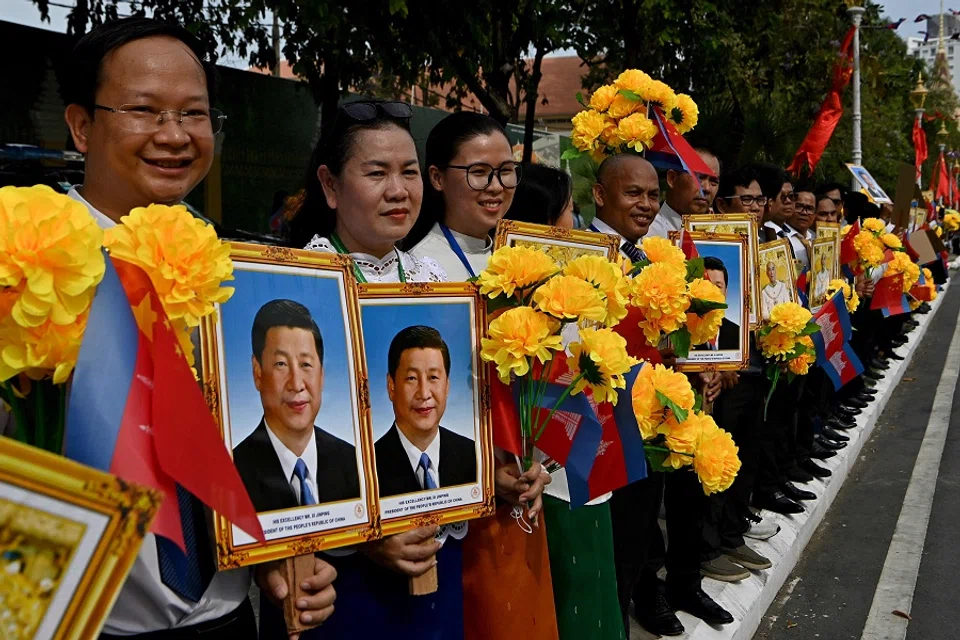

While China responded by implementing 125% tariffs against the US, China is also rallying support regionally and globally against US tariffs. On April 8, China’s Minister of Commerce Wang Wentao held a video talk with European Union’s top trade officials, raising concerns of the US’s high tariffs as well as calling for enhanced trade and economic relations between China and the West. In the same month, Chinese President Xi Jinping visited Vietnam, Malaysia and Cambodia, hoping to unite its Southeast Asian neighbors against US tariffs.

Despite Cambodia’s small economy, Xi’s tour to Cambodia during the height of the US-China trade war highlights Cambodia’s importance to China. Xi called Cambodia a “priority in China’s neighborhood diplomacy”. His visit to Cambodia also resulted in the signing of various agreements including a US$1.2 billion deal to finance the Funan Techo Canal project. Xi’s charm offensive in Cambodia was strongly applauded by Cambodian government officials and academics.

This raises the question: how does the US perceive Xi’s tour to Southeast Asia? Indeed, the US would not take China’s Southeast Asia tour positively. US President Donald Trump referred to the meeting between China and Vietnam as finding a way to “screw” the US. While Xi’s charm offensive might be hard to resist, if Cambodia is inclined to show strong support for China against the US, Cambodia could get caught in the middle of the trade war.

China’s incentive to invest in Cambodia

Furthermore, Cambodia’s economic growth and employment market rely heavily on both the US and China. While the US is Cambodia’s largest market for garment and textile products, China is Cambodia’s main source of investment in those areas. According to the Globe Newswire’s report, the garment industry employs over 750,000 people and contributed over US$9 billion to Cambodia’s GDP in 2022.

Given that most textile and garment factories in Cambodia are owned by foreigners, particularly Chinese, they could relocate to other countries to avoid the US tariff.

Trump’s tariff poses a challenge to Cambodia. While the US has implemented a 10% baseline tariff on Cambodian imports, it will be just a matter of time before the US imposes another 49% tariff to that. Given that most textile and garment factories in Cambodia are owned by foreigners, particularly Chinese, they could relocate to other countries to avoid the US tariff. Without the US market, Chinese investors might have little incentive to invest in Cambodia.

Against this backdrop and amid the intensifying US-China trade war, Cambodia needs to walk the tightrope between the two countries, as both are crucial for its economic growth.

Xi’s visit has shown Cambodia’s significance to China, but China will not be able to replace the US as Cambodia’s largest market, at least for now. Maintaining a neutral position could give Cambodia more leverage to negotiate its tariffs with the US.