Is Alibaba doomed? [Part I]

Alibaba was recently slapped with a 18.2 billion RMB fine and has acquiesced to state authorities' demands for "rectification''. Commentator Yuan Guobao asserts that Alibaba's "choose one out of two" policy of tying online merchants down to exclusive deals was already sounding alarm bells. Jack Ma's politically incorrect speech at the Shanghai Bund Summit may have been a fire starter, but the tech giant's troubles have been brewing for quite some time.

Two days after it incurred an 18.2 billion RMB fine, Alibaba was dealt another heavy blow: on 12 April 2021, the People's Bank of China (PBOC), the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, and the State Administration of Foreign Exchange held another joint regulatory session with Ant Group.

In a press conference after the meeting, reporters asked why the financial management authorities needed to interview Ant Group again. According to PBOC Deputy Head Pan Gongsheng, this was in line with China's plans to "intensify efforts to oppose monopolies and contain the disorderly expansion of capital to effectively prevent risks" and "with the strategic goal of building a new competitive advantage... to establish a sound system for the governance of internet platforms to achieve the regulated, healthy and sustainable development of its platform economy".

The part about needing to "intensify efforts to oppose monopolies and contain the disorderly expansion of capital to effectively prevent risks" is especially crucial.

Massive 'rectification' required

Next, the authorities proposed a five-part "rectification" plan for Ant Group, which includes implementing rules and regulations to correct unfair and inappropriate practices in its payment business; preventing the monopoly of information and the misuse of personal information; classifying Ant Group as a financial holdings company and supervising it as such; improving corporate governance and rectifying illegal financial activities; and managing and controlling liquidity risk for its fund products, including shrinking the assets under the management of Yu'ebao, its giant money-market mutual fund.

Alibaba is trapped under a giant net however events eventually turn out.

Looking back at the chain of events, on 10 April, the outcome of Alibaba's anti-monopoly probe was announced. Alibaba received an administrative penalty from the State Administration for Market Regulation (SAMR) and was ordered to stop illegal activities and pay a fine of 18.2 billion RMB, or 4% of its total 2019 domestic sales of 455.712 billion RMB, because of its monopolistic "choose one out of two" (二选一) policy. At the same time, the SAMR also issued administrative guidance to the group which demanded that Alibaba do a full rectification and submit self-inspection reports to the administration for three consecutive years.

One can say that with a heavy fine of 18.2 billion RMB, two powerful rectification measures attacking Alibaba's core businesses of e-commerce and financial services, and the slogan "oppose monopolies and contain the disorderly expansion of capital", Alibaba is trapped under a giant net however events eventually turn out.

This commercial furore has created waves in China since 2020, stirring up public sentiment and inviting heated discussions. A few questions are worth thinking about:

One, is this the end of the story or Alibaba's turning point?

Two, subsidiaries of Alibaba have been dealt a series of major blows. What did they do wrong?

Three, through this series of extensive measures, what messages are the government sending?

Four, Is Alibaba an isolated case of a company with monopolistic tendencies? Or is this a worldwide phenomenon?

Five, what can Chinese internet giants and even the entire business society learn from the case of Alibaba?

...we can be sure that Ant Group, which Alibaba heavily relies on, is doomed.

The road ahead remains tough

Looking at the first question, I think this is not the end of the story. Alibaba still has a lot of convincing to do and the road ahead remains tough.

When Alibaba was interviewed again by the authorities on 12 April, Alibaba Director and CEO Daniel Zhang said that the 18.2 billion RMB fine is not expected to have a "material negative impact" on the group.

In fact, after the 18.2 billion RMB fine was imposed, Alibaba's US-listed shares increased by over 9%. Some believe that the capital market's confidence in Alibaba stems from two points: one, that Alibaba's disciplinary measures have been implemented and the uncertainty of previous risks has been completely eliminated; two, while Alibaba's fine of 18.2 billion RMB is by far the highest one that any Chinese company has received for violating anti-monopoly rules, it is but 4% of its 2019 domestic sales, which is at the midpoint of the penalty range between 1% and 10%.

These caveats notwithstanding, after the exposé on Alibaba's 12 April meeting with the regulatory authorities, we can be sure that Ant Group, which Alibaba heavily relies on, is doomed. Consumer loan providers Jiebei and Huabei are in fact the money trees of Ant Group and even the entire Alibaba Group. In the earlier half of 2020, these micro-lending platforms generated 28.586 billion RMB in income for the group, accounting for 39.41% of total revenue.

All of the five rectification measures are aimed at containing the "disorderly expansion of capital" and are like an albatross around Ant Group's neck.

For example, the first point in the rectification plan states that "unfair competition practices in its payment business" must be corrected, and more choice in methods of payment must be given to consumers. Furthermore, Alipay's "inappropriate connection" to Huabei, Jiebei and other financial products must be severed, and "illegal behaviours" such as embedding credit business in payment products must be done away with.

This demand is akin to grabbing Ant Group by the throat. Over the years, people who shop on Taobao or make purchases via Alipay have set Huabei as their default payment option, which is what the "inappropriate connection" between Alipay and Huabei refers to. And the majority of Huabei and Jiebei users - over 500 million - come from these platforms. Thus, once such a connection is cut off, Ant Group's source of users will be severely affected.

Ant Group's name change from "Ant Financial Services" to "Ant Group" on the eve of its listing last year was an attempt to evade the supervision of the China Banking and Insurance Regulatory Commission under the cloak of being a technology firm.

More importantly, the third aspect of the rectification plan states that Ant Group is to apply to become a financial holdings company and incorporate all their institutions engaged in financial activities within that so that they will be under the supervision of the financial management authorities. This is the strongest rectification measure proposed and hits Alibaba where it hurts.

To some extent, Ant Group's name change from "Ant Financial Services" to "Ant Group" on the eve of its listing last year was an attempt to evade the supervision of the China Banking and Insurance Regulatory Commission under the cloak of being a technology firm. According to relevant reports, Ant Group was once able to borrow 360 billion RMB after starting with a principal sum of 3 billion RMB. This equates to a leverage ratio of 120 times.

Carefree days are over

When it was not under supervision, the sky was the limit for this "ant" in terms of leverage ratios, which is extremely dangerous in any country. But now that it is under the supervision of financial management authorities, its carefree days of earning quick cash are completely over.

For example, in the past, if Ant Group provided a loan of 10,000 RMB, the interest could amount to 2,000 RMB. However, banks working with Ant had to provide 9,800 RMB of the principal amount, while Ant only provided the extra 200 RMB. In addition, the profit of 2,000 RMB would be equally split between both parties. This meant that with 200 RMB, Ant was already able to make a profit of 1,000 RMB, enjoying a 500% rate of return. After Ant comes under the supervision of financial management authorities, it would need to provide 30% of the 10,000 RMB principal amount. Assuming that interest rates remain the same, its rate of return would drop to 33%.

Thus, just this rectification measure alone would significantly reduce Ant's revenue. The impact of this major blow far exceeds that of the 18.2 billion RMB fine. Coupled with the rest of the measures on corporate governance and control of liquidity risk for fund products, the scope and scale of Ant Group's business will likely be drastically curtailed.

Not to mention the fact that in addition to its 18.2 billion RMB fine as a result of anti-monopoly investigations, Alibaba would also have to continue making rectifications for the next three years. In other words, for the next three years or longer, the e-commerce platform Alibaba will be under the close watch of regulatory authorities and continue to face immense pressure.

On the other hand, as other e-commerce platforms such as Pinduoduo and JD.com become stronger and get more powerful, the rise and fall of these platforms would have a greater impact on Alibaba's e-commerce market share in the future. As the target in the dual fight against "the disorderly expansion of capital" as well as "opposing monopolies", Alibaba's foundations have been shaken to an unprecedented extent.

Based on this point, it does not seem like a case of this being the end of story but an actual turning point.

What did Alibaba do wrong?

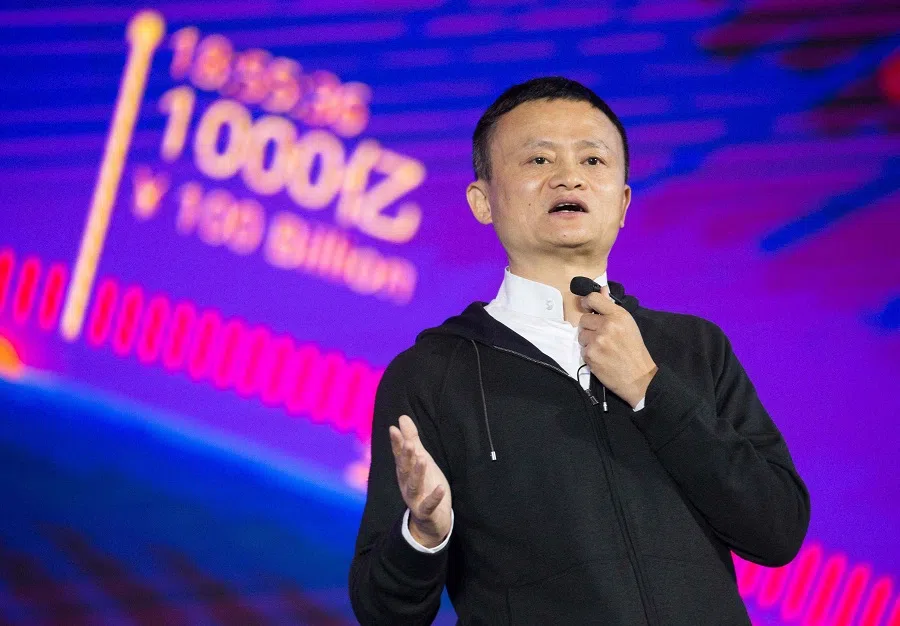

As a proverb goes, "you reap what you sow". Some believe that the trigger to this entire debacle was 57-year-old Jack Ma's appalling speech at the Bund Summit in Shanghai last October. In his nearly 4,000-word speech, Ma criticised traditional banks for operating with a "pawn shop" mentality, referred to the Basel Accords as a "club for the elderly", and attacked the government's regulatory logic. He did not mince his words and his speech was unlike any other.

Since then, Ant Group has landed itself in the soup. Not only was there talk that Ant Group was being put in its place, Ant Group's IPO was also suddenly halted, e-commerce platform Tmall was shunned everywhere, and the SAMR officially launched an anti-monopoly probe into Alibaba, leading to the immediate loss of trillions of its market value. The consecutive blows that Alibaba has had to face demonstrate the severity of the troubles it has landed itself in:

On 24 December 2020, the SAMR officially launched an investigation into Alibaba for suspected monopolistic behaviour in accordance with the law. That same day, the People's Daily commented on Alibaba's investigations, while Alibaba responded to these allegations. On 27 December 2020, the on-site investigation into Alibaba was concluded. On 10 April 2021, Alibaba Group was slapped with a fine of 18.2 billion RMB to which Alibaba responded that it would ensure its "compliance with determination". That same day, the People's Daily commented on Alibaba's punishment, and Alibaba issued an open letter saying that the punishment served to "alert and catalyse companies like [theirs]". On 12 April 2021, Alibaba CEO Daniel Zhang said that the fine is not expected to have a "material negative impact" on the group...

While these events occurred over a period of less than six months, the public was riled up every time there were new developments in the Alibaba case. An event of such a great impact can be said to be unprecedented in the history of the development of Chinese enterprises.

Putting Ma's remarks aside, what exactly did Alibaba do wrong? To a certain extent, what was said and done in the past have resulted in today's punishment.

Galanz, a home appliance manufacturer based in Guangdong, had once stood up to Tmall, accusing it of monopolistic behaviour in a statement released in June 2019. It ended the statement with the phrase "匹马立高台,单枪挑乌云" (lit. horse standing on a tower, fighting the black clouds). (NB: As 乌云 (black clouds) and 马云 (Ma Yun) look similar, Galanz could have meant that it was taking on Alibaba.)

"Choose one out of two" policy is normal market practice to get rid of the weaker class. - Wang Shuai, chairman of Alibaba's marketing and public relations committee

When the dragon slayer becomes the dragon

The background to this is that following Galanz's visit to Tmall's competitor Pinduoduo in May 2019, Tmall allegedly started diverting traffic away from Galanz's store, even hiding search results of Galanz's products. At one point, it was impossible to call up Galanz's flagship store, resulting in major losses on Galanz's side.

Just as Rome wasn't built in a day, the problem with Alibaba's "choose one (platform) out of two" policy existed long ago.

Prior to Galanz's accusations, JD.com sued Alibaba for its "choose one out of two policy" in 2015, demanding compensation worth 1 billion RMB. The lawsuit lasted several years but because Tmall requested the court to transfer the case to the Zhejiang High People's Court, the case was stalled by a dispute over court jurisdiction.

Despite the protests of numerous platforms and merchants, Alibaba maintained a strong and even arrogant stance. For example, in October 2019, the chairman of Alibaba's marketing and public relations committee Wang Shuai made the remark that the "choose one out of two" policy is normal market practice to get rid of the weaker class. He said that the platform had to invest a lot of resources and capital into organising large promotional activities and thus it was expected that merchants and brands put in a similar effort in terms of goods, prices and so on.

A "choose one out of two" policy is glaringly at odds with the vision of an industry leader to "make it easy to do business anywhere". Alibaba has continued to take advantage of its market dominance to exploit merchants and seek illegitimate benefits and also oppressed its opponents covertly. This behaviour reeks of being pampered and spoilt.

On the other hand, Ant Group, an affiliate of Alibaba, can be said to have been a "bloodsucker" in recent years. Tossed about by the waves of consumerism, the younger generation have clearly taken a beating from consumer loans. More importantly, if Ant Group's systemic risks are left unchecked, it would inevitably result in huge damage to the country. With its high leverage ratios and the massive exclusive control it has over the personal data of hundreds of millions of users, the bloodthirsty nature of Ant Group has already spun out of control.

The dragon slayer became a dragon in the end - this state of affairs is highly regrettable. When all is said and done, everything boils down to the earlier mentioned mantra of "intensify[ing] efforts to oppose monopolies and contain the disorderly expansion of capital to effectively prevent risks".

Related: What the Chinese government wants to tell Alibaba and China's tech giants [Part II] | Blacklisted and fined: The end of Chinese tech companies' heyday? | Is Alibaba leaving its carefree days behind? | Alibaba probe: China's challenges in dealing with monopolies start with the state-owned enterprises | China's tightening fintech regulations may benefit Ma Yun's Ant in the long term | Jack Ma: Traditional banks are operating with a 'pawn shop' mentality | Lesson for Jack Ma's Ant: Finance is finance and technology is technology

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)