China’s appliance makers hunt for emerging market growth

Against a backdrop of deglobalisation and trade wars, many Chinese home appliance companies are opting to build factories in Southeast Asia, the Middle East and Latin America, as their home turf has become saturated.

(By Caixin journalists Qin Min and Wang Xintong)

From emerging markets to premium segments, China’s home appliance makers are hunting for new growth overseas, as their home turf has become saturated.

Companies are also ramping up investment in brand recognition and local manufacturing bases abroad, as more shift from their traditional role as third-party producers for foreign brands to carving out markets for their own marques.

“Previously, only major appliance brands ventured abroad, but now even second- and third-tier manufacturers are doing so,” said an executive at a home appliance company in Zhongshan, South China’s Guangdong province. “They’re not just engaging in original equipment manufacturing (OEM), but also boldly trying to market their own brands.”

While Chinese manufacturers once earned higher profits locally than from exports, this trend has reversed in recent years, prompting many companies to seek growth overseas.

While the competition has intensified in the domestic appliance market, overseas markets — especially emerging ones — hold significant growth potential, Xu Dongsheng, a vice president of the China Household Electrical Appliances Association, told Caixin.

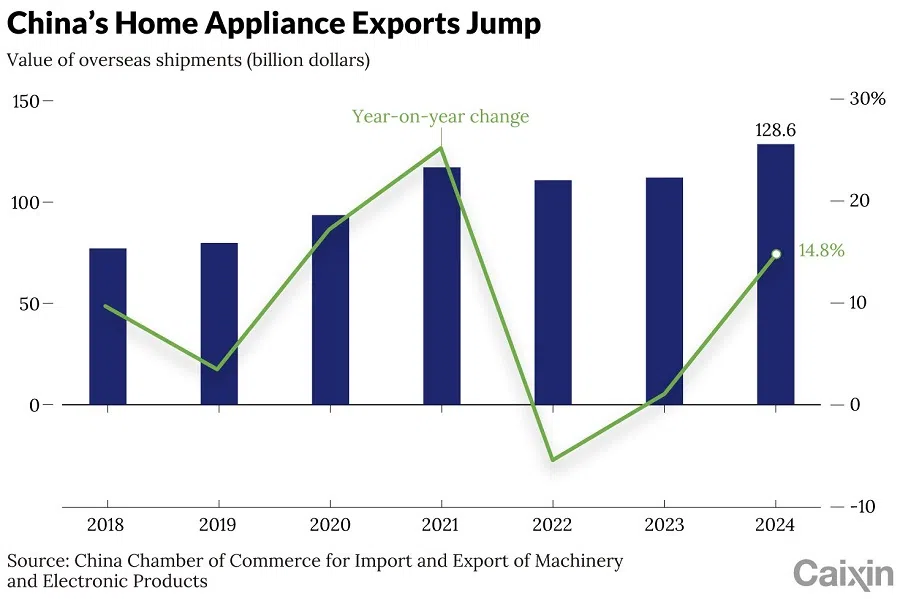

China’s home appliance exports rose 14.8% year-on-year to US$128.6 billion in 2024, the fourth straight year above US$100 billion, according to data from the China Chamber of Commerce for Import and Export of Machinery and Electronic Products (CCCME).

“The domestic home appliance market is really too competitive now,” said Zhou Nan, secretary-general of the CCCME’s home appliance branch. While Chinese manufacturers once earned higher profits locally than from exports, this trend has reversed in recent years, prompting many companies to seek growth overseas.

Some Chinese home appliance makers are leveraging technical innovations to go after high-end overseas markets that have traditionally been dominated by companies including South Korea’s Samsung Electronics Co. Ltd. and LG Electronics Inc., Zhou said.

However, the China-US trade war has hamstrung Chinese competitors. Against a backdrop of deglobalisation and trade wars, many Chinese home appliance companies are opting to build factories in Southeast Asia, the Middle East and Latin America, said a person familiar with the matter.

As they expand geographically, China’s larger players are moving into new segments of the global home appliance market. China’s TCL Industries Holdings Co. Ltd. and Hisense Home Appliances Group Co. Ltd... are tapping higher-end customers.

Overseas premium markets

As they expand geographically, China’s larger players are moving into new segments of the global home appliance market. China’s TCL Industries Holdings Co. Ltd. and Hisense Home Appliances Group Co. Ltd., two of the world’s largest TV-makers by shipments, in particular are tapping higher-end customers.

TCL, for example, is challenging established players like Samsung in overseas premium markets — its QD-Mini-LED technology enables TCL to produce TVs at a lower price than Samsung’s OLED tech.

In the fourth quarter of 2024, Samsung’s share of the global premium TV market by shipments fell to 29%, down 12 percentage points year-on-year, according to Counterpoint Research. TCL’s share grew to 20%, surpassing LG to take second place.

Ivan Lam, a senior analyst at Counterpoint Research, expected Chinese appliance-makers to continue growing in overseas markets thanks to their cost and technology advantages.

However, Lam also noted Chinese companies will face greater marketing costs than their more established competitors, as they have lower brand recognition.

Hisense, TCL’s main domestic competitor, has been trying to boost its global brand image by sponsoring major sporting events. It was the first Chinese company to sponsor the UEFA European soccer championship in 2016 and has also been named the first official partner of the first ever 32-team FIFA Club World Cup due to kick off in the US in June.

Shift in manufacturing

Chinese home appliance makers are increasingly leading their charges into overseas markets with their own brands in hand.

Chinese companies are focusing more on own-brand goods as they aim to achieve sustainable business development. — Zhang Hongjun, an executive, Shenzhen Chuangwei-RGB Electronic Co. Ltd.

In January, Fang Hongbo, chairman of Midea Group Co. Ltd., announced at a company conference that the appliance-maker’s top priority is now ramping up expansion overseas and original brand manufacturing (OBM) — producing and selling products under its own marque.

Midea started its international operations in the 1980s in OEM by manufacturing products for foreign brands. The bulk of its overseas revenue still comes from this part of its business. However, in 2023 the company shifted its focus to own-brand products.

The manufacturer wants to tap into a wider range of home appliance categories and gain greater market share, Fu Jian, president of Midea International, told Caixin. He explained that in the US and European markets, established brands of large appliances such as refrigerators and washing machines typically produce core products themselves, leaving Chinese manufacturers only with orders from smaller companies and for non-core products.

For Zhang Hongjun, an executive at electronics-maker Shenzhen Chuangwei-RGB Electronic Co. Ltd., Chinese companies are focusing more on own-brand goods as they aim to achieve sustainable business development. Chuangwei-RGB’s overseas business includes both OEM and OBM.

Smaller manufacturers are also making similar moves. Royalstar, a home appliance brand under state-backed Rongdian Group, began by manufacturing products for overseas clients in 2019. Last year, the company launched its own brand in Southeast Asia.

In deciding to set up its own brand, Rongdian considered the uncertainty of a future in the US market as relations between Beijing and Washington grow more fraught, as well as the more profitable nature of OBM compared to OEM, Liu Moudong, executive general manager of the company’s foreign trade division, told Caixin.

Countering US tariffs

US President Donald Trump has twice raised tariffs on Chinese imports since taking office in January. The combined 20% increase, along with existing duties, means Chinese-made home appliances such as air conditioners, freezers and refrigerators are now subject to import levies as high as 48%.

Amid the possibility of further US tariff increases, Chinese home appliance makers are working to “address weak links and strengthen their supply chains,” and enhance their local manufacturing presence abroad, Xu said.

... growing demand for local production facilities has driven up labour costs and rents in some industrial parks. Additionally, the “hidden costs” of crossing cultural boundaries and building relations with local governments remain significant. — Li Jiancai, a researcher, Shan Hai Map

Currently, the preferred destination for these manufacturers is Southeast Asia, where countries like Thailand and Vietnam have strong industrial foundations and stable relations with Beijing, he said. Chinese home appliance makers building factories in Thailand and Vietnam can also benefit from the countries’ preferential policies aimed at boosting local manufacturing, Lam said.

Xu said in the US and Europe, distributors have significant control over product pricing, and customers prefer leading brands or local brands for essential household appliances, making it difficult for smaller Chinese manufacturers to break into the market with their own brands. Instead, countries participating in Beijing’s Belt and Road Initiative, such as those in Southeast Asia and the Middle East, may present better opportunities, he said. The initiative is a multibillion-dollar infrastructure investment scheme aimed at boosting trade between Asia, Africa and Europe.

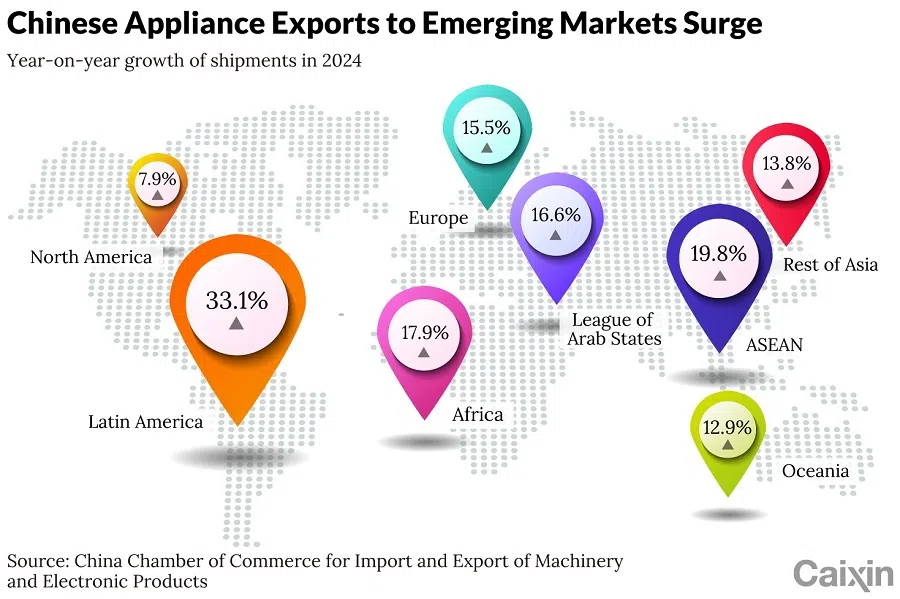

Chinese home appliance exports grew significantly in some emerging markets last year, with shipments to Latin America up 33.1% year-on-year, ASEAN region up 19.8% and the Arab League states, up a combined 16.6%, according to CCCME data.

However, Li Jiancai, a researcher at Beijing-based consultant Shan Hai Map, which advises Chinese companies on overseas expansion, warned that entering the Southeast Asian market has become more costly.

Li explained that growing demand for local production facilities has driven up labour costs and rents in some industrial parks. Additionally, the “hidden costs” of crossing cultural boundaries and building relations with local governments remain significant.

Meanwhile, Trump’s recent tariffs on imports from Mexico have cast a shadow over the country, which was once a popular destination for Chinese manufacturers due to its lower labour costs and proximity to the US, as well as the United States-Mexico-Canada Agreement (USMCA) that allows certain locally made goods to enter the US duty-free.

Trump slapped a 25% blanket tariff on Mexican imports on 4 March. Two days later, he announced that levies on goods covered by the USMCA would be delayed until 2 April.

Hisense invested US$260 million in 2021 to build an appliance industrial park in Monterrey, the capital of Nuevo León in northeastern Mexico. In February, the company said revenue from the local factory accounts for only a small portion of its global income and expected the impact of the US tariff hikes to be manageable. However, the company is also ramping up construction of factories in Southeast Asia and continuing to diversify its overseas supply chain in preparation for future trade policies.

TCL founder and chairman Li Dongsheng emphasised that globalisation requires localisation. TCL has adopted a strategy in which regional operations are led by local management and teams, with support from headquarters in China. In this way, Li said, it is possible to build efficient, competitive groups centered around local markets to support the company’s sustainable growth in the future.

This article was first published by Caixin Global as “In Depth: China’s Appliance-Makers Hunt Emerging Market Growth”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)