How Trump’s new tariff hikes will affect Sino-US trade

The constantly shifting US trade policies will have widespread implications for global trade and the shipping industry. In particular, the uncertainty surrounding US policies toward China is expected to continue affecting the structure of Sino-US supply chains.

(By Caixin journalists Luo Guoping, Li Rongxi, Feng Yiming and Han Wei)

Donald Trump, the US president, has escalated trade tensions with China, imposing an additional 10% tariff on Chinese imports at the end of February — just weeks after announcing a broad 10% tariff increase on 1 February.

The move has sparked concerns over its potential impact on China’s exports to the United States and the broader implications for global trade.

On 27 February, Trump unexpectedly announced a 25% tariff on Canadian and Mexican imports, effective from 4 March, alongside an additional 10% duty on Chinese goods. This contradicted his remarks at a cabinet meeting the previous day, when he said the extra duties would not take effect until 2 April.

In 2024, China’s exports to the US reached US$524.7 billion, marking a 4.9% year-on-year increase. The US remained China’s largest export destination, far ahead of second-place Japan.

Analysts previously estimated that the comprehensive tariff rate on US imports of taxable goods from China stood at 20%. With the additional 20% tariff, the overall rate is set to climb to 40%.

In 2024, China’s exports to the US reached US$524.7 billion, marking a 4.9% year-on-year increase. The US remained China’s largest export destination, far ahead of second-place Japan.

“Given the US’s economic scale and demand, the market is indispensable and not easily replaced,” said Gao Shiwang, director of the China Chamber of Commerce for Import and Export of Machinery and Electronic Products.

Ni Xiaorong, president of Kuehne+Nagel in Greater China, said the constantly shifting US trade policies will have widespread implications for global trade and the shipping industry. In particular, the uncertainty surrounding US policies toward China is expected to continue affecting the structure of Sino-US supply chains.

Gao said the additional tariffs will mainly impact corporate expectations. Before the election, Sino-US trade in machinery and electronics had stabilised, with both its absolute value and market share reaching a relative equilibrium. However, Trump’s election victory has triggered a significant shift in corporate expectations. A sudden and sharp tariff increase would severely disrupt a previously stable outlook.

“An additional 10% tariff, however, coupled with future uncertainties, will severely dent corporate confidence in Sino-US trade.” — Gao Shiwang, Director, China Chamber of Commerce for Import and Export of Machinery and Electronic Products

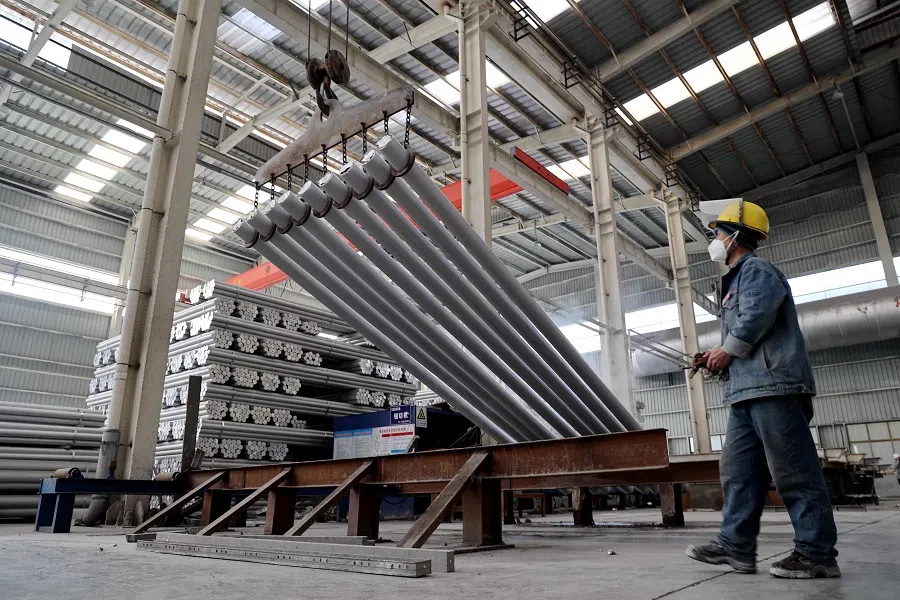

Among China’s major export categories to the US, machinery and electronics accounted for the largest share, totalling US$218.18 billion — accounting for 41.6% of total exports to the US last year. The second-largest category is textile materials and products, making up 9.4%, followed by base metals and their products, such as steel, copper and aluminium, which account for 5.76%.

“The first 10% tariff could still be managed through cost-sharing, price cuts or supply chain adjustments. Companies had no choice but to absorb it to maintain customer relationships,” said Gao. “An additional 10% tariff, however, coupled with future uncertainties, will severely dent corporate confidence in Sino-US trade.”

According to an industry insider, the initial 10% tariff levy was usually split evenly between Chinese exporters and US importers. “But Chinese exporters are now unable to shoulder further tariffs at current prices, forcing them to pass the burden down to US importers and beyond in the supply chain,” said the person.

A kitchenware exporter in Ningbo told Caixin that US clients, facing incoming tariffs, are demanding 5% price cuts while he can only offer 2% to 3%. To cope with the rising tariffs, he is planning to set up assembly in Southeast Asia.

Analysts suggested that a short-term rush to stockpile goods is possible. The kitchenware exporter said his largest US client has already requested early shipments, demanding that best-selling products for March through October be shipped by the end of March. He added that while securing shipping capacity isn’t a problem, the real challenge lies in rapidly scaling up production to meet the demand.

Overall, shipping capacity remains ample. This is partly due to a previous wave of stockpiling during Trump’s 2024 campaign. Additionally, when tariffs were imposed in early February, only goods shipped to the US before 1 February were exempt, leaving shippers no opportunity to advance their shipments.

Gao said that while leading companies often rely on overseas factories to serve the US market, small and medium-sized enterprises may face the risk of losing customers... he advised companies to focus on improving product design, increasing added value, and strengthening their bargaining power.

Given the rushed rollout of these tariffs and ongoing uncertainties, the urgency to stockpile this time may be less pronounced. Gao told Caixin that while the 2018 tariffs triggered a brief surge in stockpiling, this round differs. The tariffs were implemented hastily, bypassing typical hearings, and with much of the supply chain already shifted overseas, the urgency to export is likely to be lower than in the previous round, said Gao.

“Traders worry that tariff policies could undergo further changes, potentially escalating into a trade war and creating a more complex and unstable market environment,” said Ni. “This uncertainty has forced businesses to adopt a more cautious approach when planning logistics and procurement strategies.”

Moreover, constantly shifting tariff policies may lead to stricter and more complicated customs procedures, prolonging clearance times, disrupting logistics efficiency and increasing both operational and time costs for companies, Ni added.

The impact varies across different types of businesses. Gao said that while leading companies often rely on overseas factories to serve the US market, small and medium-sized enterprises may face the risk of losing customers. To mitigate this, he advised companies to focus on improving product design, increasing added value, and strengthening their bargaining power.

According to Ni, Mexico serves as a critical gateway for Chinese companies entering the North American market, with significant investments in factories and supply chains.

Several trading industry sources said Trump may impose more tariffs on Chinese exports to the US at a rate of 10% per month. These tariffs are expected to drive up product prices, dampen end-consumer demand and ultimately affect shipping rates. During his presidential campaign, Trump vowed to impose 60% tariffs on Chinese goods.

Trump’s renewed threat to impose tariffs on Mexico could also disrupt some of China’s export flows. In 2024, China’s exports to Mexico totalled US$90.2 billion, marking a 10.8% year-on-year increase and making Mexico China’s eighth-largest export destination.

According to Ni, Mexico serves as a critical gateway for Chinese companies entering the North American market, with significant investments in factories and supply chains.

Tariffs on Mexico could therefore have an indirect impact on Chinese businesses operating overseas. He said that the US aims to use tariffs on neighbouring countries to reshore manufacturing and reshape trade dynamics, though the effectiveness of this strategy remains uncertain.

Trump has yet to target Southeast Asian countries, and industry sources expect that successive US tariff hikes on China will benefit Chinese factories relocating to the region. However, concerns remain that the US tariff “stick” could soon swing toward Southeast Asia.

Trump has already signalled plans to impose “reciprocal tariffs” on all trading partners. In 2024, America’s top ten trade deficit partners were the Chinese mainland, Mexico, Vietnam, Ireland, Germany, Taiwan, Japan, South Korea, Canada and India.

This article was first published by Caixin Global as “Analysis: How Trump’s New Tariff Hikes Will Affect Sino-U.S. Trade”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)