What the Chinese government wants to tell Alibaba and China's tech giants [Part II]

Alibaba was fined a record 18.2 billion RMB after an anti-monopoly probe. Commentator Yuan Guobao observes that Alibaba is not the only tech giant in China accused of monopolistic practices; for that matter, the "big four" companies in the US have also come under the spotlight. All this suggests that on a global level, tech companies must be prepared to adhere to a strict regulatory environment, even as they break new ground.

Alibaba is not the only company in the eye of the Chinese regulatory storm. Several tech giants have been similarly scrutinised.

First, national regulation has been frequent and continuous. For example, the day before "Singles Day" on 11 November last year, the State Administration for Market Regulation (SAMR) sought views on draft anti-monopoly guidelines for the platform economy, putting strict restrictions on behaviours by platform businesses, such as the "choose one out of two" (二选一) policy and the use of click farms, reviews, and big data to take advantage of regular customers. As a result, on Singles Day last year, the "big four" of Alibaba, JD.com, Meituan, and Pinduoduo missed out on nearly a trillion RMB in market value.

On 14 December last year, the SAMR took quick action against Alibaba, China Literature, and Hive Box, deciding on administrative punishment for not declaring operations as required by law, resulting in fines of 500,000 RMB for each.

The financial capabilities of Tencent and Alibaba can match a first-tier city.

Internet giants being reined in

At the end of 2020, the SAMR led an administrative session for regulating the internet economy, where 26 giants including Alibaba, Tencent, JD.com, Meituan, Baidu, ByteDance, Beike, Kuaishou, DiDi, Sina Weibo, Pinduoduo, and Gome were invited for a chat. And in March this year, the SAMR fined 12 companies 500,000 RMB each, in ten cases of irregular internet operations by businesses.

Most importantly, the fifth plenary session of the 19th Central Committee of the Chinese Communist Party, the Central Economic Work Conference, and the ninth meeting of the Central Financial and Economic Affairs Commission gave a clear call to strengthen anti-monopoly measures and prevent the "disorderly expansion of capital". The tone has been set, and a storm will follow; it is just that Alibaba is the first to get into trouble.

Previously, an article in New Fortune featuring Tencent and Alibaba noted: "Through their recent investments and acquisitions to the scale of 500-600 billion RMB, Tencent and Alibaba have respectively built an ecosystem worth about 10 trillion RMB, which has gained ten times its value within five years."

Now here is a set of staggering figures. The listed companies under the Shanghai local government are worth a total of 2.8 trillion RMB; the 300 listed companies in Shenzhen are worth 11 trillion RMB; A-shares are worth a total of US$10 trillion. The financial capabilities of Tencent and Alibaba can match a first-tier city.

Of course, scale in itself is not an offence. But using scale to exert a monopoly and gain wrongful commercial benefits, and squeeze small and medium companies in terms of space as well as platform users in terms of value - that is the biggest problem with internet giants, and that is the reason for the state's frequent action.

More importantly, the situation has also got to the point where regulation is necessary. The fact is, hidden in these laterally expanding internet titans are also enormous risks.

While the giants keep invading traditional sectors, not only is there no sign of exciting innovations, they are using subsidies and price wars to destroy small and medium enterprises, as well as the ecology of the sector.

Reducing the risk of wrecking people's lives

In recent years, supported by strong finances, China's so-called internet giants have engaged in unbridled lateral expansion, which has seeped through to all aspects of people's lives - if a company were to collapse, it would destroy the lives of ordinary people. The most direct examples are credit and finance services such as the Ant Group's Huabei and Jiebei, JD.com's Baitiao, and other internet financial services by major internet platforms, which are destroying the will and lives of young people with abandon.

Furthermore, what these internet titans are doing is transferring the risk to the community. While the giants keep invading traditional sectors, not only is there no sign of exciting innovations, they are using subsidies and price wars to destroy small and medium enterprises, as well as the ecology of the sector. For example, when it comes to the sharing economy such as bicycle- and car-sharing, they have left behind a mess.

Finally, these internet giants are using their advantaged position to reap the benefits of monopoly. With their strong finances, they use traffic volume, the platform, big data, subsidies, and discounts and price wars, to firmly control people's lives. The vicious cycle of "the winner takes it all" cannot be stopped, and they monopolise all sectors and reap the fruits. Meituan's big data strategy works like that, and so does Tmall's "choose one out of two" strategy.

And that leaves society with no choice but to act.

A global fight against monopolisation

So are monopolistic companies like Alibaba common throughout the world?

The answer is: of course.

In October 2019, the US House Judiciary Committee released a report on new technology titans after a 16-month investigation, concluding that the "big four" - Amazon, Apple, Facebook, and Google - "companies that once were scrappy, underdog startups that challenged the status quo have become the kinds of monopolies we last saw in the era of oil barons and railroad tycoons."

Take Amazon for example. Over the past 20 years, Amazon has bought up at least 100 companies, from direct competitors Zappos and Quidsi, to China startup Blink, which deals in smart home security systems. Through big data storage, Amazon ensures its monopolistic position. Worse, Amazon keeps strengthening its advantage by threatening third party sellers on its platform, imposing mandatory arbitration, raising costs for sellers, claiming data from third party sellers, and tying its own advertisements into packages.

Under monopolistic pressure from internet titans, various sectors in the US are having to swallow "bad fruit" as never before. According to the report, there has been a sharp decline in new business formation as well as early-stage startup funding in recent decades. "The rates of entrepreneurship and job creation have also declined over this period. The entrepreneurship rate - defined as the 'share of startups and young firms' in the industry as a whole - fell from 60% in 1982 to a low of 38% as of 2011."

Looking at Europe too, the fight against monopolisation continues. Take fines for example. In 2016 alone, the European Commission levelled nearly 4 billion euros in fines on allegedly monopolistic companies. (NB: Between 2013 and 2017, the Commission doled out 8.472 billion euros (US$9.54 billion) worth of fines for breaking competition rules. The Commission has also imposed massive fines on Google in three separate competition cases, which are under appeal.)

The EU has also taken frequent action in regulatory measures. For example, in 2018, the EU released the General Data Protection Regulation, imposing heavy fines on Apple, Facebook, and Google for data monopoly and tax evasion. On 15 December 2020, the EU announced two draft laws on digital services and the digital market, with the aim of regulating the tech titans in Silicon Valley.

...when so-called high-tech companies grow to such a scale, they totally lose the ability to self-correct and self-regulate.

Interestingly, in 2015, US company Qualcomm was fined 6 billion RMB by China's National Development and Reform Commission for monopolistic practices, which was 8% of its income in China in 2013.

Given that Alibaba's fine was 4% of its income, the state went easy on it.

Tight global regulation, investigations, and penalties all show one simple fact: when so-called high-tech companies grow to such a scale, they totally lose the ability to self-correct and self-regulate. In December 2020, the New York Times (NYT) invited lawmakers and experts in technology and policy to a discussion on tech giants, concluding that the "era of self-regulation is over and congressional action is required".

Worse, abetted by technology, the monopolistic practices of tech giants worldwide have damaged sector ecosystems far more than in the past. One former Google employee said at the NYT session: "Having looked back at antitrust issues from 100 years ago versus now, one major change is that what used to be above the surface now looks like an iceberg, where most of what consumers and most businesspeople see is above the waterline. And what's dramatically changed with data is that icebergs are 10% above the water and 90% below the water. With AI and the systems around data, the lock-in on some of these systems is very much below the waterline."

One might say that under the fourth industrial revolution, there is now a global war on monopoly, and the conflict between internet tech giants and various governments is escalating.

From this perspective, China's tight, firm regulatory actions based on the principles of strengthening anti-monopoly efforts and preventing disorderly expansion of capital is not just a timely correction of unhealthy competition in China including "choose one out of two", recommendations based on algorithms, artificial intelligence, and big data, but also a larger global trend.

And this is not just a simple "lesson" for Alibaba.

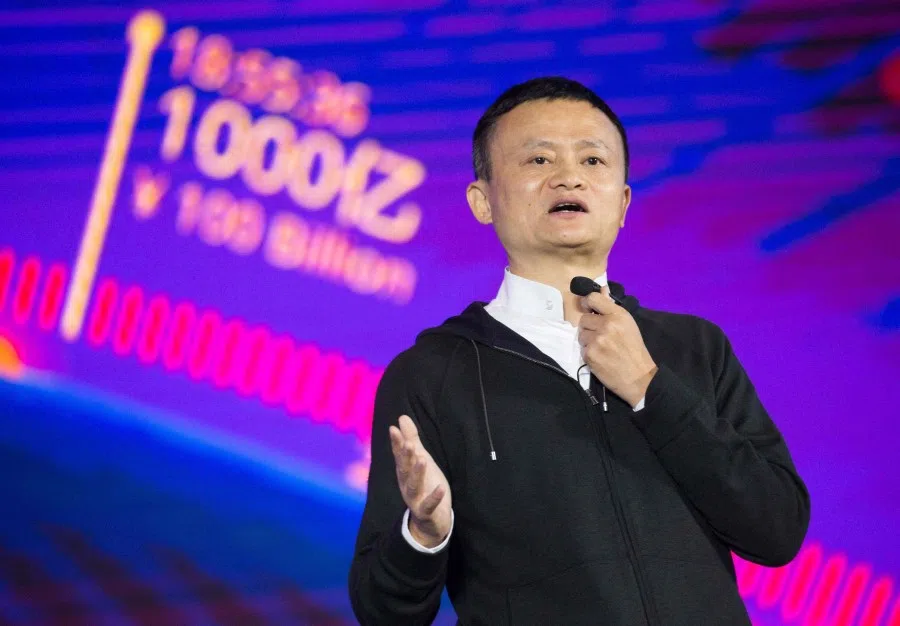

Alibaba still has a chance at embracing greatness and becoming a company that will really last for "102 years", as Jack Ma has said.

Remember the three textbook lines

And now, the last question: what message will the Alibaba debacle send to China's internet titans, and even its entire business community?

The first line to remember is from political textbooks: learn from past mistakes to avoid future ones, and treat the ailment to cure the patient.

On 10 April, after the result of the Alibaba case was announced, People's Daily ran a commentary: "This does not mean writing off the important role the platform economy plays in general economic development, or that China's support for the platform economy has changed, but it wants to balance development and regulation and get a grasp of the growth of the platform economy, to build a sound management framework for the platform economy and drive the healthy and sustained development of a regulated platform economy."

For Alibaba, this ordeal is a warning, but it can still look to the future. As long as it makes immediate and thorough corrections and resolves its own problems, and lets go of its longstanding pride and prejudice, Alibaba still has a chance at embracing greatness and becoming a company that will really last for "102 years", as Jack Ma has said.

The second line is from Communist Party history textbooks: do not be greedy or you are sure to get caught.

The fact is, in recent years, many Chinese internet giants that boast of innovative technology have more or less been somewhat "errant". On the one hand, they have expanded with abandon in the end user domain. They are untiring in their efforts in retail, healthcare, consumer finance, internet credit, internet payments, transport, housing, media, travel, logistics - any sector that earns quick money, allows "storytelling", and where financial games are played, from which they have earned handsome profits. On the other hand, these giants get listed for cash in the name of new concepts such as big data and cloud computing, or use these to pry into people's privacy. They use big data to take advantage of regular customers and squeeze platform vendors, and use that monopoly to gain unfair competitive benefits.

China's internet giants have always lacked core innovation, and have had little interest in truly disruptive technological innovations which involve a lot of investment in time and effort.

One might say that their gaze is always fixed on people's wallets. In sharp contrast, China's internet giants have always lacked core innovation, and have had little interest in truly disruptive technological innovations which involve a lot of investment in time and effort.

But now, such abnormal lateral expansion is hard to sustain. Figures show that since 2016, there has been a bottleneck in growth of the mobile internet. There have been views that China's internet growth is highly dependent on its large population bonuses, but now that these bonuses are gone they have to start from scratch, and after their profits slipped they have no qualms about testing the limits of the business sector and society.

If even now these giants do not turn back, what is happening to Alibaba now will happen to them in the future.

The third line is from general history textbooks: carry out reform like Shang Yang of the Qin dynasty, focusing on agriculture and reining in commerce.

Self-regulation a myth

The fact is, after a thousand years of focusing on agriculture and reining in commerce, the heart of the matter is to protect productive projects and hit non-productive sectors.

In this land of the old and the new, if companies want to distance themselves from the rabble, they need to learn their lessons. But the ultimate aim of business competition is a monopoly to maximise benefits; this is inevitable as businesses grow to a certain size and poses a dilemma for the long-term development and expansion of businesses. And one of the biggest traps of the free economy is thinking that the economy can self-correct, and commerce can grow healthily with no need for external forces or political forces to make adjustments.

But after several economic disasters, especially the pandemic of 2020, people would realise that it is capitalist nonsense that the business sector can self-correct and grow healthily without external intervention. Former Prime Minister of Singapore Lee Kuan Yew once astutely said of Hong Kong magnate Li Ka-shing:

"Is Li Ka-shing making a product that is selling worldwide? No, he's just acquiring real estate, ports, retail stores and telecoms companies." The implication is that Li was not doing much for the real economic development of Hong Kong.

Ma has finally learned to keep quiet.

Hence, as the Alibaba incident draws to a close, the deeper impact on China is this: the business model of gaining enormous profits through monopolies and alliances and squeezing people's room for survival through abnormal expansion will not work in China.

As for Jack Ma, after the harsh criticism he has faced over the past six months, he must have had some deep thoughts about life. Ernest Hemingway once said: "It takes two years to learn to speak and sixty to learn to keep quiet."

Ma has finally learned to keep quiet.

Related: Is Alibaba doomed? [Part I] | Is Alibaba leaving its carefree days behind? | Alibaba probe: China's challenges in dealing with monopolies start with the state-owned enterprises | Blacklisted and fined: The end of Chinese tech companies' heyday? | Lesson for Jack Ma's Ant: Finance is finance and technology is technology

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)