When Washington tests the Fed, it tests the dollar

In the face of US President Trump’s attacks on the Federal Reserve and its chair, Jerome Powell, major central bankers around the world showed their solidarity. This is out of their own interest to see the dollar-centric system preserved and a warning not to engage in self-sabotage. Academic Hao Nan explains.

Apart from geopolitical clamours in Venezuela, Iran, Yemen and Greenland, early January also delivered a striking anomaly in the normally staid world of central banking: a rare, coordinated statement from the heads of the European Central Bank, the Bank of England, the Bank of Canada and over a dozen other major monetary authorities, expressing “full solidarity” with the Federal Reserve and its chair, Jerome Powell. They explicitly framed central bank independence as a “cornerstone” of global price and financial stability.

Such a diplomatic intervention is unprecedented. Central bankers do not lightly wade into another nation’s domestic political fray unless they perceive a direct and imminent threat to their own stability. This was not merely a gesture of professional courtesy for Jerome Powell. It was a stark, collective alarm bell — an attempt to safeguard the crumbling credibility of the very system that makes the US dollar the world’s paramount currency. The message was clear: the weaponisation of legal process against the Fed chair and hence the independence of the institution, is an attack on a cornerstone of the dollar-centric system.

This assault on independence strikes directly at the foundation of dollar dominance. The Fed’s political insulation is not an academic virtue; it is a critical “commitment device”.

Fed’s operational independence turned into political variable

The Trump administration’s threat of criminal indictment against Powell, facilitated by a Justice Department grand jury subpoena, represents a profound institutional escalation. The formal pretext, as reported, involves Powell’s 2025 congressional testimony concerning cost overruns in a multi-billion-dollar Fed headquarters renovation. Yet Powell himself has bluntly characterised the legal threat as a “pretext”, alleging its true purpose is to exert pressure over interest-rate decisions.

The global central bankers’ statement, urging the preservation of independence “with full respect for the rule of law”, subtly underscores this dangerous subtext. Regardless of the investigation’s legal merits, its timing and chosen instrument — the spectre of criminal charges — shatter a core taboo. It conflates prosecutorial power with monetary policy influence, transforming the Fed’s operational independence from a bedrock institutional fact into a contested political variable.

This assault on independence strikes directly at the foundation of dollar dominance. The Fed’s political insulation is not an academic virtue; it is a critical “commitment device”. It allows the central bank to credibly prioritise long-term price stability over short-term political stimulus, anchoring inflation expectations for households, firms and global bond markets.

This credibility confers a priceless “institutional premium” on dollar assets. When markets trust the Fed’s autonomy, the term premium embedded in US Treasury yields — the extra compensation investors demand for long-term risk — remains contained. Erode that trust, and investors will demand a higher price for “regime uncertainty”, pushing up funding costs for America and for the world.

A frantic attempt to preserve stability

The dollar’s supremacy rests not just on its share of reserve portfolios, but on its role as the indispensable substrate of global finance — the currency of trade invoicing, bank funding and derivative collateral. If the Fed’s reaction function appears politically malleable, the cost and volatility of dollar liquidity everywhere will rise. The foreign central bankers’ intervention is, in essence, a desperate bid to protect the stability of this global pricing kernel, upon which their own financial and economic security depends.

From their perspective, Washington is voluntarily degrading the institutional quality that has long justified the dollar’s exorbitant privilege.

Their mobilisation is an act of profound self-interest, not sentimentality. Their institutions sit atop trillions in dollar-denominated reserves, and their domestic banking systems rely on predictable access to dollar liquidity, especially through Fed swap lines in a crisis. They are simultaneously watching other pillars of the dollar system strain.

US fiscal trajectories point toward structurally higher deficits and debt, while official reports have flagged worrying episodes of fragility in the US Treasury market — the deepest pool of “safe assets” on earth. Now, they see the guardian of that market’s credibility being legally threatened. From their perspective, Washington is voluntarily degrading the institutional quality that has long justified the dollar’s exorbitant privilege.

Dangerous game: money used as lever for near-term political gains

This episode does not exist in a vacuum. It amplifies a meta-signal that core economic institutions are becoming fair game for political pressure. Consider the parallel push to one-year cap credit card rates at 10%, called for by President Trump himself, a popular but economically disruptive idea. Independently, its impact is limited. In concert with an attack on Fed independence, it paints a pattern where price-setting mechanisms — for credit, for money itself — are viewed as levers for near-term political gain, an appeaser to US voters for mitigating inflation and increasing the affordability of consumer goods.

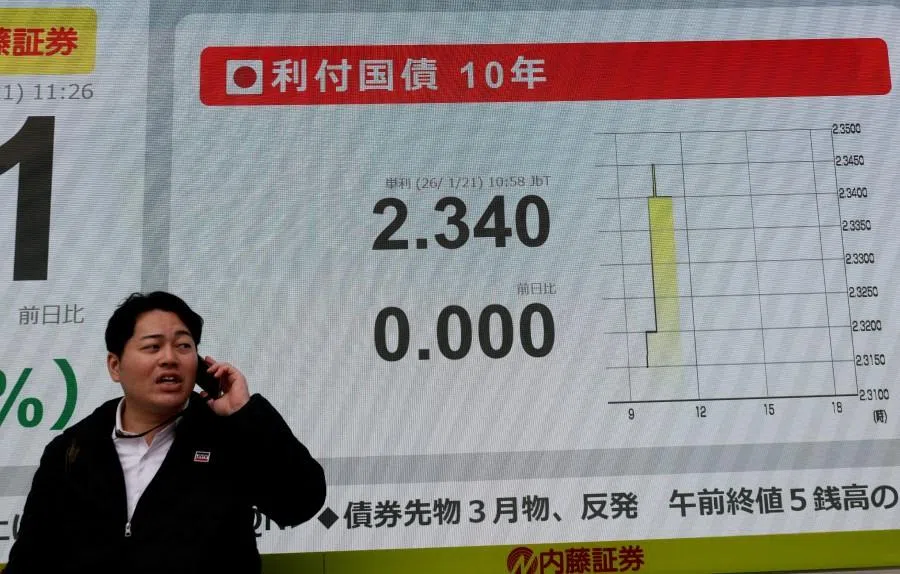

Meanwhile, other forces are actively rewriting the dollar’s operating environment. In Japan, the Bank of Japan’s exit from negative interest rates is recalibrating the vast yen carry trade — where cheap yen funds higher-yielding dollar investments — a fundamental source of global dollar funding. With Japan’s fiscal and economic policy under Prime Minister Sanae Takaichi and her anticipated further ramped-up approach after her likely return to office in February, this alters the price and volatility of dollar liquidity in international markets.

In China, strategic moves are creating functional alternatives. The rapid development of the mBridge platform for cross-border digital currency settlements, which has already processed tens of billions in transactions, offers a parallel pipeline that can bypass traditional dollar-clearing channels for trade. Concurrently, a global central bank rush into gold — accelerated by large-scale discoveries and infrastructure build-out in Shanghai and Hong Kong — reflects a deliberate hedging against sovereign credit risk, including that of the US. These are not theoretical threats but tangible, accelerating workarounds.

The united front of global central bankers was a plea from within the fortress walls, a warning that setting fire to the institutional sprinkler system is an act of self-sabotage.

Dollar hegemony undergoing stress test

The critical question is what constitutes a point of no return. The dollar’s network effects are immensely durable, and no single alternative is poised to supplant it. A true paradigm shift would require crossing specific thresholds: an actual indictment of the Fed chair on policy-related grounds; a legal precedent that dismantles the “for cause” protection for Fed governors; or a clear, data-defying policy shift by the Fed perceived as a political capitulation. The world can accommodate an indebted America; it struggles with an America that actively politicises the referees of its own economic system.

Thus, we are witnessing a significant moment for dollar hegemony, though not its melodramatic collapse. The system is undergoing a severe stress test, transitioning from a default, unchallenged order to one that must be actively and credibly maintained. The united front of global central bankers was a plea from within the fortress walls, a warning that setting fire to the institutional sprinkler system is an act of self-sabotage. The likely outcome is not the dollar’s abdication, but the emergence of a costlier, more fragile, and contested version of its dominance — a privilege whose premium is now being painfully repriced by a wary world.