Will Europe pour more money into China?

This year's dramatic geopolitical changes have significantly altered the calculus for foreign investment in China as large European enterprises are increasingly taking the lead and Japanese businesses are retreating in manufacturing and advancing in services. American companies, on the other hand, are frozen as the US government imposes tough sanctions on China's tech sector and as manufacturers weigh strategic moves back to the US.

(By Caixin journalists Luo Guoping, Yu Cong, Zhang Erchi, Yang Jinxi, Guo Jiying, Shen Xinyue and Denise Jia)

The visit to China this month by a dozen leaders of blue-chip German companies provided an opportunity to take the pulse of foreign investor confidence in the country amid the war in Eastern Europe, the pandemic, rising inflation and recession fears.

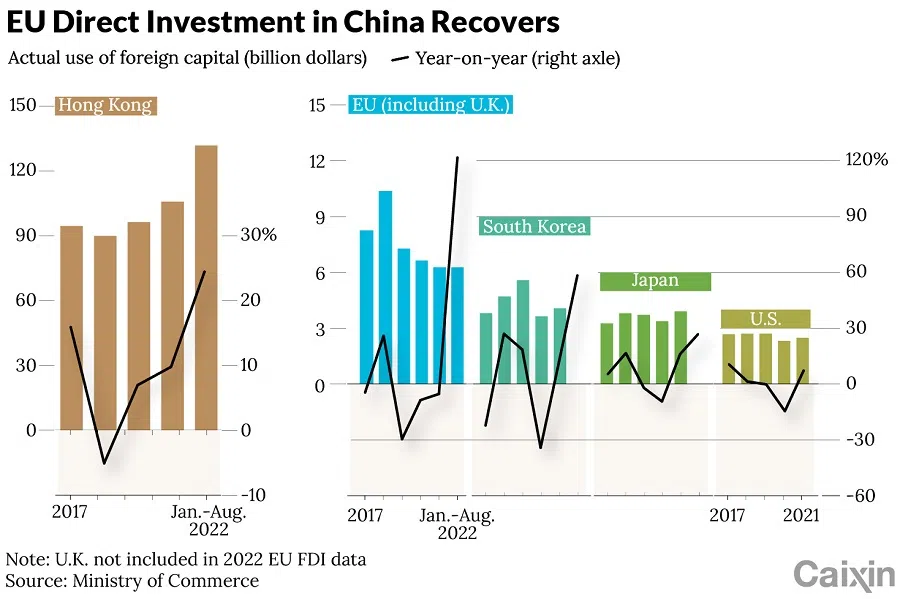

As German Chancellor Olaf Scholz led a delegation including the businesspeople, European Union (EU) investment in China had fallen for three consecutive years from US$10.4 billion in 2018 to US$6.3 billion in 2021. But in the first eight months of this year, EU investment more than doubled from a year earlier.

This year's dramatic geopolitical changes have significantly altered the calculus for foreign investment in China. Large European enterprises are increasingly taking the lead. Japanese businesses are retreating in manufacturing and advancing in services. And American companies are frozen as the US government imposes tough sanctions on China's tech sector and as manufacturers weigh strategic moves back to the US.

The top ten European investors in China in each of the past four years accounted for nearly 80% of total European direct investment in the country. - Report by Rhodium Group

Dominated by large players

The German delegation included CEOs or representatives of auto giants Volkswagen and BMW; industrial conglomerate Siemens; chemical powerhouses BASF and Wacker Chemie; Deutsche Bank; drugmakers Merck KGaA, Bayer and BioNTech; green heating systems maker GeoclimaDesign; organic baby food producer Hipp; and sportwear maker Adidas.

Most of them are large German enterprises committed to expanding their business in China, said Joerg Wuttke, president of the EU Chamber of Commerce in China, a lobbying group representing more than 1,700 European companies.

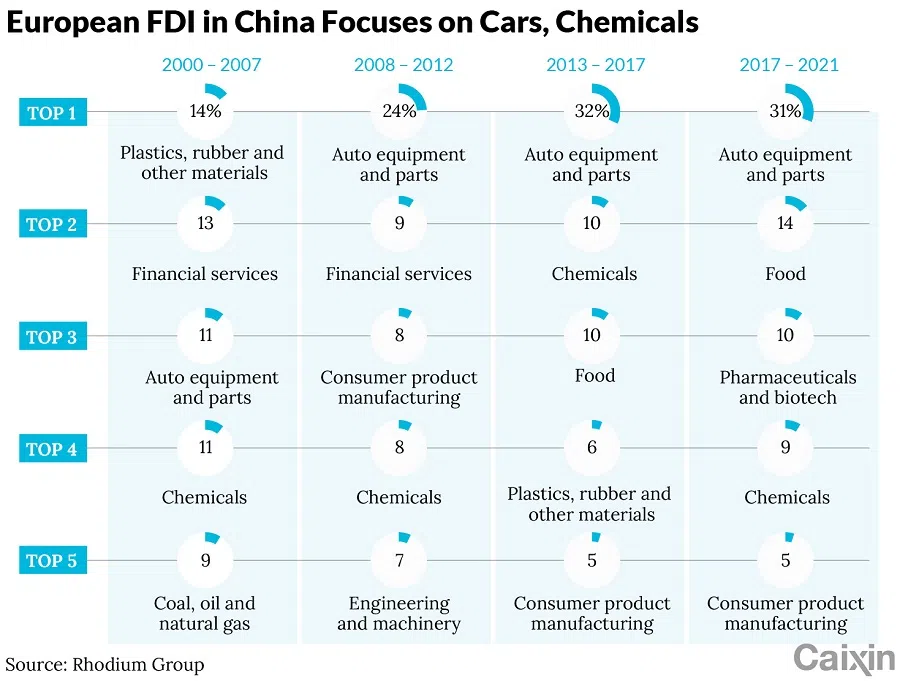

A report by research firm Rhodium Group in September found that European investment became much more concentrated in a handful of large companies. The top ten European investors in China in each of the past four years accounted for nearly 80% of total European direct investment in the country. Among them, Volkswagen, BMW, Daimler and BASF contributed 34% of all European foreign direct investment in China by value from 2018 to 2021.

BASF divulged a plan this year to invest as much as 10 billion euros (US$9.95 billion) in a giant complex in Zhanjiang in southern China's Guangdong province to produce engineering plastic compounds for the automotive and electronics industries. In March, the chemical giant also signed a 25-year supply agreement with China's state-owned State Power Investment Corp. to provide renewable electricity to the Zhanjiang project.

"The Chinese renewable energy market is developing very rapidly and offers us attractive opportunities to accelerate our transformation," BASF director Markus Kamieth said.

BASF is reducing its energy-intensive production of ammonia in Europe and sourcing it from the global market instead, the company told Caixin. In the first three quarters this year, BASF's chemical production in Europe declined while output in China and North America rose.

European manufacturers' profits have long relied on Russia's low-cost oil and gas. The sudden energy decoupling from Russia as result of the attack on Ukraine is putting extreme pressure on energy-intensive European companies' costs and price competitiveness.

Other multinational companies have begun to expand investment in China capacity after running into production problems in Europe.

Since Russia invaded Ukraine, some European investments began shifting to the US and China, which have energy or market advantages, said Wu Yabin, head of the United Nations Industrial Development Organization Investment and Technology Promotion Office in Beijing.

BMW was one of the first Western automakers to benefit from the relaxation of China's foreign ownership rules. In February, Chinese authorities gave BMW permission to raise its stake in its venture with Brilliance China Automotive Holdings Ltd. to 75% from 50%. BMW said taking control of the joint venture would bolster its annual earnings by as much as 8 billion euros.

"China's role as the global leader in vehicle electrification and intelligent transportation magnifies its prominence for foreign investment." - Yang Jing, Director of China Corporate Research, Fitch Ratings

Volkswagen said last month that it would invest 2.4 billion euros to set up an autonomous driving joint venture with China's Horizon Robotics Inc., strengthening VW's tech presence in its biggest market.

Mercedes-Benz Group AG set up a research and development center in Shanghai earlier this year to focus on developing technologies related to connectivity, intelligent driving and big data.

Increased investment by foreign automakers reflects China's importance as the world's largest auto market, said Yang Jing, director of China Corporate Research at Fitch Ratings. China's role as the global leader in vehicle electrification and intelligent transportation magnifies its prominence for foreign investment, she said.

Retreating in retail

Not all sectors in China are embracing foreign investment. The retail sector faces the biggest challenges. Foreign retailers in China rely heavily on Chinese supply chains and local retail partners. Decisions by foreign retailers on whether to expand or exit the market can set off chain reactions through local production supply chains.

Ito-Yokado, one of the largest supermarket chains in Japan, said last month it would close its landmark store on Chunxi Road, a popular pedestrian shopping street in Chengdu, the capital city of Sichuan province, by the end of the year. The Chunxi Road store was the first store the Japanese retailer opened in China 25 years ago. The news raised speculation about more foreign retailers leaving China.

Last week, iconic American clothing retailer Gap Inc. sold its business in Greater China to Chinese e-commerce services provider Baozun Inc. for as much as $50 million after closing stores in the country in recent years.

Before the sale, Gap moved its supply chain from China to Southeast Asia because of rising labour costs. In fiscal 2021, 33% of Gap's merchandise was made in Vietnam and 16% in Indonesia, compared with 31% from China in 2009.

French retailer Carrefour, once China's largest foreign retail chain, sold an 80% controlling interest in its China unit to Chinese electronics appliance retailer Suning.com in 2019 after struggling for years with sinking sales and increased competition.

Speculation that American retail giant Walmart is seeking a buyer for its China business has been circulating since 2021. As a key supporter of the US strategy of bringing home manufacturing jobs, Walmart in July 2021 launched its "American Lighthouses" initiative, aiming to provide tools and resources for businesses to invest in US production and supply chains.

Since the outbreak of the pandemic in early 2020, virtually no new European businesses have made direct investments in the country. - Report by Rhodium Group

Absence of smaller businesses

Europe's small and medium-sized companies have not made much new investment in China in the past few years.

Since the outbreak of the pandemic in early 2020, virtually no new European businesses have made direct investments in the country, according to the Rhodium Group report. Conversations with stakeholders suggest that a longer-term dynamic may be at work, with smaller European companies reluctant to accept the growing risks of investing in China, Rhodium Group said.

Small and medium-sized companies are relatively weak for taking on global risk, Wuttke said. In addition, foreign executives have been unable to visit China amid strict Covid-19 control measures, making it more difficult to decide on making a new entry to China or to expand investment there, he said.

Frenchman Christian Weibel is the general manager at Eltek Electromechanical Products (Yantai) Co. Ltd., an auto parts maker in Yantai, a port city in eastern China's Shandong province. The company, which is wholly owned by Italian company Eltek S.P.A., has fewer than 200 full-time employees, a typical small foreign-owned company.

Weibel said the biggest problem he faces is personnel exchange. Eltek's senior executives haven't set foot in China for three years, he said.

In recent years, China's increasingly strict environmental controls on manufacturing have raised the entry threshold and production costs in China.

American investors' recent activities in China also show similar concentration in large players.

"Most recent investments have been made by large companies, with little activities by [smaller businesses], which used to be very active contributors," American Chamber of Commerce (AmCham China) president Michael Hart told Caixin.

Smaller enterprises have less in cash reserves, making them more sensitive to market downswings or supply chain disruptions, Hart said. Few new small operations have joined the chamber in recent years, he said.

China no longer welcomes foreign investment regardless of environmental costs as it did in the early days of opening up. In recent years, China's increasingly strict environmental controls on manufacturing have raised the entry threshold and production costs in China.

A May survey by AmCham China showed that 52% of respondents either delayed or decreased investments in China. A June survey found that 14% of respondents said foreign staff was refusing to relocate to China or making plans to permanently exit the country because of the effects of pandemic-related restrictions.

Many current investments were planned years ago and were put in place before the pandemic, so the consequences of putting plans on hold over the past three years will probably be felt in years to come, AmCham China's Hart said.

European businesses in China are reevaluating their plans after the country's Covid-19 controls further isolated China, the European chamber's Wuttke said.

"While there is still 'a select group of high-profile multinational companies ready to make billion-dollar splashes', the trend of declining [foreign direct investment] is unlikely to reverse while European executives are heavily restricted from traveling to and from China to develop potential greenfield projects," according to a report by the European chamber in September.

China recently told local governments to facilitate access for international businesspeople to enter the country in a bid to stabilise foreign investment, especially in manufacturing. The move is part of measures in a document issued on 25 October by six central government agencies including the National Development and Reform Commission.

Localities should make good and full use of the "fast track" - which China has been establishing with some countries since 2020 to facilitate essential business and official travel - and further clarify standards and procedures based on local conditions to make it more convenient for overseas personnel to enter China, according to the document.

Lu Yutong contributed to this report.

This article was first published by Caixin Global as "Cover Story: Will Europe Pour More Money Into China?". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)