[Big read] Global fight for lithium battery raw materials heats up

Amid the global electric vehicle (EV) race, European countries and the US are doubling down on their efforts and investment towards building an even more localised vertically integrated battery supply chain. This comes amid China dominance over the global lithium-ion battery supply chain. As the race for raw materials continues, Southeast Asian countries such as Indonesia and Singapore can play an increasingly significant role. Lianhe Zaobao business correspondent Lai Oi Lai speaks with experts and business insiders to find out more.

As the owner of a nickel mine in Indonesia, Mr Chen has been paying close attention to Tesla CEO Elon Musk's moves over the past year. This is because whether Chen can restart his mine, which has been closed for nearly a decade, will depend on what the electric car giant does next.

Indonesia's nickel industry on edge

During an interview with Bloomberg in October, Indonesian President Joko Widodo said that the Indonesian government was still in talks with Tesla about the latter's investment in manufacturing materials for lithium-ion batteries in Indonesia.

According to Indonesia's Coordinating Minister of Maritime and Investment Affairs Luhut Pandjaitan, the investment has not come to fruition because Musk is concerned about the global economic outlook and oversupply in the electric vehicle (EV) industry.

However, Chen remains hopeful. He told Lianhe Zaobao, "Many Chinese businesses are watching the situation closely. As soon as demand for EVs further increases, we will restart mining activities."

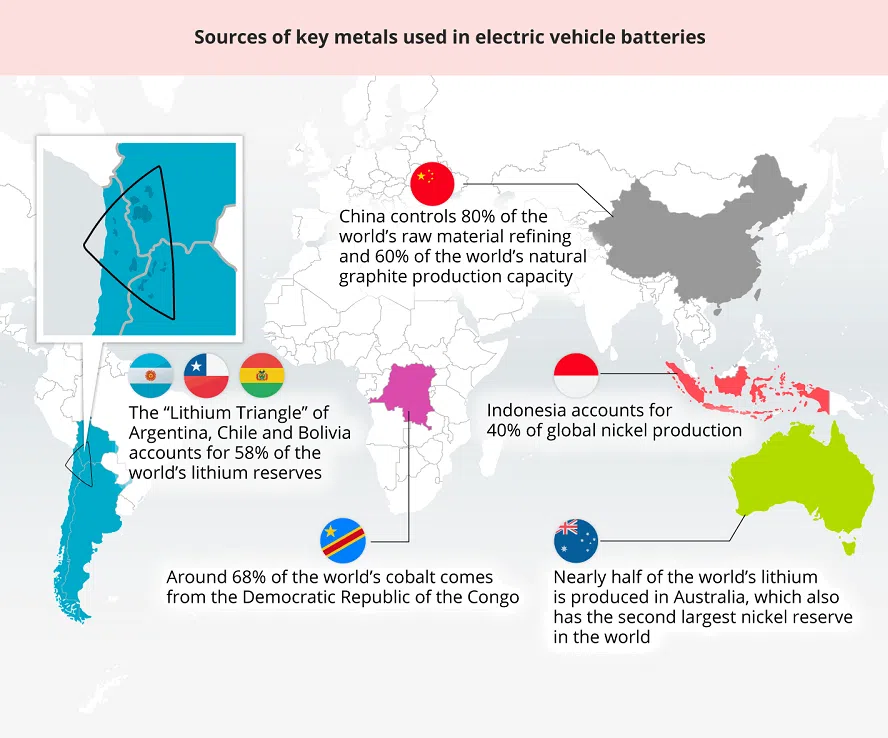

According to an International Energy Agency report, Indonesia accounts for 40% of global nickel production. However, this resource is currently hardly used in EV batteries because the country produces nickel laterite, a type of nickel ore deposit that requires additional, extremely energy-intensive processes before it can be used to make lithium-ion batteries.

"... we saw business opportunities in batteries. Hearing that Musk was going to invest in Indonesia, some mine owners who have long been dormant became active again." - Mr Chen, a nickel mine owner in Indonesia

Chen has mining rights over a nickel mine in the eastern part of Sulawesi. He secured a mining licence after the Indonesian government opened up the industry to private enterprises in 2000.

He pointed out that the Indonesian government implemented a new act in 2009 that prohibited the export of raw ore, meaning that the nickel ore could only be exported after they were processed locally.

Hindered by early infrastructure such as insufficient electricity supply, coupled with outdated technology prone to environmental pollution, few companies could offer processing services, leading to the closure of Chen's mine in 2014.

The market has since undergone massive changes. Chen said, "In the early days, the nickel we mined was mainly used to produce stainless steel. Following the development of EVs later on, we saw business opportunities in batteries. Hearing that Musk was going to invest in Indonesia, some mine owners who have long been dormant became active again."

Not enough raw materials, soaring battery costs

Nickel, lithium and cobalt are the three main metals used in lithium-ion batteries. Their main producing regions are dispersed all over the world, in particular in emerging and frontier markets.

Koketso Tsoai, automobiles analyst at Fitch Group's BMI research firm, told Lianhe Zaobao, "A sudden reduction in the supply of battery raw materials would push up their prices, and negatively impact battery prices and EV adoption."

Last March, the battery supply chain was affected by the Russia-Ukraine war, causing nickel prices to soar. Amid a short squeeze at one point, the London Metal Exchange (LME) was forced to suspend the trading of nickel after prices soared 250%, reaching US$100,000 a tonne.

Before that, China's Tsingshan Holding Group, the world's largest nickel producer that has also ventured into EV battery raw materials production in recent years, had built a short position, betting that nickel prices would fall. This attracted the attention of global investment companies, which took advantage of the intense Russia-Ukraine war, the low level of nickel inventories and its volatile prices to further push up nickel prices.

Tsingshan's obligation to pay brokers and the LME for margin calls mounted, resulting in a short squeeze. According to Tsingshan's peers, they "felt like small animals watching an elephant being torn apart by the bloodthirsty".

Due to slowing EV sales, nickel prices have now fallen to around US$17,000 a tonne.

... mainland China is by far a leader in the global EV supply chain, dominating EV production, battery manufacturing, and the materials-refining sector to dominate a large chunk of the EV supply chain. - Koketso Tsoai, automobiles analyst, Fitch Group's BMI research firm

Impact on Japanese pharmaceuticals and ceramics

Compared with nickel, lithium is even more irreplaceable as a key raw material. Although lithium prices have fallen by 70% this year, countries have been scrambling to mine lithium to snatch up a piece of the EV pie in recent years, affecting the production of other products needing that raw material.

It was reported that by March 2025 Japanese drugmaker Mitsubishi Tanabe Pharma plans to stop producing lithium carbonate tablets, which is used for treating bipolar disorder, due to the risk of future shortages and price hikes for lithium.

Japanese casserole pot makers are also affected by the shortage of raw materials. The governor of Mie prefecture recently received a letter claiming that Zimbabwe's Bikita lithium mine, an important producer of petalite, will no longer accept orders from Japanese ceramic makers as the mine shifts its supplies to lithium-ion battery manufacturers. The mine was acquired by China's Sinomine Resource Group last year.

Petalite is added to ceramic raw materials to make the ware more heat resistant. The highly heat-resistant "banko ware", produced in Mie prefecture's Yokkaichi, currently accounts for 80% of the Japanese market for domestic donabe pots.

China dominates global lithium-ion battery supply chain

Sinomine Resource Group's acquisition of the Bikita lithium mine is just one of many projects. It was reported that Chinese firms have spent more than US$1 billion over the past two years to acquire and develop lithium projects in Zimbabwe.

Although slowing EV sales have softened raw material prices, Australia and New Zealand Banking Group Limited (ANZ) senior commodity strategist Daniel Hynes and ANZ commodity strategist Soni Kumari remain optimistic about the long-term prospects for nickel, lithium and cobalt. "Supply still needs to increase by 1.5 to 3.5 times over the next five years, which is not an easy goal to achieve," they noted.

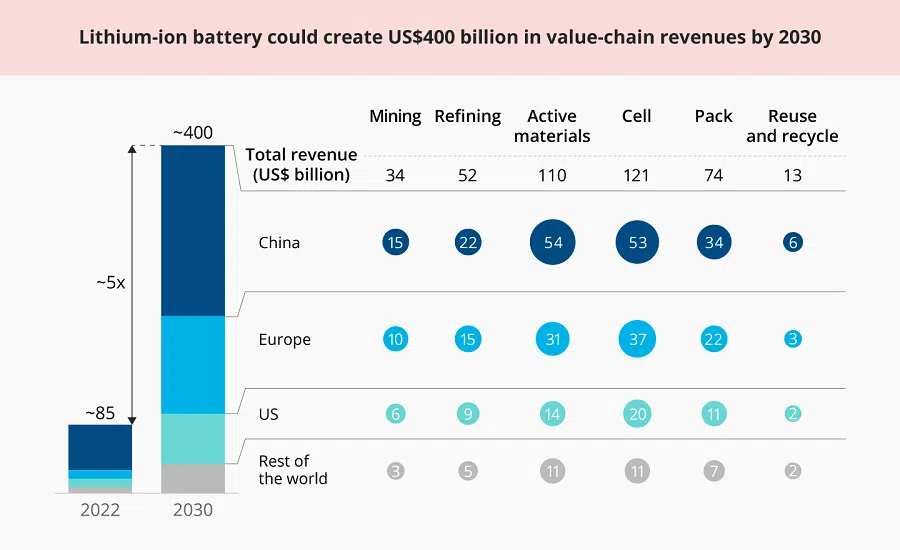

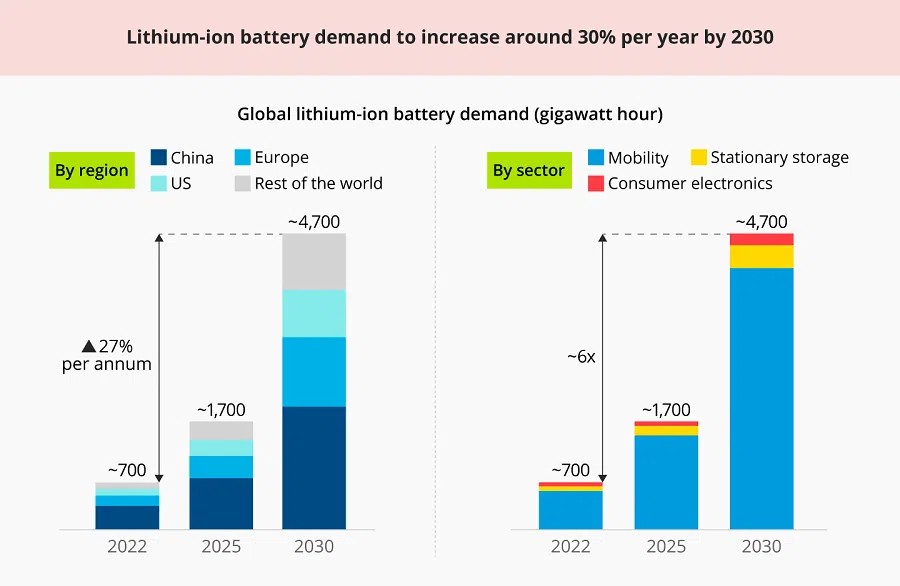

The Global Battery Alliance (GBA) predicts that the entire lithium-ion battery chain - from mining to refining, battery pack assembly and recycling - could grow by over 30% annually from 2022 to 2030, when it would reach a value of more than US$400 billion and a market size of 4.7 terawatt-hours.

Taking a look at the entire industrial chain, Tsoai pointed out that mainland China is by far a leader in the global EV supply chain, dominating EV production, battery manufacturing, and the materials-refining sector to dominate a large chunk of the EV supply chain. He added, "Chinese mining companies have secured raw materials from countries that are well endowed in critical minerals such as cobalt from the Democratic Republic of the Congo, nickel from Indonesia and lithium in Argentina."

China is also firmly in control of the production and export of the anode material graphite for batteries, accounting for more than 65% of global production.

China could account for 45% and 40% of total lithium-ion demand in 2025 and 2030 respectively. Nevertheless, growth is expected to be highest globally in the EU and the US...

Export restrictions to counter EU and US

From December onwards, China will place restrictions on the export of graphite. Analysis believes that this is a countermeasure against the EU, which slapped an anti-subsidy probe on Chinese EVs, as well as the US, which expanded its chip sanctions.

Tsoai also highlighted China's dominance in battery technology, as the country now accounts for more than half of all battery patents.

According to Tsoai, China's Contemporary Amperex Technology (CATL) is the most noteworthy battery manufacturer, as it is the largest battery manufacturer globally with long-term supply agreements in place across various carmakers, which easily makes the company the largest player in the global EV supply chain.

He added, "The firm managed to overtake Panasonic by securing vast swathes of materials that go into batteries and a very large battery manufacturing capacity thanks to generous incentives and a favourable regulatory environment."

Some reports say that compared with similar products from the US and Europe, China-made batteries have a cost advantage of up to 30%.

The GBA estimates that between now and 2030, at least 120 to 150 new battery factories will need to be built globally in order to meet market demand.

China could account for 45% and 40% of total lithium-ion demand in 2025 and 2030 respectively. Nevertheless, growth is expected to be highest globally in the EU and the US, driven by recent regulatory changes, as well as a general trend towards localisation of supply chains.

Countries compete to develop local supply chain

The Boston Consulting Group pointed out that the Inflation Reduction Act (IRA) passed by the US last year is highlighting a global trend in the battery industry, with countries competing to build a more localised vertically integrated supply chain.

The Act, which amounts to US$500 billion in expenditure, would provide up to US$7,500 in tax credit for the purchase of EVs produced in the US, Canada or Mexico. However, this tax break comes with strict conditions.

To qualify for half the maximum amount, the EV must utilise battery components assembled in North America. The other half requires the battery to use certain critical minerals sourced from countries that have free trade agreements with the US.

According to the regulations, from 2024, EVs using batteries manufactured or assembled by a foreign entity of concern would be disqualified from receiving the subsidy. From 2025, EVs with batteries that contain applicable critical minerals that were extracted, processed or recycled by a foreign entity of concern would be ineligible for subsidy. Foreign entities of concern refer mainly to businesses from China, Russia, Iran and North Korea that are owned by, controlled by, or subject to the jurisdiction or direction of the government.

The Biden administration announced in mid-August this year that companies have pledged more than US$110 billion in new clean-energy manufacturing investments since the IRA became law, including over US$70 billion in the EV supply chain.

For Europe, some renowned European car factories have also announced their investment projects for locally produced battery materials. One example would be Ionway, a US$2.9 billion joint venture (JV) between Germany's Volkswagen and Belgium's materials firm Umicore. The JV aims to hit an annual production capacity of 160 gigawatt hours per year, which would be enough to power 2.2 million EVs, by 2030.

Although it would take some time for Europe's and the US's efforts to bear fruit, it is a clear sign of their desire to reduce reliance on China's supply chain.

In this global contest, bounded by national territory and market size, Tsoai opined that Singapore will most likely play a somewhat limited role.

He said, "But, we see the region as having great potential as a whole and can allow each member state to contribute in their own ways. Some markets will dominate others as we expect Thailand to easily remain the largest [regional] player in the EV production sector."

Tsoai added that Indonesia will "contribute to the supply of battery-grade materials and battery cell production" and Malaysia will "play an important role in the semiconductor device assembly sector".

"Singapore is a major exporter of petroleum coke (ranked third largest exporter in the world), which is currently a potential feedstock for making anode materials in batteries, such as graphite." - Dr Chiam Sing Yang, Deputy Executive Director, A*STAR's Institute of Materials Research and Engineering

Potential opportunity for Singapore

Although Singapore's role may be limited, Dr Chiam Sing Yang, deputy executive director at Singapore technology research firm A*STAR's Institute of Materials Research and Engineering, opined that Singapore possessed certain advantages that should not be ignored.

Chiam told Lianhe Zaobao, "While Singapore does not have raw materials, we have a strong chemical sector. Singapore is a major exporter of petroleum coke (ranked third largest exporter in the world), which is currently a potential feedstock for making anode materials in batteries, such as graphite."

Extracting raw materials from recycling batteries is another potential opportunity. Chiam pointed out that once a battery reaches the end of its useful life, the battery pack can be collected, dismantled and shredded. The shredded material can be processed to produce "black mass", which consists of high amounts of lithium, manganese, cobalt and nickel metals. These materials can then be extracted from the black mass and reused in new battery production.

Chiam, who is concurrently the technical director of the Singapore Battery Consortium, said, "Singapore is considered an early mover in battery recycling in the ASEAN region, as we are the only country in ASEAN with ongoing minerals extraction from black mass."

Singapore battery recycling firm Se-cure Waste Management (SWM) is an example.

In an interview, SWM's general manager Wu Yao Kun said that six or seven years ago, he had already taken note of how many recyclable batteries were shipped to other places via Singapore. He said, "We can capitalise on this opportunity, extracting and recycling minerals from batteries here and sell it to countries who need it."

EVs are still a small part of the local market, and thus SWM recycles EV batteries from areas such as the US, Europe and the United Arab Emirates. Wu would not reveal specific locations but commented that SWM has set up factories with an eye on expansion in neighbouring countries, North America and Europe, to increase their capacity for battery recycling.

Besides SMW, Durapower, TES and startup NEU Battery Materials are Singapore companies that are invested in developing recycling techniques for lithium-ion batteries.

Currently, China is the leader in the global battery supply chain, while the rest of the world is working hard to catch up. It is worth paying attention to this race: would the rest of the world catch up, or could there even be a new leader rising to the fore?

This article was first published in Lianhe Zaobao as "各国争抢电池原料点燃贸易战火".