Slow burn: China’s 15th Five-Year Plan and the art of endurance

Amid global uncertainty, Beijing’s 15th Five-Year Plan doesn’t promise a new miracle — but mastery through control. With AI, clean tech, and quiet confidence, China’s path is less about catching up to the West than outlasting it. Economist Alicia García Herrero offers her read.

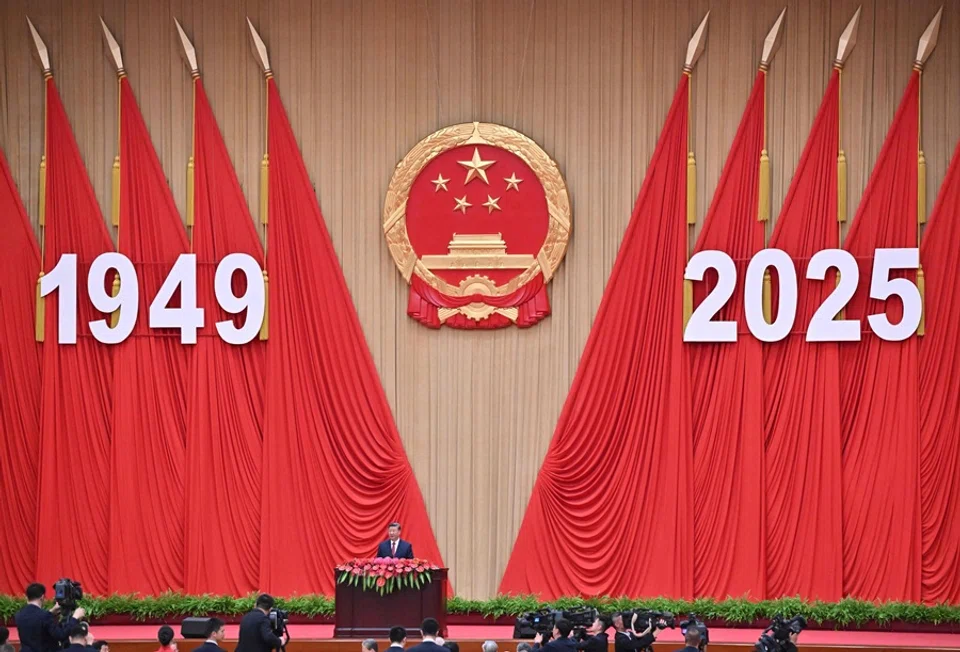

In the steady rhythm of China’s political calendar, the fourth plenary session of the 20th Central Committee has just concluded, a gathering that unfolded without the fanfare of seismic shifts or bold declarations. Instead, it embodied a deliberate continuity — a quiet involution of the nation’s core strategies.

For observers accustomed to the spectacle of Western policy pivots, this plenum serves as a reminder of Beijing’s preference for measured persistence over dramatic reinvention. At its heart lies a reaffirmation of state-orchestrated growth, an unyielding pursuit of technological independence, and a security apparatus so deeply embedded in economic planning that it feels less like an add-on and more like the very fabric of decision-making. This is not the stuff of headlines screaming “transformation”; it’s the architecture of endurance, designed to weather storms both domestic and global.

Factories humming with robotic precision, labs birthing gene-edited crops, and data centres powering predictive algorithms: this is the China that the plenum envisions...

Blueprint for the future

The concept of “high-quality development” remains the guiding star, a phrase that has echoed through Xi Jinping’s tenure like a mantra etched in policy stone. It prioritises not raw GDP expansion but a refined trajectory: sustainable, innovative, and resilient.

Central to this vision is the recurring spotlight on “new quality productive forces,” a term that captures Beijing’s ambition to leapfrog traditional industrial models through cutting-edge advancements. These forces — encompassing artificial intelligence, biotechnology, quantum computing, and next-generation manufacturing — represent a bold wager on human ingenuity amplified by state direction.

Factories humming with robotic precision, labs birthing gene-edited crops, and data centres powering predictive algorithms: this is the China that the plenum envisions, one where innovation isn’t left to market whims but steered by five-year blueprints and generous subsidies.

The perils of plenty

Yet, in doubling down on these new productive forces, China treads a familiar tightrope, one where enthusiasm for scale collides with the perils of excess. The push for rapid industrialisation in high-tech sectors has already birthed a shadow: overcapacity.

In electric vehicles, solar panels, and lithium batteries, production lines have outpaced demand, flooding domestic markets and spilling into global ones. Factories in Guangdong and Jiangsu churn out EVs at a clip that dwarfs consumer uptake, leading to warehouses brimming with unsold inventory and prices slashed to unsustainable lows. This isn’t mere efficiency; it’s a structural imbalance, where state-backed investments prioritise output metrics over profitability, creating a glut that ripples outward.

Globally, it manifests as “dumping”— cheap Chinese goods undercutting competitors from Detroit to Dortmund, sparking tariffs and trade wars. Domestically, the fallout is deflationary pressure: falling prices that erode corporate margins, discourage investment, and trap consumers in a cycle of delayed spending.

Beijing’s response? More coordination, perhaps, but the plenum’s silence on recalibrating these forces suggests the gamble continues, betting that sheer volume will eventually forge dominance...

As wages stagnate amid this supply surge, the very productivity gains meant to elevate living standards risk hollowing out the middle class, turning high-quality development into a phrase that rings hollow for the factory worker facing job insecurity or the small entrepreneur squeezed by behemoth competitors.

Beijing’s response? More coordination, perhaps, but the plenum’s silence on recalibrating these forces suggests the gamble continues, betting that sheer volume will eventually forge dominance — even if it means navigating a deflationary minefield in the interim.

Dual circulation: powering growth at home and abroad

Complementing this internal drive is the enduring “dual circulation” strategy, a framework that positions domestic demand as the primary engine while keeping international trade as a vital, if carefully calibrated, accelerator.

Imagine an economy no longer overly reliant on foreign appetites for its exports but fortified by a robust internal loop: urban consumers snapping up homegrown gadgets, rural revitalisation fueling local services, and e-commerce platforms knitting it all together. This isn’t isolationism; it’s strategic autonomy.

The plenum’s nod to dual circulation underscores Beijing’s intent to insulate against geopolitical headwinds — US chip bans, European carbon tariffs, or supply chain snarls from distant conflicts. Yet, the “dual” aspect is key: China has no plans to relinquish its export prowess. Ports in Shanghai and Shenzhen will continue to dispatch ships laden with semiconductors and machinery, leveraging the yuan’s stability and Belt and Road corridors to secure markets in Africa and Latin America.

Security, too, has ascended from a supporting role to the unyielding foundation of this economic edifice. No longer just coordinated with growth, it now permeates every layer, from the granular to the grand.

In practice, this means policies that boost household consumption — through expanded social safety nets or green urban upgrades — while preserving manufacturing’s competitive edge. It’s a balancing act, one that acknowledges the vulnerabilities of overdependence on the West without slamming the door shut. For Chinese households, it promises a more self-sustaining prosperity; for global partners, it offers predictability, albeit on terms where reciprocity is non-negotiable.

Security now underwrites prosperity

Security, too, has ascended from a supporting role to the unyielding foundation of this economic edifice. No longer just coordinated with growth, it now permeates every layer, from the granular to the grand.

Supply chains are fortified against disruptions, with “dual-use” technologies blurring lines between civilian innovation and military readiness. Data sovereignty tightens, mandating localised servers and algorithmic oversight to shield against cyber incursions. Food and energy security get equal billing, with vast investments in hybrid rice strains and offshore wind farms ensuring that no external embargo can starve the system.

This securitised lens views market efficiency as a luxury secondary to stability — a calculus where a reliable chip from a domestic fab trumps a cheaper import from Taiwan, even if it means short-term costs. In an era of US-China decoupling whispers and Indo-Pacific alliances, this approach isn’t paranoia; it’s pragmatism. It reflects a worldview where economic vitality is inseparable from national resilience, a lesson etched from the Covid-19 supply shocks and the 2018 trade truce’s scars.

It charts an independent trajectory through roiling global waters — US elections, climate tipping points, tech arms races — where self-reliance isn’t defiance but destiny.

A meticulous endorsement of the status quo

For Western policymakers and investors, the plenum’s signals are a balm of sorts: stability amid uncertainty. No erratic stimulus floods to inflate bubbles, no liberalising free-for-alls that upend the playing field. Instead, expect a growth trajectory anchored in government-curated industrial policies — lavish R&D infusions into fusion energy and rare-earth processing, infrastructure megaprojects linking Xinjiang’s solar farms to coastal grids. Opportunities abound in collaborative niches: joint ventures in clean hydrogen or critical minerals extraction, where Western capital meets Chinese scale.

Short-term, China’s GDP hum will hold steady around 4-5%, buoyed by these levers, though deflation’s chill may linger, cooling inflation imports for the world. Structural reforms à la Washington Consensus? Unlikely; Beijing’s path is proudly sui generis, prioritising harmony over disruption.

In essence, the upcoming 15th Five-Year Plan, set to crystallise these themes, emerges not as a radical reroute but as a meticulous endorsement of the status quo. It charts an independent trajectory through roiling global waters — US elections, climate tipping points, tech arms races — where self-reliance isn’t defiance but destiny.

China’s model, for all its overcapacity pitfalls and deflationary drags, endures because it delivers: lifting millions, commanding supply chains, and projecting power without apology. Involution, in this context, is revolution enough — a slow burn that reshapes the world on its own inexorable terms. As the plenum fades into the archives, the real story unfolds in the labs and loading docks, where tomorrow’s productive forces take shape, flaws and all.