Painful retrenchments at China's internet giants

Even as the pandemic created greater demand for internet companies like Kuaishou, Alibaba and Meituan, these companies are finding their large staff numbers unsustainable, leading to a wave of major retrenchments over the past year or so. This is not just due to overexpansion, but also operational pressures that come with new regulations to protect employment rights. Zaobao journalist Meng Dandan reports.

In mid-December 2021, 28-year-old Xiaoai (pseudonym) suddenly joined the sizable ranks of those retrenched by Chinese short video platform Kuaishou.

"No one can be a permanent fixture on the internet, I suppose?" While feeling dreary and disappointed, she is clear-eyed about reality.

The wave of retrenchments among China's internet companies that began at the end of 2021 continues, with well-known names like Kuaishou, ByteDance and Alibaba revealed to have retrenched as many as 1,000 people. And while China's internet companies have retrenched staff in the past couple of years during the year end, the latest round of retrenchments is far larger in scale.

Xiaoai said that the retrenchment exercise at Kuaishou was branded as a "structural adjustment", but she felt she was made to leave as she was not working in a core area of business, nor was she a team lead with core responsibilities.

His task in 2021 was to retrench 30% of his staff, which meant six people out of his team of 20. As for the criteria for retrenchment, he said: "We assessed their contributing value and how well they worked in a team.

Marketed as the "number one stock in short video platforms", Kuaishou got its Hong Kong IPO in January 2021, and was immensely popular with investors during the offering. Recently however, there has been frequent news of retrenchments.

The Paper (澎湃新闻) reported that Kuaishou's retrenchment exercise began in 2021 and is ongoing, covering departments such as e-commerce, internationalisation, commercialisation and gaming, with some teams suffering a 30% cut in headcount.

One Kuaishou team lead who declined to be named told Lianhe Zaobao: "The financial figures for the third quarter of 2021 did not look good, and manpower costs were a major expenditure."

His task in 2021 was to retrench 30% of his staff, which meant six people out of his team of 20. As for the criteria for retrenchment, he said: "We assessed their contributing value and how well they worked in a team. And the first consideration was salary - retrenching one person would allow us to hire another two or three people."

Kuaishou is not the harshest with retrenchments. The tech pages of sina.com.cn and sohu.com reported that video platform iQiyi, with over 100 million subscribing members, is in the midst of its largest retrenchment exercise in recent years.

After getting listed three years ago, iQiyi has lost 26.4 billion RMB (about S$5.6 billion). The staff retrenched are mainly those with higher salaries, while peripheral departments were almost all retrenched.

ByteDance, which runs short video platform TikTok - and which has taken the world by storm over the past couple of years - has also retrenched thousands of staff since August 2021, as its education arm has been hit by China's "double reduction" policy in the education sector.

Apart from video platforms, Alibaba's local lifestyle services arm, which expanded by riding on the pandemic, was also reported to have started a large-scale retrenchment exercise as 2022 began.

NYSE-listed Mogujie (蘑菇街) was the first to roll out live shopping in China, and was revealed to have retrenched 60% of its technical department in 2021.

...overexpansion has led to overstaffing and huge manpower costs, so that the burden became too heavy for the internet "big factories".

Painful retrenchments after expanding too fast

Pushed by capital, China's internet companies have expanded over the past ten years, rolling out new areas of business. Generous benefits have attracted large numbers of university graduates, and netizens have called some well-known internet platforms "big factories" because of their large staff numbers.

However, this explosive growth driven by capital and hot money is facing a problem with sustainability. While the pandemic has led to greater online demand over the past year, this has not translated into growth opportunities for internet companies. Instead, overexpansion has led to overstaffing and huge manpower costs, so that the burden became too heavy for the internet "big factories".

Since late 2020, Chinese authorities have hit out hard against monopolies and the disorderly expansion of capital. Coupled with a slowdown in economic growth and reduced advertising, as well as strict regulatory scrutiny of the gaming and live streaming industries, have all brought about unprecedented pressure on the internet industry.

Plummeting market value of internet companies

With the outflow of capital and strict regulations, China's internet industry is making adjustments.

Last year, the market value of listed Chinese internet companies plunged, with Tencent and Alibaba dropping out of the list of the global top ten companies in market capitalisation.

Over the past year, iQiyi's stocks fell by 85%, and roughly 120 billion RMB of its market value has evaporated. Kuaishou's stock price also plummeted from its record high of HK$417 (about S$73), with its stocks plunging more than 80% over 11 months.

Analysts interviewed have different opinions about the prospects of China's internet industry. Yang Chang, chief analyst at Zhongtai Securities' research institute, sees that with the Chinese government setting development boundaries and formulating clearer rules for various industries including the internet, "the internet industry still has much room for development even though a set of established boundaries is in place."

Yang also thinks that the current wave of job cuts in China's internet industry is due to operational difficulties faced by internet giants.

"For example, upstream real estate developers may be advertising less on internet platforms because their cash flow is tight, which in turn shrinks the revenue of internet companies," he pointed out.

Employees without benefits

However, Xia Hailong, a lawyer at Shanghai Excellence Law Firm, is not optimistic about the sustainability of some of these internet companies' business models.

Over the past few years, Xia has been handling various internet employment lawsuits. He sees that with changes in laws and policies, some Chinese internet giants would soon be facing the pressures of surging labour costs.

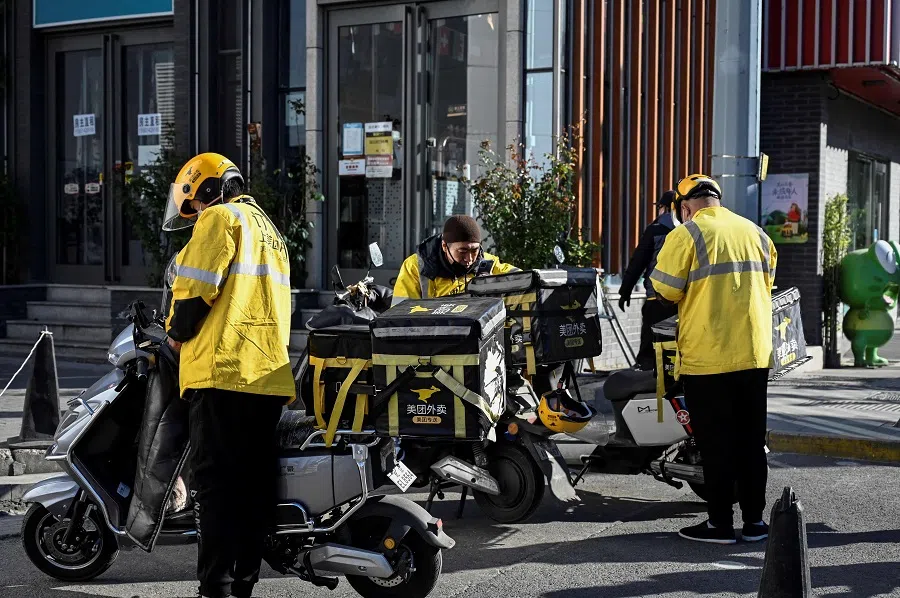

To protect the rights and interests of food delivery drivers, officials have rolled out relevant policies.

Giving the examples of China's major food delivery giants Meituan and Ele.me, Xia told this reporter that labour-intensiveness is a key trait of these companies' core business models. However, the businesses do not have the means to bear high social security costs. Thus, they usually try to bring down labour costs by using labour dispatch or flexible employment (灵活就业) models.

He observed that the number of internet workers has been increasing in recent years and so has the occurrence of work-related injuries. To protect the rights and interests of food delivery drivers, officials have rolled out relevant policies. In addition, courts have also ruled that food delivery platforms should directly bear the liability for work-related injuries of drivers who do not have labour relationships with the platform.

Xia thinks that the trajectory of these policies and laws and the increased awareness of user rights can only mean greater cost pressures for platform companies.

Increasing employment pressure

This wave of layoffs in the internet industry, the education crackdown, the cooling of the property market and the slump in tourism and consumption as a result of the Covid-19 pandemic have put pressure on China's job market and alarmed the authorities about the possibility of an employment crisis.

During the Central Economic Work Conference held in December 2021, the bread-and-butter issue of employment also came under the spotlight.

In the report released by state media Xinhua News Agency following the conference, the word "employment" (就业) was mentioned eight times. Among them, "flexible employment" was mentioned for the first time at a high-level meeting, setting the tone for the coming year's economic work.

Under the new economic environment and the direction that macro policies are going, many industries that grew rapidly in recent years will have to accept the fact that their heyday is over. The people who have lost their jobs amid this wave of layoffs will also have to carve out a new path for themselves.

Xiaoai, who earned over 27,000 RMB a month before she was retrenched, said that she has started changing her mindset and extravagant spending habits. After all, "it is quite difficult to find another job that pays me around the same", she lamented.

Related: China's burgeoning e-commerce cyberspace and its ever more complex regulations | Blacklisted and fined: The end of Chinese tech companies' heyday? | What the Chinese government wants to tell Alibaba and China's tech giants [Part II] | HKEX a refuge for Chinese companies fleeing US stock exchanges?

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)